geopolitical risk

The Ultimate Insurance Policy: Why Investing in Deterrence is the Smartest Economic Move

Viewing defense spending as a strategic investment in economic stability is crucial. This is the insurance premium we pay to avoid the catastrophic costs of war.

Financial Firestorms: Building a Resilient Portfolio in an Age of Unforeseen Crises

A tragic fire serves as a metaphor for financial crises. This post explores how fintech, blockchain, and smart investing can build a resilient portfolio.

Global Tremors: Decoding Market Signals from Hong Kong’s Tragedy to a UK Tax Overhaul

A deep dive into how a Hong Kong tragedy, a US security scare, and a UK tax overhaul signal critical shifts in global finance, investing, and the economy.

Beyond the Gaffe: How One Remark on NATO Could Reshape Global Finance

A single remark questioning NATO’s mutual defense pact threatens to upend global finance, imperiling the US dollar and shaking the stock market.

Beyond the Ticker: Why a Minor Legal Correction Signals a Major Shift in Geopolitical Risk for Investors

A minor legal news item reveals the deep impact of geopolitical risk on finance, investing, and the global economy. Explore the implications for your portfolio.

Frozen Billions, Fiery Debates: How Russian Assets Are Fueling a High-Stakes Financial Gambit for Ukraine

G7 nations debate a landmark $50bn loan for Ukraine, backed by profits from frozen Russian assets, blending high-stakes finance with geopolitics.

Ireland’s Trillion-Dollar Vulnerability: The Digital Achilles’ Heel of the Global Economy

Ireland’s neutrality makes it a vital tech hub but also a major security risk for the global economy. What does this mean for investors and finance?

Trump, Xi, and a High-Stakes Phone Call: What It Means for the Global Economy and Your Investments

A phone call between Donald Trump and Japan’s PM hints at major shifts in global economic and security policy, with huge implications for investors.

The Machu Picchu Gridlock: What a Tourist Dispute Reveals About Monopoly, Fintech, and Investment Risk

A tourist bus dispute at Machu Picchu offers a powerful lesson on monopoly risk, supply chain fragility, and the disruptive potential of fintech solutions.

The Empty Chair: What the US G20 Boycott Means for the Global Economy and Your Portfolio

The US boycott of the G20 summit in South Africa signals a major shift in global power dynamics, with deep implications for the economy, investing, and finance.

Libya’s High-Stakes Bet: Is the World Ready to Invest in Africa’s Largest Oil Reserves?

Libya is launching its first oil exploration auction in 18 years, a high-stakes move to attract investors to Africa’s largest reserves. Is it worth the risk?

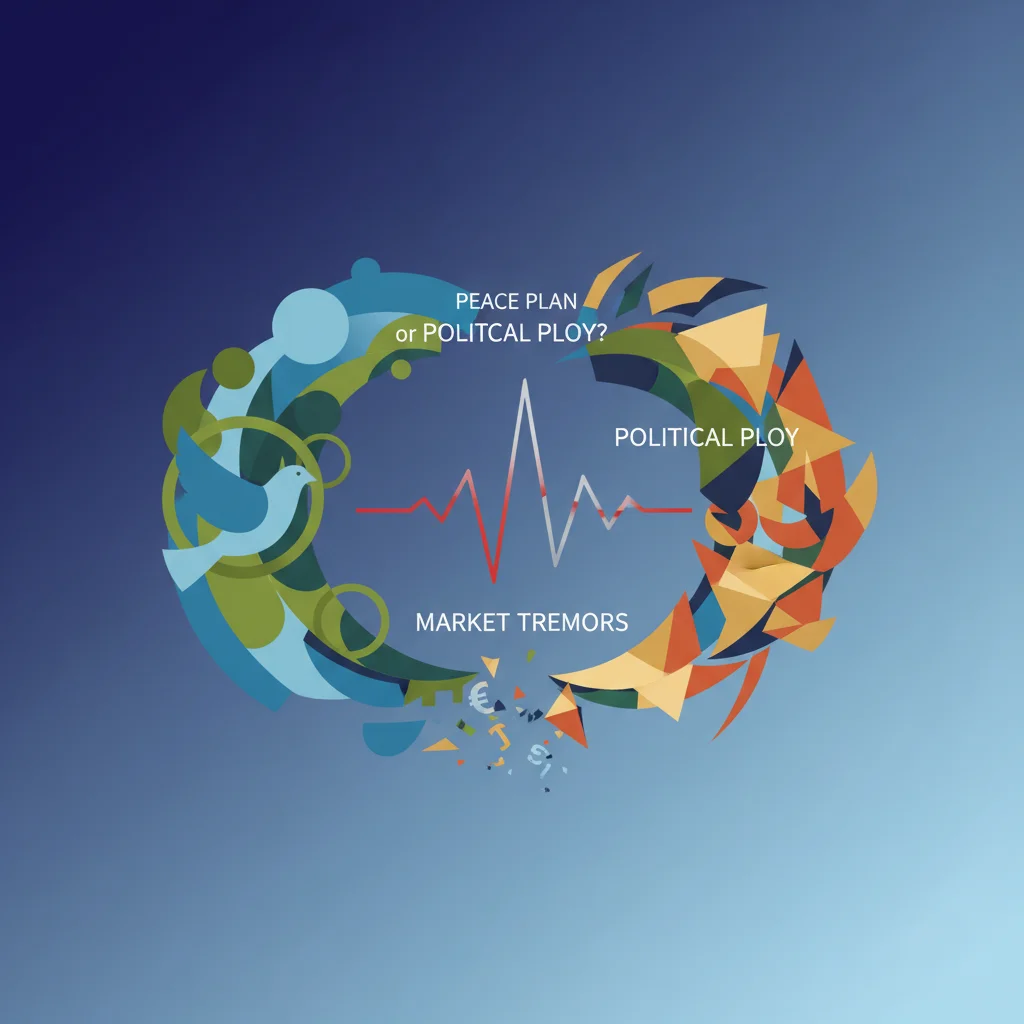

Peace Plan or Political Ploy? Unpacking the Market Tremors from the Ukraine Policy Reversal

A contentious Ukraine peace plan was floated and then denied, revealing deep policy uncertainty. This analysis explores the impact on the economy and markets.