UK Tax Policy

The UK’s Non-Dom Shake-Up: A High-Stakes Gamble for Britain’s Economy

The UK’s abolition of its non-dom tax status, despite an IHT concession, is deemed “too little, too late” by advisers, risking a capital exodus.

UK’s New Tax Gauntlet: Are High-Earning Professionals in the Crosshairs?

A deep dive into the UK’s new plan to tax wealthy partnerships, impacting lawyers, doctors, and financiers, and what it means for the economy.

The UK’s New Tax Frontier: Why High-Earners in Partnerships are in the Government’s Crosshairs

UK’s crackdown on wealthy tax partnerships explained. Discover the impact on finance, professionals, and the economy.

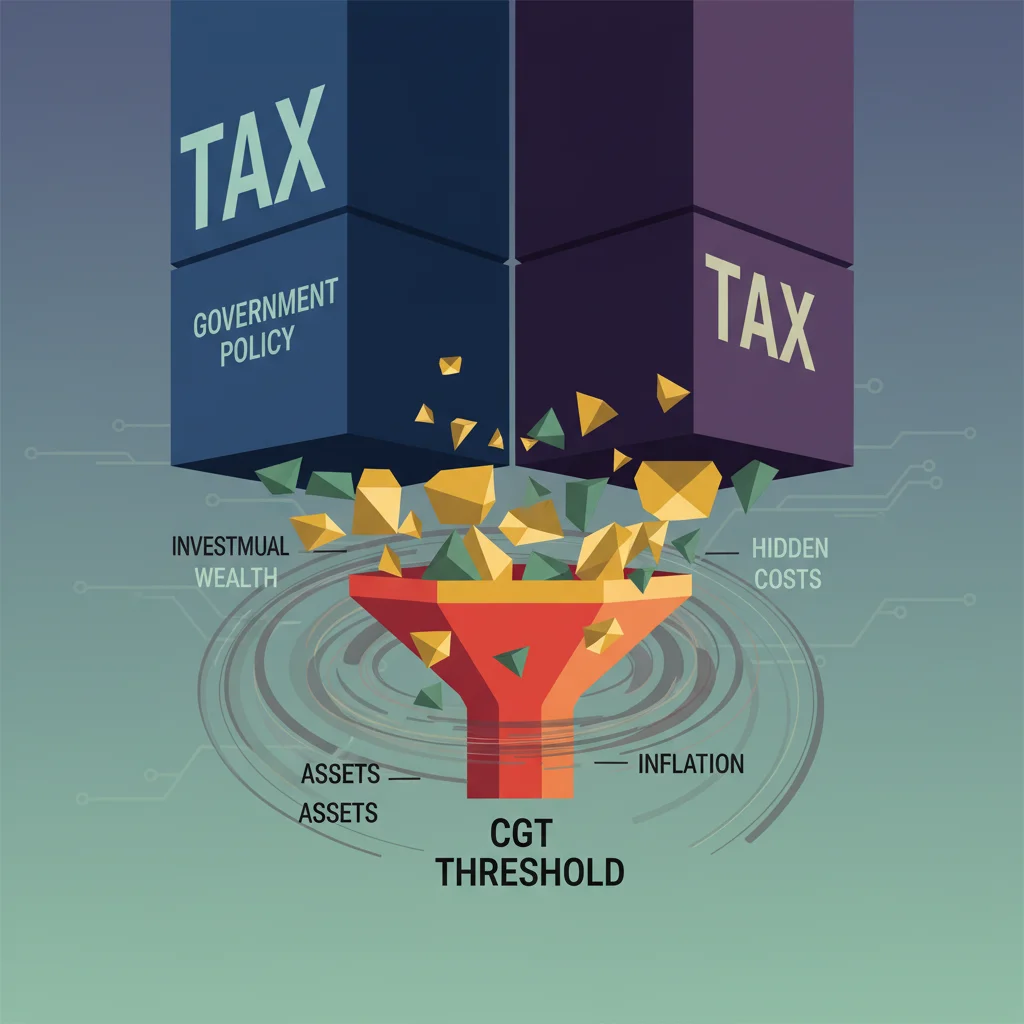

The Stealth Tax Squeeze: Why the UK’s Shrinking CGT Threshold is a Bigger Deal Than You Think

The UK’s Capital Gains Tax-free allowance has been cut by over 75%. Discover who’s affected and the strategies you need to protect your investments now.