Finance

Tech Updates

Editor Picks

Features and Events

The Greenland Glitch: What a Minor Fault on Air Force One Reveals About Major Risks in the Global Economy

A minor fault on Air Force One reveals a major lesson on systemic risk, economic fragility, and the importance of resilience for investors and leaders.

The Unbreakable Monopoly: Why One Dutch Company Controls the Future of Technology

Discover how Dutch firm ASML built an unbreakable monopoly on the machines that power the global tech economy, a dominance markets cannot correct.

Greenland’s Price Tag: How a Diplomatic Spat Threatens to Derail a US-EU Trade Deal and Rattle Global Markets

A US bid for Greenland sparks EU outrage, threatening a major trade deal and sending shockwaves through global financial markets.

Australia’s Trial by Fire: The New Economic Reality of Climate Risk

Australia’s recurring bushfires are a critical stress test for its economy, reshaping risk for investors, banking, and the stock market.

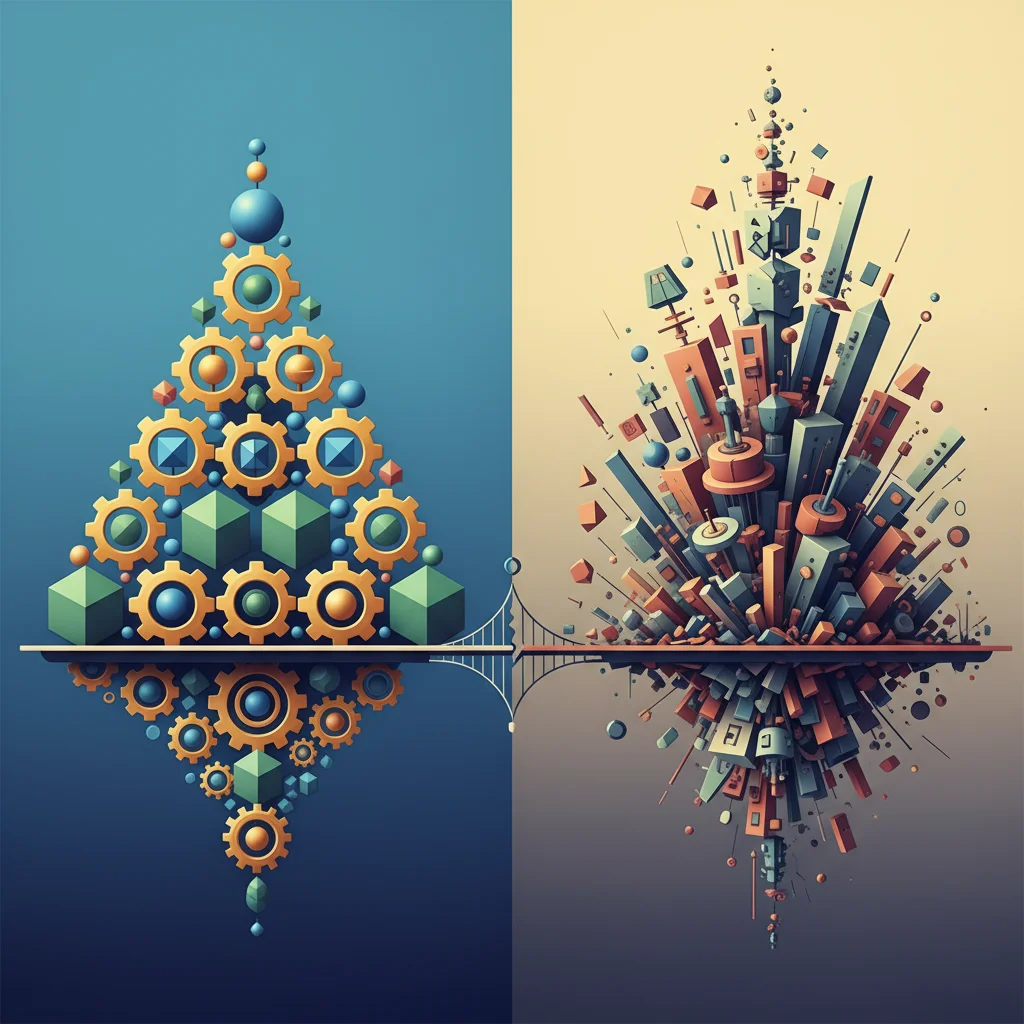

Solving the Global Economy: Why Modern Finance is the Ultimate Crossword Puzzle

The global economy is the ultimate cryptic crossword. To succeed, investors must learn to solve the “across” clues of macroeconomics and the “down” clues of industry shifts.

The Contrarian’s Gambit: Is Betting Against the Financial Times a Winning Strategy?

A professor’s witty letter to the FT suggests a contrarian strategy: buy what the media tells you not to. Is this a genius move or a path to ruin?

The Billion-Dollar Footprint: Why Niche Markets Are the Next Frontier in Finance and Investing

A simple consumer complaint about shoe sizes reveals a massive economic blind spot. Discover why investors are now targeting niche markets as the next big opportunity.

The Silent Crisis: Why Your Health is the Biggest Threat to the UK’s Financial Future

The UK’s pension crisis isn’t just about living longer; it’s about the stagnating years of good health, creating a fiscal time bomb for the economy.

Beyond the Balance Sheet: Why Major Economic Decisions Can Never Escape Politics

Major economic decisions can’t be separated from politics. This post explores why ‘rational’ investing must account for political realities and social values.

The Corporatist Threat: Why Your Old Model of Political Risk Is Dangerously Obsolete

The old model of political risk is obsolete. Discover why the rise of corporatism—the nexus of state and corporate power—is the new threat for investors.

The Quiet Revolution: How APIs and Code are Truly Democratizing the Stock Market

Beyond commission-free apps, a quiet revolution is using Open Banking and APIs to empower individuals to run their own automated trading algorithms.

The Anna Karenina Principle of Investing: Why Every Financial Failure is Uniquely Tragic

Tolstoy’s Anna Karenina Principle reveals a key truth about finance: successful investors are all alike, but every failed investor fails in their own way.