inflation

The Great Rupture: Mark Carney’s Blueprint for Navigating a Fractured Global Economy

Mark Carney, former Governor of the Bank of England, dissects a “world in rupture,” outlining the new economic playbook for a post-globalization era.

The Uniform Indicator: Why a Second-Hand Clothing Store Is a Must-Watch Signal for the Global Economy

A surge in demand at a second-hand uniform store is a powerful micro-indicator of macro-economic trends, offering key insights for finance and investors.

The UK’s Economic Crossroads: Decoding Slowing Wage Growth and Its Impact on Your Finances

UK wage growth has slowed to a 5-year low as employment falls. This analysis explores the impact on the economy, investing, and business strategy.

The UK’s Paycheck Puzzle: What Slowing Wage Growth Means for the Economy, Markets, and Your Wallet

UK wage growth is slowing, a critical sign for the economy. We break down what this means for investors, businesses, and your personal finances.

The Trump Economy 2.0: Decoding Voter Anxiety and Market Signals

A deep dive into mixed voter sentiment on the U.S. economy, analyzing potential Trump-era policies and their impact on finance, investing, and markets.

The No-Free-Lunch Economy: What a Simple Seat Upgrade Teaches Us About Inflation, Investing, and the Stock Market

A simple request for a flight upgrade reveals a deep economic truth: there’s no free lunch. This principle explains the inflation reshaping our economy today.

The Great Re-Allocation: Why BlackRock Says Volatility is Forcing a Historic Shift to Private Markets

In a new era of volatility, BlackRock reports a massive client shift from public stocks to private markets, reshaping the future of global investing.

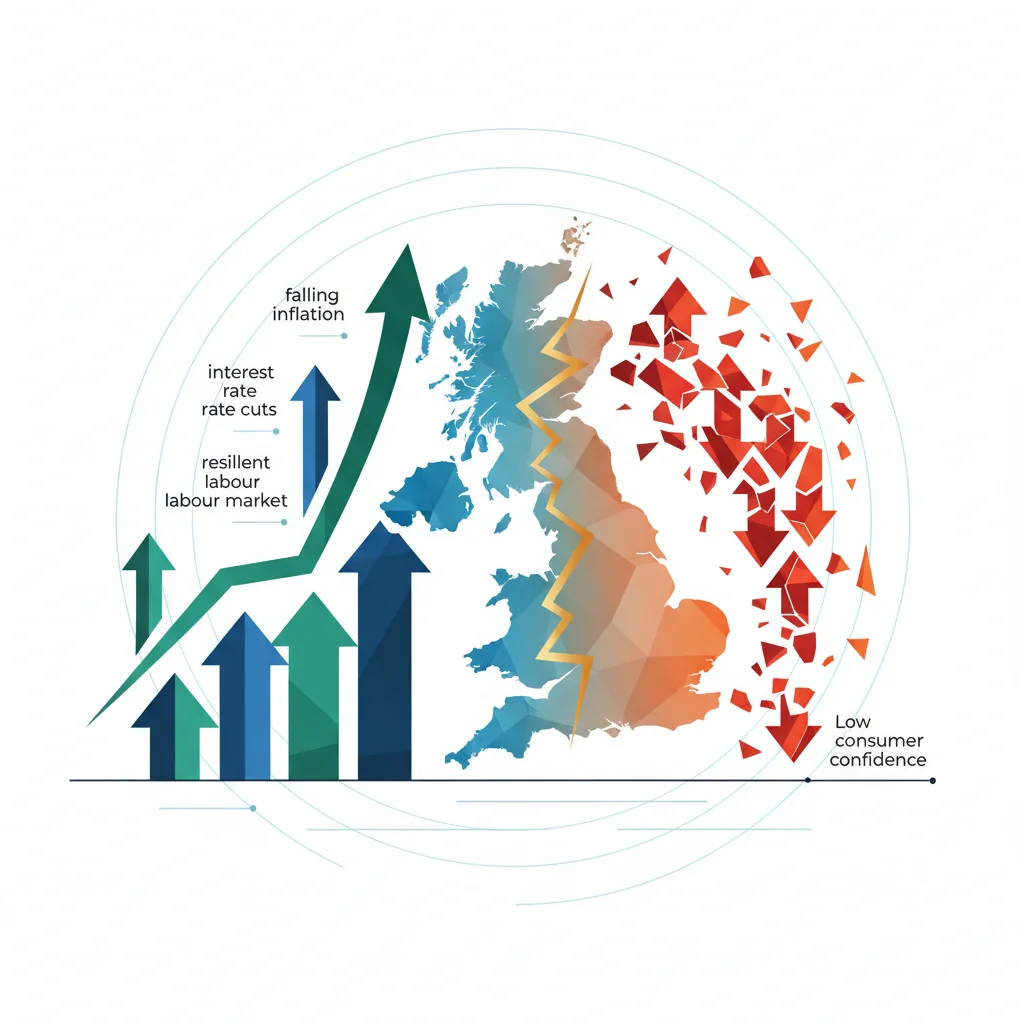

The UK’s Economic Paradox: Why Consumer Confidence Reveals a Nation Divided

Beneath the UK’s rising consumer confidence lies a stark generational divide, with profound implications for investing, finance, and the broader economy.

The High-Stakes Showdown: Why Political Interference with the Federal Reserve Threatens Your Portfolio and the Global Economy

Political pressure on the US Fed isn’t just talk. It’s a historical recipe for economic disaster that could threaten your investments and global stability.

The Great Economic Divide: Why UK Consumer Confidence Reveals a Tale of Two Generations

UK consumer confidence is rebounding, but a stark generational divide reveals a fractured economic recovery with major implications for investors and businesses.

A Dangerous Game: When Politics and Central Banking Collide

Political pressure on the U.S. Federal Reserve mirrors historical episodes in other countries that led to economic disaster, posing risks to the economy.

The Original Sin of Central Banks: How a Generation of Easy Money Brought Us to the Brink

An expert warns that decades of easy money have created a trap for the global economy. What comes next, and how can you prepare for the fallout?