shareholder value

The Billion-Dollar Blind Spot: Why the McDonald’s Harassment Scandal is a Wake-Up Call for Investors

The McDonald’s harassment scandal is more than a PR crisis; it’s a financial red flag for investors, highlighting the tangible costs of a toxic culture.

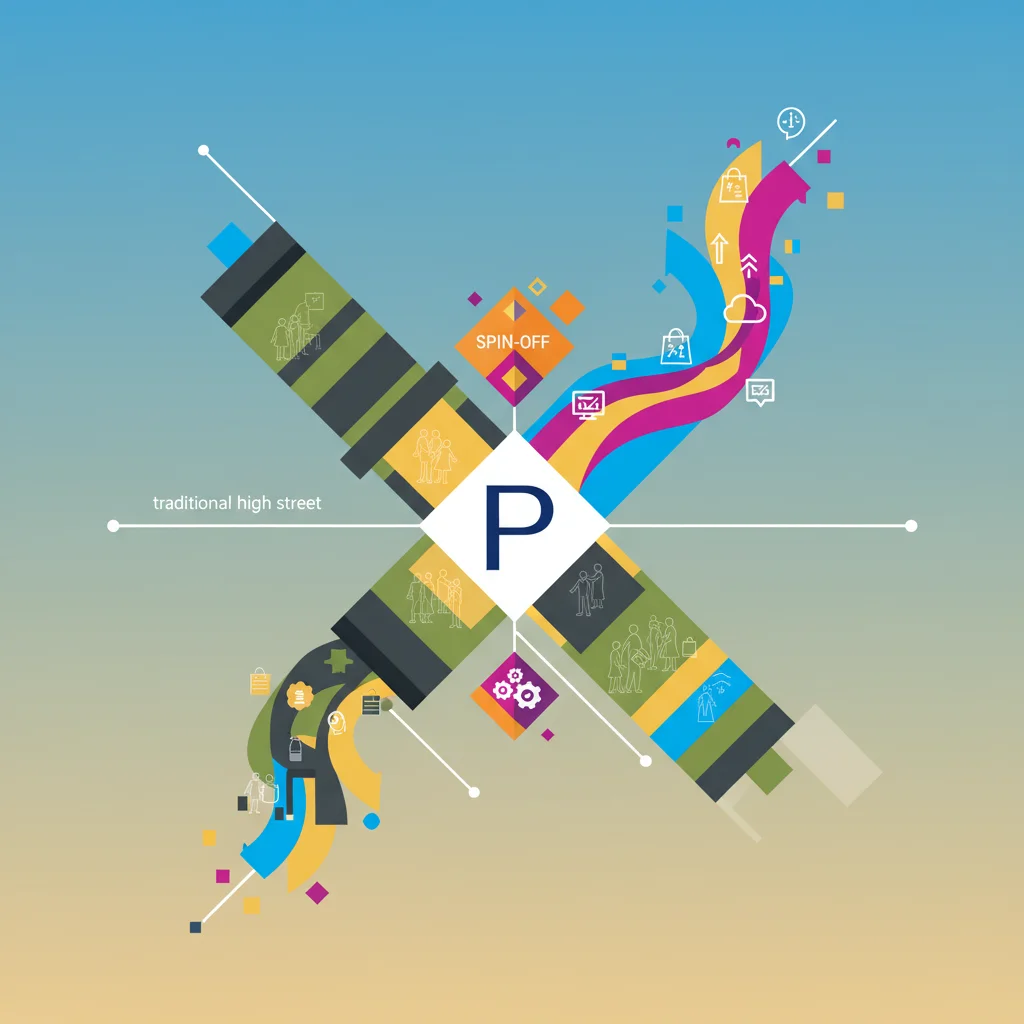

Primark at a Crossroads: Why a Potential Spin-Off Could Redefine a Retail Empire

A dip in UK sales has parent company ABF exploring a spin-off of Primark, a move that could unlock value and reshape the retail and investment landscape.

Beyond the Bar Tab: The Financial Engineering Keeping Mega-Brewers Profitable

Discover the financial engineering behind mega-brewers. Learn how they use price hikes and cost cuts to maximize free cash flow and reward investors.

A Tale of Two Titans: Why Wall Street Cheered Google’s AI Strategy and Jeered Meta’s

A tale of two tech titans: Why Alphabet’s stock soared on AI profits and dividends, while Meta’s huge AI spending spooked the market.

More Than a Scoop: The Financial and Economic Implications of Ben & Jerry’s Activist Brand

The Ben & Jerry’s-Unilever conflict over a Palestine-themed ice cream is a critical case study in corporate finance, brand risk, and ESG investing.

Korea’s Stock Market Surge: Unpacking the Twin Engines of AI and Corporate Reform

Discover why South Korea’s Kospi is the world’s top-performing stock market, driven by a powerful combination of the AI boom and historic corporate reforms.

Nestlé’s Strategic Overhaul: What 16,000 Job Cuts Reveal About the Future of Corporate Finance and the Economy

Nestlé plans to cut 16,000 jobs under its new CEO’s “performance mindset” initiative, a strategic pivot with major implications for investors and the economy.

J&J’s Next Big Move: Why the Orthopaedics Spinoff Signals a New Era in Healthcare Investing

J&J plans to spin off its orthopaedics unit, a major strategic shift to focus on high-growth pharma and MedTech, reshaping its future and the market.

Activist on the Attack: Is Starboard Brewing a Shake-Up at Keurig Dr Pepper?

Activist investor Starboard Value builds a stake in Keurig Dr Pepper, signaling a potential corporate shake-up after the company’s unpopular M&A plans.