Mergers and Acquisitions

The Greenland Gambit: Deconstructing the Geopolitical M&A of a Lifetime

An in-depth financial analysis of the Greenland “deal,” exploring its implications for investing, the economy, and the future of geopolitical M&A.

The Week in Review: 5 Critical Market Signals and What They Mean for Your Portfolio

From central bank pivots to AI mega-mergers, we decode the week’s key financial signals and explain their impact on investing, the economy, and fintech.

Navigating the Tides of Power: Why Hanwha’s Stake in Austal is a Global Economic Bellwether

Australia’s conditional approval for Hanwha to raise its stake in shipbuilder Austal highlights the new era of geopolitical finance and national security.

The Billion-Dollar Revolt: Why Private Equity is Waging War on Its Most Powerful Law Firm

A revolt is brewing in private equity as investors push back against the massive legal fees of top law firm Kirkland & Ellis, signaling a major power shift.

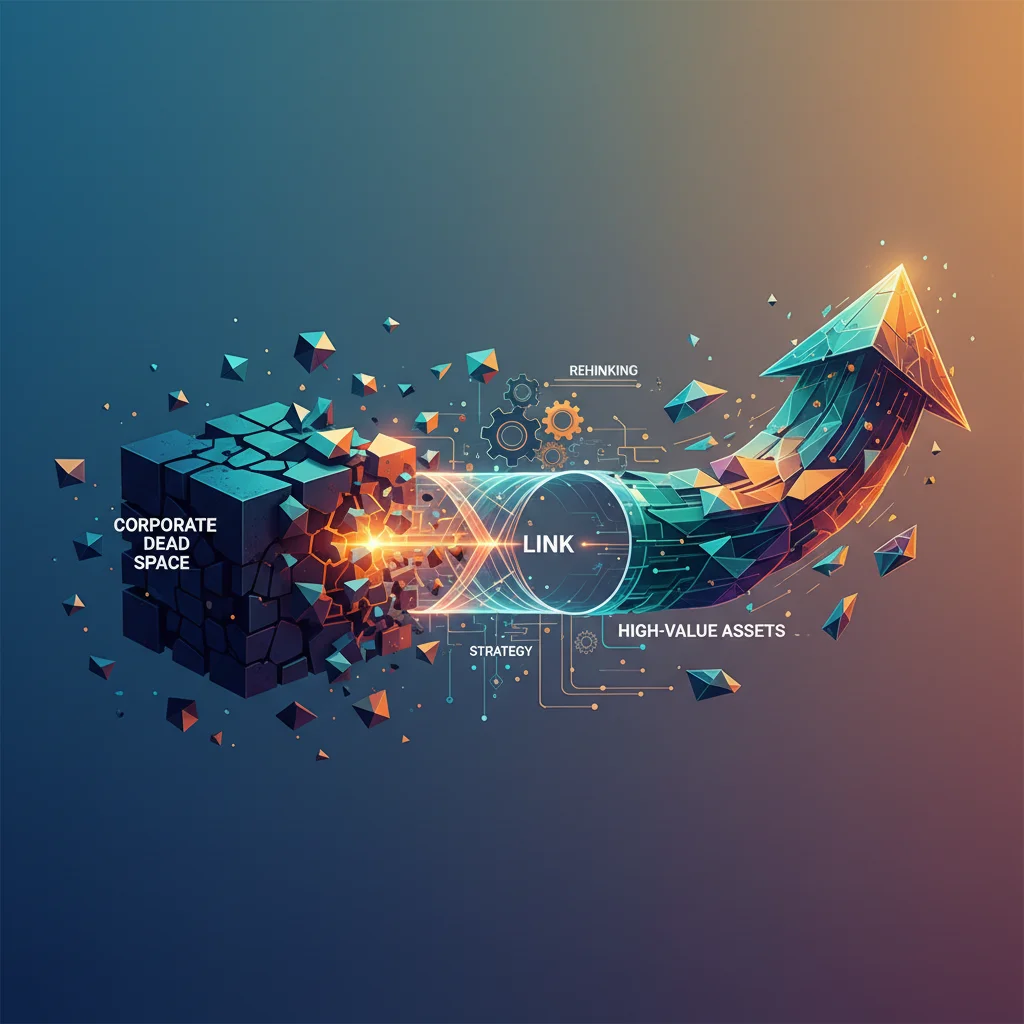

The Link Room Strategy: Transforming Corporate Dead Space into High-Value Assets

Discover how architectural design principles can revolutionize business strategy, transforming transitional processes from cost centers into high-value assets.

Beyond the Box: Unpacking Tritax’s £1 Billion Wager on the Future of Logistics

Tritax Big Box’s £1.04bn logistics portfolio acquisition sends its stock soaring, signaling a major bet on the future of e-commerce and supply chains.