financial stability

Wall Street’s Warning Bell: Is the US Financial System’s Plumbing About to Clog Again?

Wall Street banks are warning the Fed that the US money market is at risk of a liquidity squeeze, which could spark a new bout of financial instability.

The Silent Unwinding: Why the Fed is Hitting the Brakes on Quantitative Tightening

The Fed’s balance sheet reduction is nearing its end. Discover what this policy shift means for the economy, financial markets, and your investments.

Geopolitical Tremors: How Frozen Assets, Trade Wars, and Political Upsets Are Reshaping the Global Financial Landscape

Geopolitical risks are reshaping global finance as the EU stalls on using Russian assets, US-Canada trade tensions rise, and UK politics deliver a shock.

Beyond the Shadows: Why It’s Time to Retire the Term ‘Shadow Banking’

The term ‘shadow banking’ is a dangerous misnomer. Discover the reality of market-based finance and its crucial role in the modern global economy.

Truce on a Knife’s Edge: Decoding the Economic Tremors of the Gaza Ceasefire for Global Investors

The fragile Gaza ceasefire is a critical variable for the global economy, influencing market volatility, energy prices, and supply chain stability for investors.

The Great Economic Reset: Why the Old Rules of Finance No Longer Apply

The old rules of finance are broken. A new settlement is needed for a world of high debt and entangled central banks. Here’s what it means for the economy.

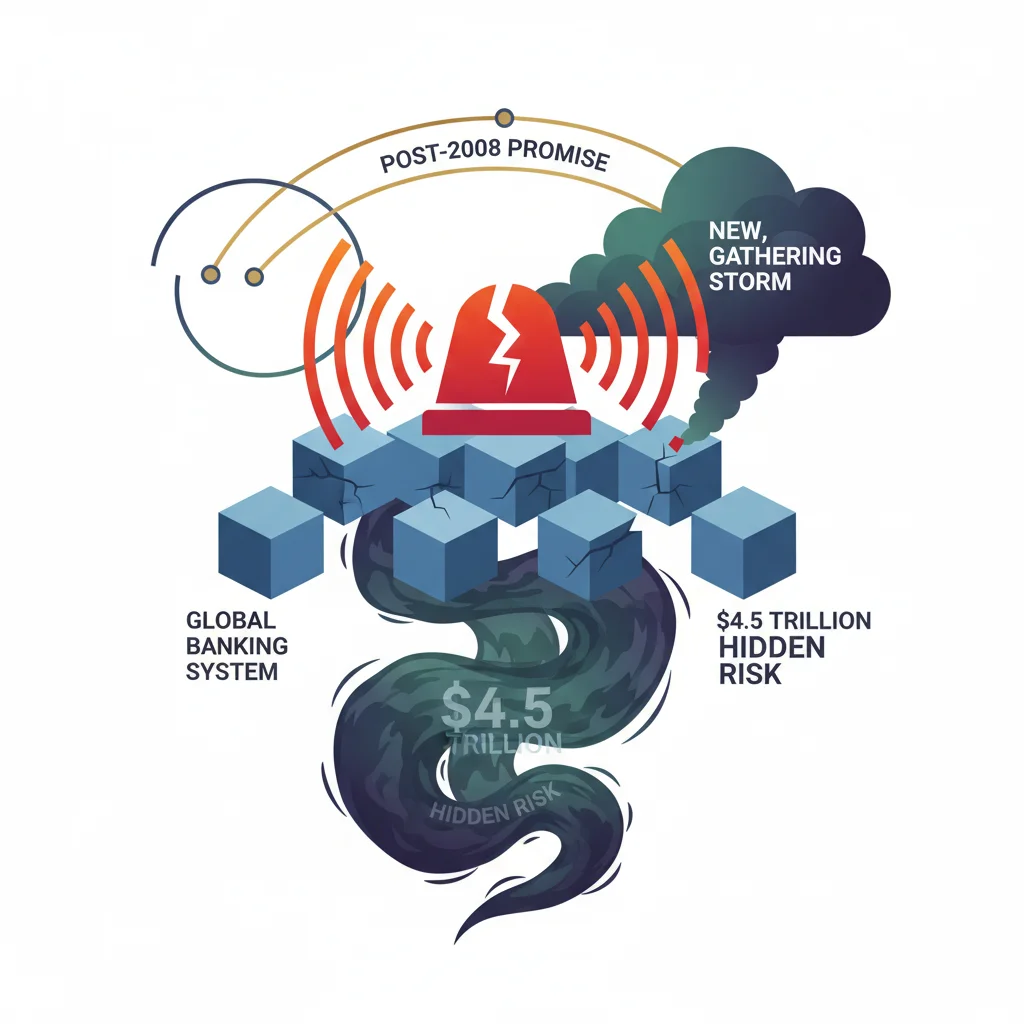

IMF Sounds the Alarm: A $4.5 Trillion Hidden Risk Looms Over the Global Banking System

The IMF warns of a $4.5T exposure of banks to hedge funds and private credit, creating hidden leverage and systemic risk for the global economy.

The SFr16.5 Billion Blunder: Swiss Court Rules Credit Suisse Bond Wipeout Unlawful, Shaking Global Finance

A Swiss court ruled the SFr16.5bn Credit Suisse AT1 bond wipeout was unlawful, a landmark decision challenging regulatory power and investor rights.