financial technology

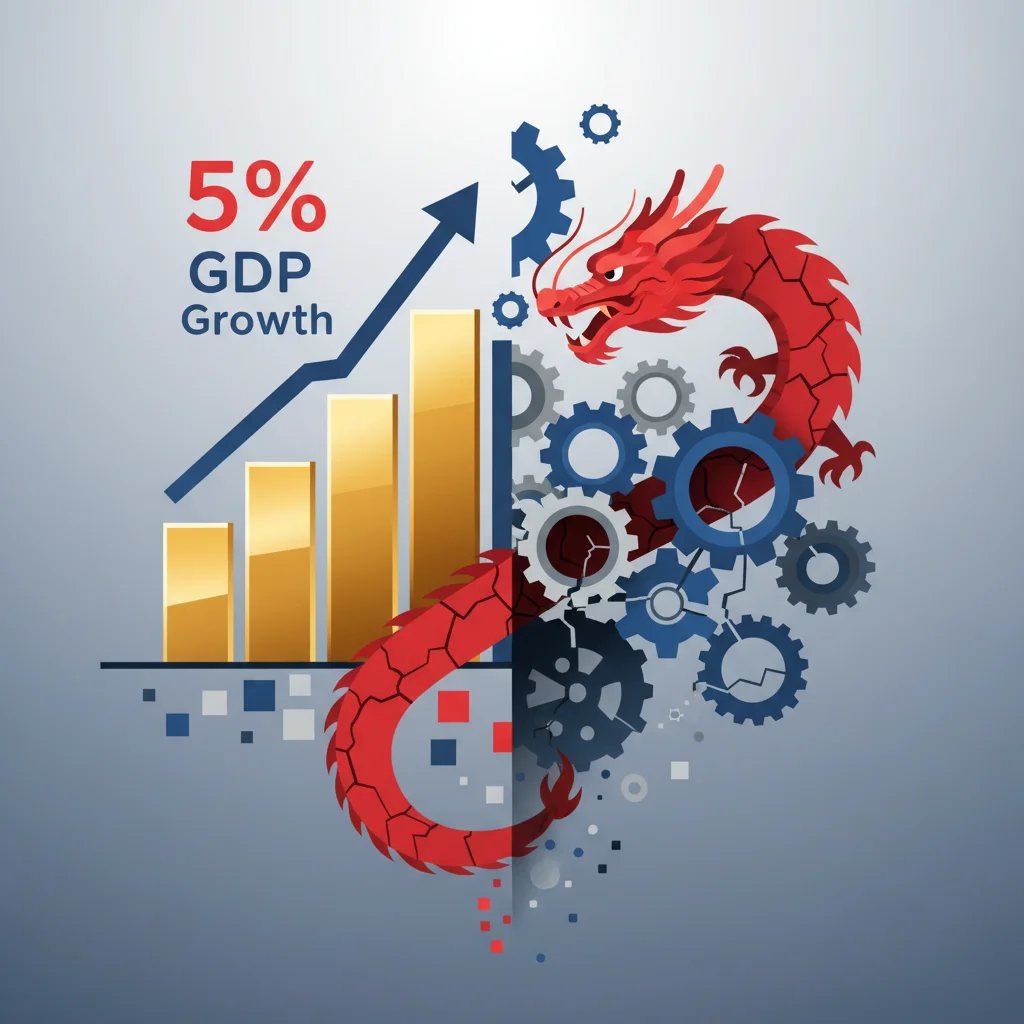

China’s Economic Paradox: Why 5% GDP Growth Masks a Deeper Story

China’s 5% GDP growth in 2025 masks a divided economy, with booming exports offsetting a fragile domestic market. A deep dive for investors and leaders.

China’s Economic Paradox: 2025 Growth Target Met, But Are Storm Clouds Gathering?

China met its 5% GDP growth target for 2025, but a Q4 slowdown to 4.5% reveals deep economic challenges beneath the surface of its export boom.

The No-Free-Lunch Economy: What a Simple Seat Upgrade Teaches Us About Inflation, Investing, and the Stock Market

A simple request for a flight upgrade reveals a deep economic truth: there’s no free lunch. This principle explains the inflation reshaping our economy today.

UK Housing Market Defies Gravity: A Post-Budget Rebound or a Bull Trap for Investors?

UK house prices saw a surprise jump in January, reversing previous declines. Is this a sustainable recovery fueled by post-Budget optimism or a temporary blip?

Whitehall’s Wallet Watch: Why the UK’s Crackdown on Spending Matters to Every Investor

A deep dive into the UK Treasury’s review of government spending and its profound implications for the economy, investors, and the financial markets.

The Greenland Gambit: How a Diplomatic Spat Reveals the New Rules of Global Finance and Investing

A diplomatic spat over Greenland reveals the new era of geopolitical risk, impacting the economy, investing, and the future of financial technology.

