Bank of England

UK Fortifies Financial Safety Net: Bank Deposit Protection Set to Rise to £120,000

A major boost to UK financial security is coming, with bank deposit protection set to rise significantly, enhancing confidence for savers and businesses.

The Great British Standstill: Decoding the UK’s Economic Flatline and What It Means for Your Portfolio

The UK economy has hit a wall, with 0.0% GDP growth. We dissect the causes and explore what this stagnation means for investors, businesses, and the future.

UK Economy at a Crossroads: Decoding the Tepid Q3 Growth and What It Means for Your Investments

The UK economy’s near-stagnant 0.1% Q3 growth reveals deep-seated issues. Discover what this means for finance, investing, and the stock market.

Beyond the Headlines: UK Unemployment Hits 3-Year High – What It Means for Your Finances

The UK unemployment rate has hit a 3-year high of 5%. We analyze what this means for the economy, investors, and the future of work in Great Britain.

One Vote, Nine Views: Is the Bank of England’s Decision-Making Process Flawed?

The Bank of England’s MPC has nine expert views on the economy but often lands on one interest rate decision. Is this groupthink, and what are the risks?

Navigating the Summit: What the Bank of England’s Interest Rate Plateau Means for the UK Economy and Your Investments

Bank of England Governor Andrew Bailey signals UK interest rates are near their peak. Discover what this means for investors, businesses, and the economy.

The Great Pause: Bank of England Holds Rates Amid Peak Inflation Claims – A Deep Dive for Investors and Businesses

The Bank of England holds interest rates in a tight vote, signaling a potential peak in inflation. What does this pivotal moment mean for you?

The 4% Standstill: Decoding the Bank of England’s High-Stakes Bet Against Inflation

The Bank of England holds interest rates at 4% in a critical move against inflation. Discover the deep impact on finance, investing, and the UK economy.

Navigating the Calm Before the Storm: Why the Bank of England is Holding Rates Steady Ahead of the Budget

Analysts expect the Bank of England to hold interest rates at 4% amid economic uncertainty and the looming government Budget, signaling a strategic pause.

Sunshine and Spending: Is the UK’s Record Retail Surge a Turning Point for the Economy?

UK retail sales surged 2.9% in May, the biggest jump since 2022. What does this mean for the economy, investors, and the stock market?

Beyond the Trillion-Pound Ledger: Why Afua Kyei’s Powerlist Triumph Signals a New Era in Finance

Afua Kyei, Bank of England’s CFO, tops the 2026 Powerlist as the UK’s most influential black person, highlighting a new era of financial leadership.

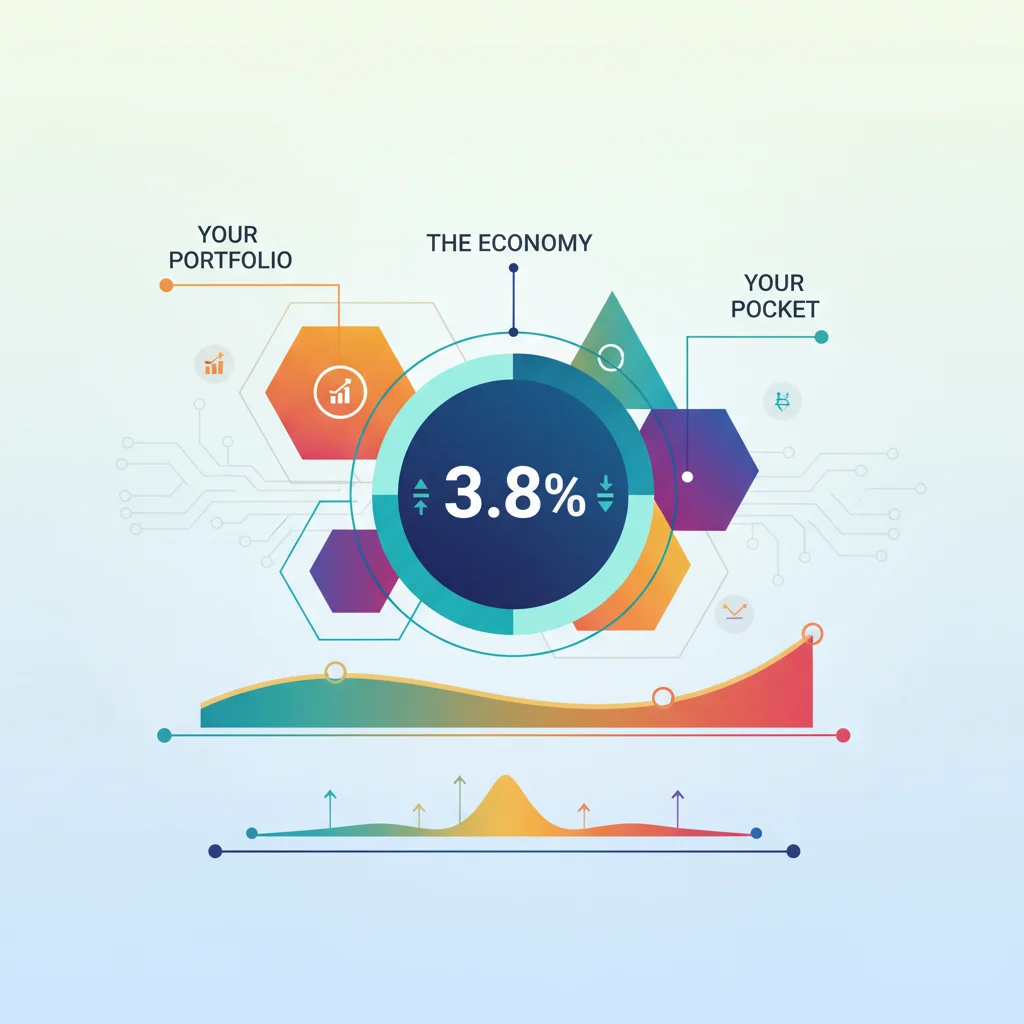

UK Inflation Holds at 3.8%: What This Number Really Means for Your Portfolio, Your Pocket, and the Economy

UK inflation holds at 3.8%. We break down what this key economic indicator means for your savings, investments, and the future of the UK economy.