The Accidental Warehouse: How Your Corner Shop Became the Final Frontier of the E-commerce Economy

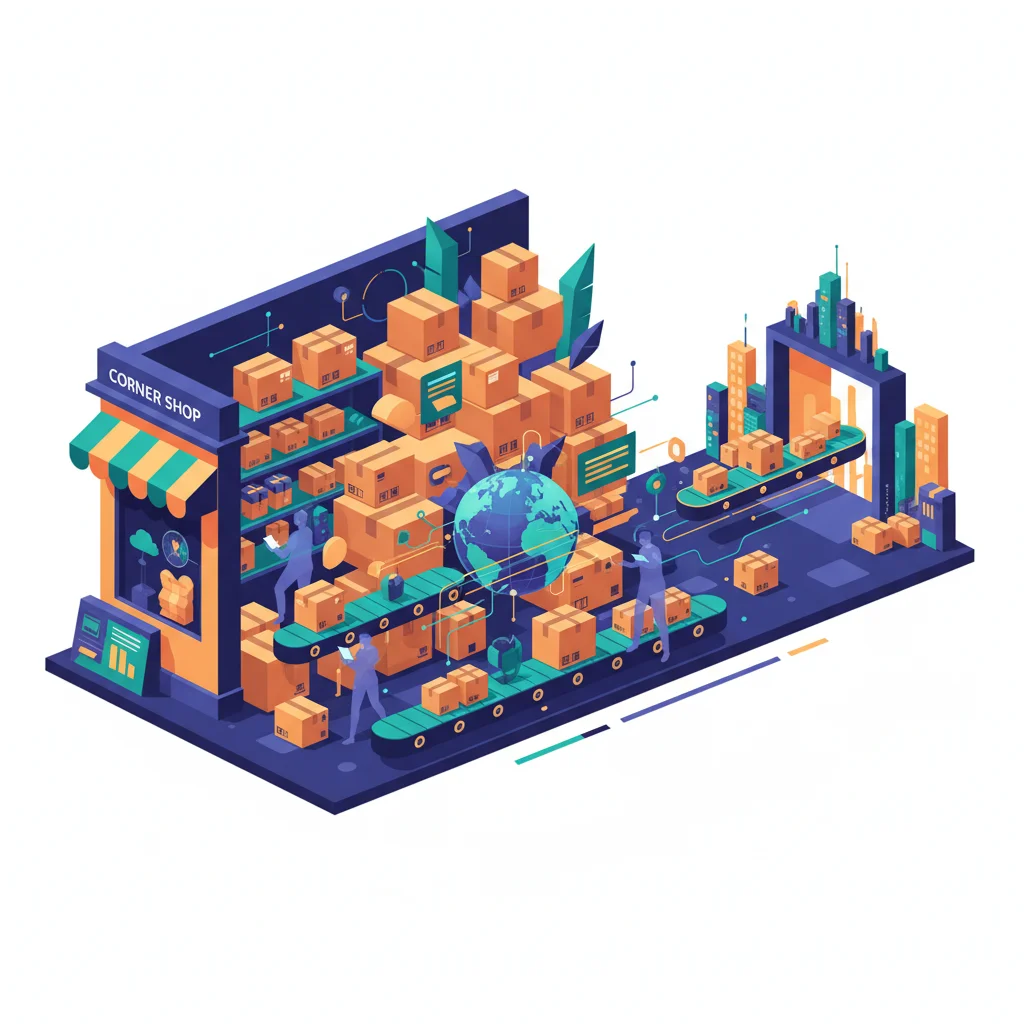

Walk into your local corner shop. What do you see? Beyond the familiar aisles of milk, bread, and newspapers, a new landscape is emerging. Towers of brown cardboard boxes lean precariously against shelves, branded parcels fill every available nook, and the shopkeeper often juggles a scanner alongside the cash register. This scene, observed with sharp clarity in a letter to the Financial Times by Laurence Russell, is more than just clutter. It’s a physical manifestation of a profound shift in our global economy—a sign that the humble corner shop has been unofficially conscripted to serve as an “ersatz fulfilment centre.”