Blueprint for Billions: Why the Netherlands’ Audacious Plan for 10 New Cities is an Investor’s Dream

The Netherlands’ plan to build ten new cities to solve its housing crisis is a monumental economic event, offering vast opportunities for investors.

The Canary in the Coal Mine: What One Pensioner’s Story Reveals About Our Economic Future

An 84-year-old’s struggle with fuel poverty is a microcosm of major economic trends, revealing systemic risks and opportunities for investors and leaders.

The VAR Paradox: Why We Forgive Human Error But Despise Flawed Algorithms in Finance

The backlash against VAR in football reveals a critical lesson for finance: we are far less tolerant of machine errors than human ones.

China’s Trillion-Dollar Pivot: What the 2025 Belt and Road Spending Surge Means for the Global Economy

China’s Belt and Road spending hit a record in 2025, signaling a strategic resource grab. We break down what this means for the global economy and investors.

The £1,500 Refund That Took 15 Months: A Case Study in Corporate Inefficiency and the Fintech Imperative

A 15-month delay for a £1,500 refund reveals deep operational risks, impacting investors, brand value, and highlighting the urgent need for fintech.

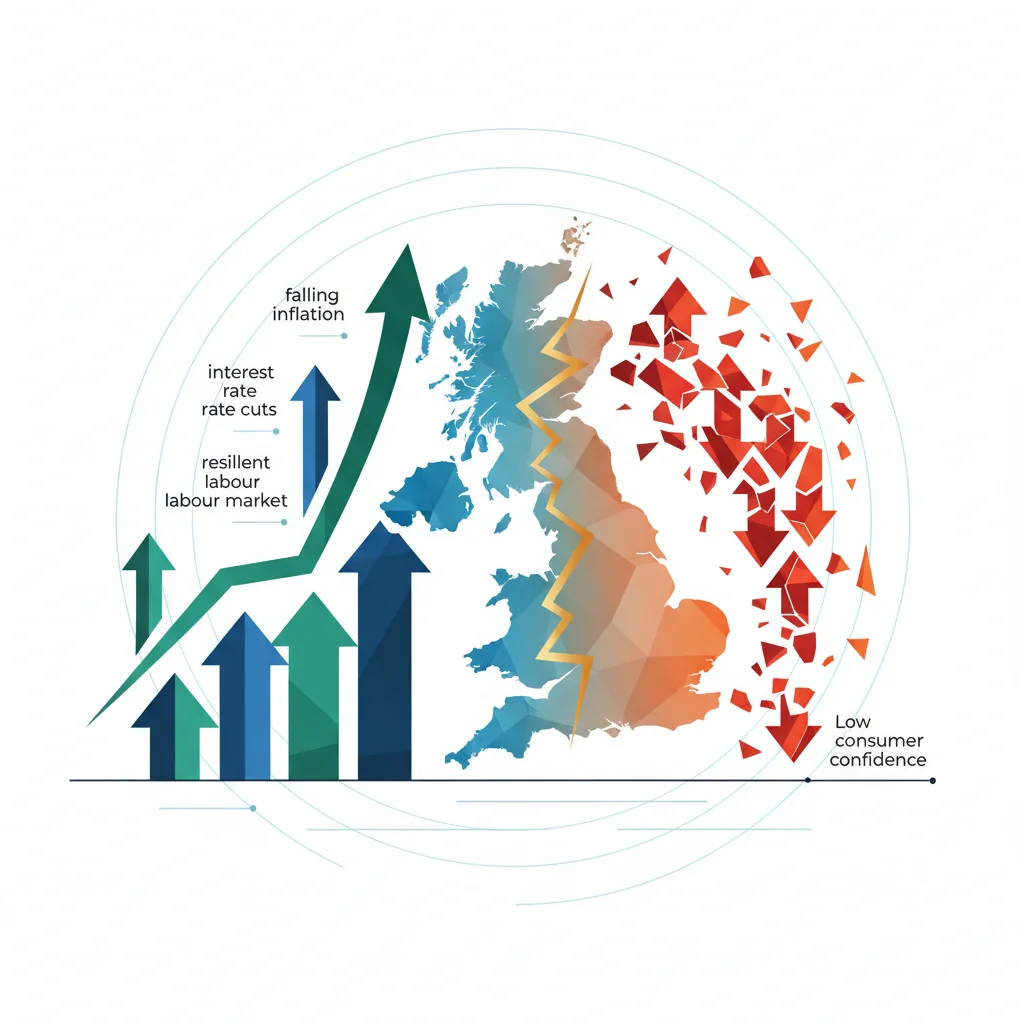

The UK’s Economic Paradox: Why Consumer Confidence Reveals a Nation Divided

Beneath the UK’s rising consumer confidence lies a stark generational divide, with profound implications for investing, finance, and the broader economy.