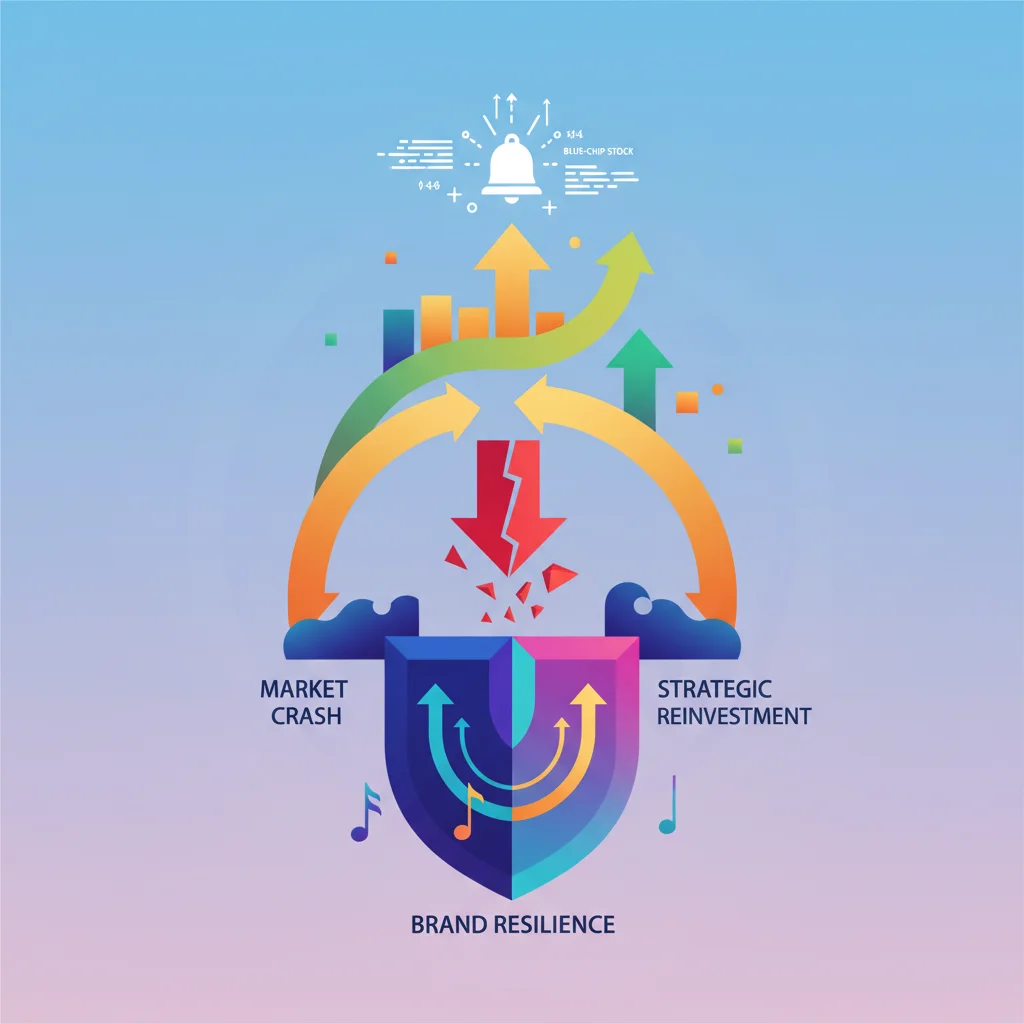

The Take That Portfolio: A Case Study in Market Crashes, Brand Resilience, and Strategic Reinvestment

The Opening Bell: From Startup to Blue-Chip Stock

In the world of finance, we are captivated by stories of meteoric rises, devastating crashes, and improbable comebacks. We analyze market trends, dissect corporate strategies, and model economic futures. But sometimes, the most potent lessons in business and investing don’t come from the stock market tickers or corporate boardrooms. They come from the pop charts. A recent Netflix documentary has brought one such story back into the limelight: the journey of Take That, a group that can be viewed as one of the most successful British enterprises of the last three decades.

To the uninitiated, they were a boy band. But to a business analyst, their formation in 1990 was a startup venture launched into the burgeoning market of teen pop. Managed by Nigel Martin-Smith, the group—Gary Barlow, Howard Donald, Jason Orange, Mark Owen, and Robbie Williams—was a meticulously crafted product. Their brand was their most valuable asset: a portfolio of distinct, complementary personas designed to maximize market penetration. Barlow was the serious musical talent, Owen the cute one, Donald the dancer, Orange the quiet one, and Williams the rebellious wildcard. This diversification within the core product ensured they appealed to the widest possible consumer base, a classic strategy for capturing market share.

Their initial public offering was a string of hit singles that functioned like consistent, high-yield dividends. Songs like “Pray,” “Relight My Fire,” and “Back for Good” weren’t just pop tunes; they were highly profitable assets that solidified the band’s position as a blue-chip stock in the entertainment industry. Their revenue streams were robust, flowing from record sales, merchandise, and sold-out tours, creating a vertically integrated business model that dominated the cultural economy of the early 1990s.