This transformation isn’t a planned evolution; it’s a reactive adaptation to the relentless pressures of the digital marketplace. As consumers, we’ve embraced the “cult of convenience,” demanding faster, cheaper, and more flexible delivery options. In response, the multi-trillion-dollar e-commerce industry has scrambled to solve its most expensive and complex puzzle: the last-mile delivery. The solution, it seems, is hiding in plain sight on our street corners.

In this analysis, we will dissect this phenomenon, moving beyond the anecdotal to explore the deep financial, economic, and technological undercurrents at play. We will examine the hard economics driving this change, the investment implications for the stock market, and how innovations in fintech and banking are poised to formalize this accidental ecosystem. What’s happening in your local shop is a microcosm of a larger battle for efficiency, convenience, and the very future of urban retail.

The Last-Mile Problem: The Achilles’ Heel of E-commerce

To understand why your local shop is drowning in parcels, we must first understand the economics of logistics. The journey of a product from a factory to your doorstep is a complex chain, but its final leg—the “last mile”—is disproportionately expensive. Industry estimates suggest that last-mile delivery can account for over 50% of total shipping costs (source). Why? It’s a battle against inefficiency.

A single cargo ship or truck can move thousands of items from a central warehouse to a regional hub with immense efficiency. The last mile, however, shatters this economy of scale. It involves a single driver navigating unpredictable traffic, searching for parking, and delivering one or two packages to dozens of individual addresses. Failed delivery attempts—when the recipient isn’t home—further compound these costs, requiring return trips and additional logistical planning. This final, chaotic step is a major drain on the profitability of e-commerce giants and a key focus for investors scrutinizing their balance sheets.

This is where Pick-Up/Drop-Off (PUDO) points enter the equation. By consolidating dozens of deliveries to a single, reliable location, logistics companies can slash their operational costs. Drivers make one stop instead of thirty, failed deliveries become a rarity, and the entire network becomes more efficient. Corner shops, with their long opening hours, ubiquitous presence in residential areas, and existing staff, are the perfect, low-cost PUDO solution. They have become the de facto buffer absorbing the inefficiencies of the modern supply chain.

To illustrate the economic drivers, consider the operational differences between the two models:

| Factor | Direct-to-Home Delivery | PUDO Point (Corner Shop) Delivery |

|---|---|---|

| Delivery Density | Low (1-2 packages per stop) | High (20-50+ packages per stop) |

| Time Per Delivery | High (driving, parking, finding address) | Low (single drop-off) |

| Fuel & Vehicle Costs | High per package | Significantly lower per package |

| Failed Delivery Rate | Moderate to high (5-15% in some areas) | Extremely low |

| Customer Convenience | High (if home), Low (if missed) | High (flexible pickup times) |

Bitcoin's Road to 0K: The Critical Support Level That Could Define the Next Bull Run

From Clutter to Capital: The Financial and Investment Landscape

This ground-level shift has significant top-level implications for the world of finance and investing. For the savvy investor, business leader, or finance professional, the cluttered corner shop is a signal—a leading indicator of where capital and innovation are flowing in the new economy.

Investing in the Logistics Ecosystem

The relentless drive to solve the last-mile problem is a powerful engine for the stock market. Investors are looking beyond the obvious e-commerce players and focusing on the picks-and-shovels of the industry:

- Logistics Giants: Companies like UPS, FedEx, and DHL are in an arms race to build the most efficient delivery networks. Their investment in technology, PUDO partnerships, and route optimization software is a key performance indicator for their stock.

- Last-Mile Tech Startups: A new generation of companies is attracting venture capital by tackling this problem head-on. They offer everything from AI-powered route planning and drone delivery systems to software platforms that manage PUDO networks, representing a high-growth area for early-stage investing.

