private credit

Power Plays: Inside the Sequoia Shake-Up, Wall Street’s Soccer Bet, and the Oil Trade of a Lifetime

A deep dive into the Sequoia Capital coup, Apollo’s bet on European football, and how a 31-year-old trader made millions from Russian oil.

Echoes of 2008? A Banking Titan’s Stark Warning on the $1.7 Trillion Private Credit Market

UBS Chair Colm Kelleher warns of systemic risk from private credit, drawing chilling parallels to the “ratings shopping” that preceded the 2008 crisis.

Anatomy of a $12 Billion Corporate Collapse: The Cautionary Tale of First Brands Group

The collapse of First Brands Group under a $12bn debt mountain offers a stark warning about the risks of private equity’s high-leverage playbook.

Inside the $1.5 Trillion AI Ecosystem: OpenAI’s Playbook and the New Kings of Wall Street

Explore OpenAI’s $1.5T deal machine, how KKR & Apollo became Wall Street’s new saviors, and the risks lurking in the world of high-stakes finance.

AI Hype and Hidden Debt: Are We on the Brink of the Next Financial Crisis?

Is the AI stock market boom a dangerous bubble? When combined with the opaque world of shadow banking, it could pose a systemic threat to the global economy.

Beyond the Hype: Where to Find Real Value in a World Obsessed with Private Credit

Beyond the private credit craze, major shifts in media M&A and the space industry offer a glimpse into the future of the global economy.

Beyond the Shadows: Why It’s Time to Retire the Term ‘Shadow Banking’

The term ‘shadow banking’ is a dangerous misnomer. Discover the reality of market-based finance and its crucial role in the modern global economy.

The Ghost in the Machine: Unpacking Corporate Mysteries, AI Ambitions, and a Telecom Titan’s Tussle

Unpacking the mystery behind First Brands’ rise and fall, Europe’s AI paradox, and KKR’s high-stakes telecom deal in a volatile global economy.

Financial Titans Sound the Alarm: Are We on the Brink of a New Lending Crisis?

Top financiers warn of eroding lending standards, a risk compounded by AI disruption and geopolitical shifts. A deep dive into the triple threat facing the global economy.

Echoes of 2008? Why Wall Street’s Titans Are Sounding the Alarm on a New Debt Crisis

Top Wall Street financiers are warning of a dangerous erosion in lending standards, raising fears of a new financial crisis. Are we on the brink?

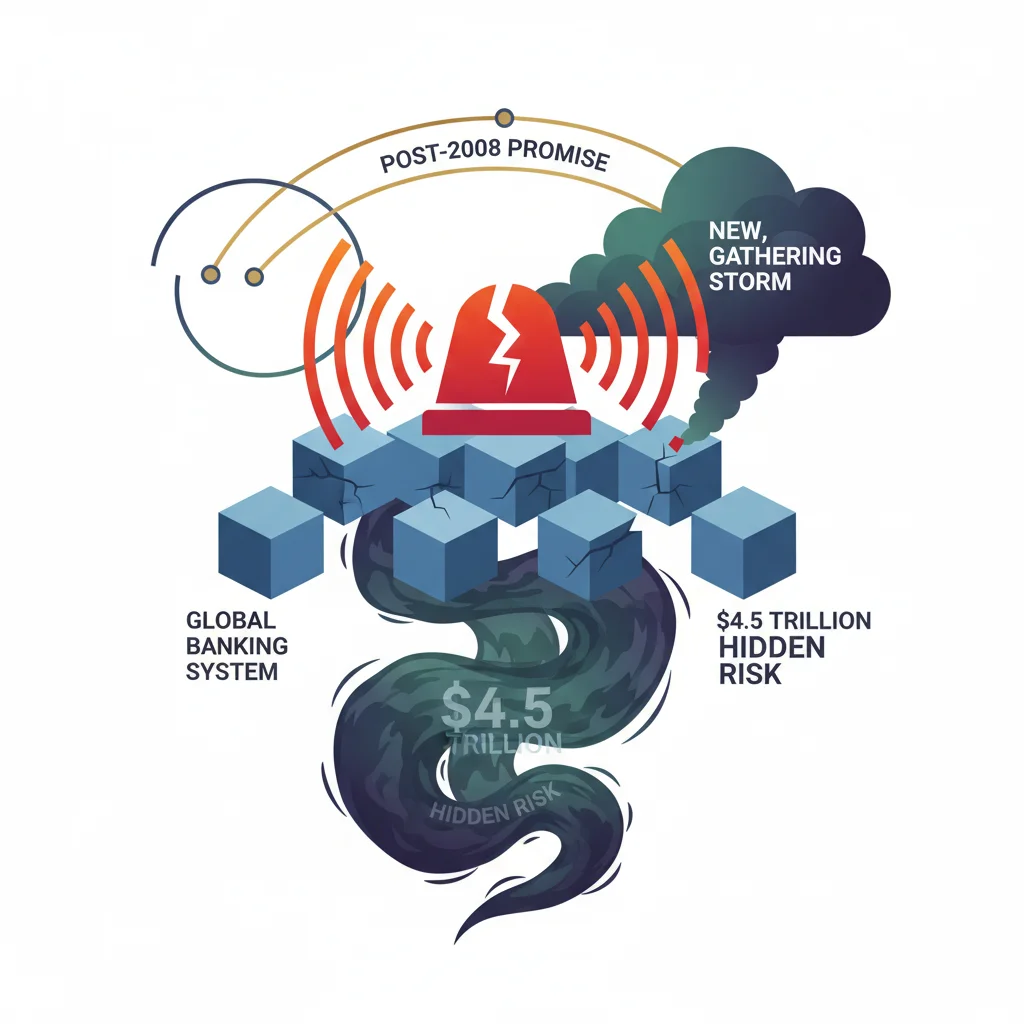

IMF Sounds the Alarm: A $4.5 Trillion Hidden Risk Looms Over the Global Banking System

The IMF warns of a $4.5T exposure of banks to hedge funds and private credit, creating hidden leverage and systemic risk for the global economy.

The AI Gold Rush is Now Fueled by Debt: Are We Building a House of Cards?

The AI boom’s insatiable demand for computing power is shifting its financial engine from venture capital to high-stakes debt. What are the risks?