The Market Crash of ’96: When a Key Asset Divests

Every seasoned investor knows that no bull market lasts forever. For the Take That enterprise, the first sign of volatility came in 1995 with the abrupt departure of Robbie Williams. In corporate terms, this was not just a key executive resigning; it was a hostile divestment of a critical, if unpredictable, asset. Williams’s departure triggered a crisis of confidence among stakeholders—in this case, millions of teenage fans. The core product felt incomplete, and the brand’s value proposition was suddenly in question.

The subsequent decision to dissolve the band in 1996 was the equivalent of a voluntary liquidation. The market reaction was a full-blown crash, famously leading to the UK government setting up telephone hotlines for distraught fans (source). The once-invincible stock had been delisted. The ensuing years saw the former members embark on solo careers, essentially launching their own individual ventures. This period serves as a fascinating study in portfolio diversification and risk. Gary Barlow, the primary songwriter, was initially seen as the safest bet, yet his solo stock underperformed market expectations. In contrast, Robbie Williams, the high-risk “junk bond” of the group, defied all predictions to become a global superstar, generating returns that dwarfed the parent company’s peak performance.

This chapter of their story offers a crucial lesson in economics and finance: past performance is not indicative of future results. The perceived value of an asset (Barlow’s songwriting) does not always translate into market success, while high-risk, disruptive assets (Williams’s charisma) can sometimes yield astronomical returns. It’s a classic tale of asymmetrical risk and reward in the volatile market of public opinion. The Gen Z Investor: Misunderstood Gambler or Disciplined Strategist?

The 2005 Merger: A Masterclass in Relaunching a Legacy Brand

For nearly a decade, the Take That brand lay dormant. The intellectual property held value, but it was a legacy asset. Then, in 2005, came the reunion. This was not merely a nostalgia tour; it was a strategic merger and a corporate relaunch of monumental success. The remaining four members reformed, targeting not their original teenage demographic, but the same fans who were now adults with disposable income. This pivot was a stroke of genius in market segmentation.

They understood that their brand equity had matured. It was no longer about posters on bedroom walls; it was about premium live experiences. Their comeback album, “Beautiful World,” and the subsequent record-breaking tours were perfectly positioned for this new market. They had effectively transformed their brand from a speculative growth stock into a reliable, high-value heritage brand, akin to a luxury goods company. The success of this relaunch was staggering, with their 2011 “Progress” tour, which included Williams, becoming the biggest-selling tour in UK history at the time (source), a testament to their renewed market dominance.

Below is a comparative analysis of the two distinct phases of the Take That enterprise, illustrating their strategic evolution:

| Metric | Phase 1: Initial Run (1990-1996) | Phase 2: The Reunion (2005-Present) |

|---|---|---|

| Target Market | Teenagers & Young Adults | Adults 30-50+ (Original Fans) |

| Core Product | Pop Singles, Merchandise | Stadium Tours, Album Experiences |

| Brand Perception | Trendy, Youthful, “Growth Stock” | Nostalgic, Premium, “Blue-Chip Stock” |

| Primary Revenue Driver | Record & Merchandise Sales | Live Concert Ticket Sales |

| Economic Strategy | Market Saturation & High Volume | High-Margin Experiences & Brand Loyalty |

The Modern Enterprise: Navigating a Disrupted Economy

Today, Take That operates as a trio, another example of corporate restructuring to maintain operational efficiency. Their continued success offers insights into navigating a severely disrupted industry. The music business, much like the traditional banking sector, has been upended by a wave of technological innovation. The shift from physical CD sales to streaming is analogous to the move from brick-and-mortar banking to fintech apps. In both cases, the fundamental product changed, revenue models were shattered, and the consumer relationship was redefined.

Take That survived this disruption by focusing on their most defensible asset: the live experience. While a song can be streamed for a fraction of a cent, a concert ticket is a premium, non-fungible experience. This is a vital lesson for any industry facing technological obsolescence: identify your core, irreplaceable value proposition and build your new model around it. Their ability to consistently sell out stadiums demonstrates a deep understanding of their modern economic flywheel. Ireland's Economic Juggernaut: Beyond the Headlines of a 12.5% Tax Rate

Looking ahead, one can speculate on how a brand like Take That might interact with emerging financial systems. The world of decentralized finance and blockchain offers intriguing possibilities. Could they issue “fan tokens” that grant governance rights or access to exclusive content, creating a decentralized autonomous organization (DAO) of fans? Could classic video performances or unreleased tracks be sold as NFTs, turning cultural moments into unique, tradable assets? This isn’t just a flight of fancy; it’s the next frontier in the intersection of entertainment, finance, and community, a new form of financial technology for the creator economy.

The Final Analysis: Enduring Lessons in Value Creation

The story of Take That is a compelling narrative of a high-growth startup, a spectacular market crash, a calculated period of individual R&D, and a masterfully executed corporate merger and relaunch. Their journey provides a rich case study for investors, entrepreneurs, and business leaders on the principles of brand management, market adaptation, and long-term value creation.

They teach us that brand equity, when managed correctly, is a resilient asset that can weather market downturns. They demonstrate the power of understanding your customer base and evolving your product to meet their changing needs. Most importantly, they prove that even after a catastrophic failure, it is possible to restructure, reinvest, and return to the market stronger and more profitable than before. In the volatile stock market of pop culture, Take That has proven to be not just a fleeting trend, but a long-hold investment that continues to pay dividends. Solving the Financial Puzzle: What a Crossword Can Teach Us About Modern Investing