– Industrial REITs: Real Estate Investment Trusts that specialize in logistics and warehouse properties have boomed, while traditional retail REITs have faced headwinds. The demand for massive fulfillment centers on the outskirts of cities and smaller, urban micro-fulfillment hubs is reshaping the commercial property market.

The Fintech and Banking Opportunity

Where there is friction in an economic system, there is an opportunity for financial technology. The current arrangement between delivery companies and corner shops is often informal and inefficient. This is a problem that fintech is uniquely positioned to solve.

Imagine a platform that seamlessly connects thousands of independent shops with multiple carriers. This system could automate payments per parcel, manage inventory tracking, and even handle insurance and liability. Such a platform would create a formal, efficient marketplace, allowing shop owners to accurately track their earnings and carriers to manage their distributed network. This represents a clear opportunity for innovation in B2B payments and platform-based banking services.

Furthermore, the data generated by this network is incredibly valuable. Lenders could use a shop’s parcel volume as a new metric to assess creditworthiness, offering bespoke financial products to help these businesses grow their hybrid retail-logistics model. The role of traditional banking could evolve to finance this new class of micro-logistics entrepreneurs.

The Milk Market Meltdown: Why a Dairy Crisis is a Red Flag for the Global Economy

A Glimpse of a Blockchain-Powered Future?

Looking further ahead, the concept of a decentralized network of thousands of micro-warehouses presents a perfect use case for blockchain technology. Each parcel scan—from the carrier dropping it off to the customer picking it up—could be recorded as an immutable transaction on a distributed ledger. This would create a transparent, auditable, and trustless system for tracking custody, virtually eliminating disputes over lost or stolen packages. While still nascent, applying blockchain to this real-world logistical challenge could unlock unprecedented levels of security and efficiency, moving beyond the speculative world of digital asset trading and into practical, industrial applications.

The Macro-Economic Reshaping of Our Cities

The transformation of the corner shop is a symptom of a larger restructuring of our urban economy. The rise of e-commerce doesn’t just mean more packages; it changes how we use physical space, how we define “retail,” and the nature of local employment.

This trend contributes to the bifurcation of commercial real estate. While prime retail locations struggle, demand for light industrial and logistics space within city limits is surging. Urban planners and policymakers must now contend with new challenges, from managing increased delivery van traffic to zoning for micro-fulfillment centers. The principles of economics show us that as consumer behavior changes, the physical landscape must inevitably adapt.

The number of parcels delivered in the UK, for example, has exploded in recent years. In 2020-2021, the postal service Royal Mail alone delivered 1.7 billion parcels, a 31% increase from the previous year, a trend accelerated by the pandemic (source). This staggering volume cannot be accommodated by old models; it forces the creation of new systems, whether accidental or intentional.

The Investor's Dilemma: Decoding Modern Finance Like a Crossword Polymath

The Future: A Threat or an Opportunity?

Is this new role as a parcel hub a death knell for the traditional corner shop or its saving grace? The answer is complex. On one hand, it threatens their identity, turning community spaces into sterile transaction points. The small payments received for handling parcels may not compensate for the loss of floor space and the friction added to the traditional shopping experience.

On the other hand, it presents a vital new revenue stream and a reason for being in an era when competing with supermarket chains on price is a losing battle. Increased foot traffic from parcel pickups could translate into additional sales. The shop that successfully integrates this logistical function—perhaps with dedicated space, efficient systems, and clear signage—could thrive, becoming an indispensable node in both the social and economic life of its neighborhood.

The future likely lies in formalization. We will see more sophisticated partnerships, better technology provided to shop owners, and clearer revenue models. The “ersatz” fulfillment center will become a planned and integrated micro-hub, a recognized and vital part of our 21st-century economic infrastructure.

The next time you step over a stack of boxes to buy a pint of milk, take a moment. You are not just in a shop. You are standing at the intersection of global logistics, financial innovation, and local community. You are witnessing the frontline of an economic transformation, one parcel at a time.