Beyond the Sparkle: What a Surprise Surge in Jewellery Sales Reveals About the UK Economy

The final month of the year often serves as a critical barometer for the health of the retail sector and, by extension, the broader economy. As households across the nation finalise their festive spending, analysts pore over the data, searching for signs of consumer confidence or caution. This past December, the numbers presented a fascinating paradox. On the surface, UK retail sales saw a better-than-expected rise, a headline that might suggest a resilient consumer shrugging off economic pressures. However, a deeper dive reveals a more complex and nuanced story—one driven by the surprising glitter of online jewellery sales amidst a landscape of deep discounting and falling sales volumes. This isn’t just a story about shopping; it’s a crucial indicator for investors, finance professionals, and business leaders navigating the intricate currents of today’s economy.

Deconstructing December’s Retail Paradox

At first glance, the figures from the British Retail Consortium (BRC) and KPMG seem cautiously optimistic. Total UK retail sales reportedly increased by 1.7% in December compared to the previous year. While any growth is welcome, this figure pales in comparison to the 6.9% growth seen in December 2022, highlighting a significant slowdown. The real story, however, lies beneath this headline number. The modest rise in sales *value* is largely a phantom created by persistent inflation. When we consider sales *volume*—the actual number of items purchased—the picture is far less rosy, with volumes continuing their downward trend. This suggests that while consumers are spending more money, they are walking away with fewer goods.

The driving force behind the positive headline figure was a notable surge in online sales for non-food items, particularly in categories like jewellery and watches. This indicates a highly selective and bifurcated consumer, one who is cutting back on many everyday purchases but is still willing to spend on specific, high-value items, especially when enticed by online convenience and promotions.

To better understand this split, let’s examine the performance across different retail categories:

| Category | December Performance Analysis | Key Drivers |

|---|---|---|

| Food & Grocery | Moderate growth in value, driven almost entirely by food price inflation. Volumes remained flat or slightly down. | Essential spending, high inflation on basic goods. |

| Online Non-Food | Positive growth, outperforming in-store sales. Strongest performance in luxury-adjacent goods. | Jewellery, watches, health & beauty products. Heavy online discounting. |

| In-Store Non-Food | Overall decline in sales value and significant decline in volume. | Reduced footfall, competition from online retailers, cautious spending on big-ticket items like furniture and electronics. |

| Apparel & Footwear | Mixed results, with heavy discounting needed to move stock. Modest growth at best. | Price-conscious consumers, competition for discretionary spending. |

This data clearly illustrates a challenging environment. The sparkle of jewellery sales is a bright spot, but it’s illuminating a landscape where many other retailers are struggling to persuade cost-conscious consumers to part with their cash.

The Digital Engine: How Fintech is Powering a New Era of Luxury E-Commerce

The success of online jewellery retailers isn’t just a fluke; it’s a testament to the powerful convergence of e-commerce strategy and advanced financial technology. A decade ago, the idea of purchasing expensive jewellery sight-unseen from a website was niche. Today, it’s a booming market. This transformation has been enabled by a sophisticated fintech ecosystem that builds consumer trust and removes friction from high-value online transactions.

Modern e-commerce platforms, powered by cutting-edge financial technology, offer features that were once unimaginable. High-resolution imaging, 360-degree video, and virtual try-on tools replicate the in-store experience. But the real revolution is in the checkout process. Fintech solutions like seamless one-click payments, integrated “Buy Now, Pay Later” (BNPL) options for spreading the cost of significant purchases, and robust, multi-layered security protocols have made consumers feel secure and empowered when buying online.

Furthermore, the conversation around high-value digital assets is increasingly involving blockchain. While not yet mainstream in retail, blockchain technology offers the potential to create immutable digital certificates of authenticity for diamonds and other precious goods. This could revolutionise the industry by combating fraud and providing a transparent, verifiable history for any item, massively boosting consumer confidence in the secondary market and justifying the initial investment. As this technology matures, it will further solidify the dominance of digitally native luxury brands.

An Investor’s Guide to a Divided Retail Stock Market

For those involved in investing or trading on the stock market, this retail data is a minefield of conflicting signals. A blanket “buy” or “sell” on the retail sector would be a foolish move. The key is to dissect the market and understand which business models are thriving and which are faltering in this new economic reality.

Companies that rely heavily on brick-and-mortar sales for non-essential, mid-range goods are facing immense pressure. They are caught between rising operational costs (rent, energy, wages) and the need to offer deep discounts to compete, leading to severe margin compression. Conversely, businesses with a strong online presence, sophisticated digital marketing, and a focus on niche or luxury-adjacent categories are better positioned to capture the selective spending of today’s consumer.

Investors should look beyond the headline sales figures and scrutinise the following metrics:

| Metric | What to Look For | Why It Matters |

|---|---|---|

| Gross Profit Margin | Stable or increasing margins. | Indicates pricing power and an ability to avoid excessive, profit-destroying discounting. |

| Inventory Levels | Decreasing or stable inventory-to-sales ratio. | High inventory suggests a company is struggling to sell its products and may be forced into clearance sales. |

| Online vs. In-Store Sales Mix | Growing percentage of online sales. | Shows the company is adapting to modern consumer behaviour and has a more scalable, lower-overhead model. |

| Customer Acquisition Cost (CAC) | A low and stable CAC. | Rising CAC can indicate that a company is spending heavily on marketing for diminishing returns in a competitive market. |

The December data reinforces the idea that the future of retail belongs to those who can master the digital shelf and cater to a discerning, value-conscious, yet occasionally indulgent, consumer.

The Macro View: What Retail Trends Mean for the Broader Economy

Retail sales are more than just a measure of shopping habits; they are a vital piece of the macroeconomic puzzle. This data provides crucial insights for understanding the broader fields of economics and finance. The reliance on discounting to drive sales is a clear signal that underlying consumer demand is weak. This weakness, despite a relatively strong labour market, suggests that high inflation and rising interest rates are genuinely squeezing household budgets.

This has direct implications for the central banking authorities. If consumer demand continues to soften, it could help bring inflation down faster, potentially leading the Bank of England to consider interest rate cuts sooner than anticipated. However, they must also be wary of the stickiness of inflation in the services sector. The retail figures paint a picture of an economy walking a tightrope: too much weakness could tip it into recession, but persistent inflation could force the central bank to keep monetary policy tight, further pressuring households and businesses.

The performance of the retail sector is a leading indicator. Its struggles today could signal wider economic challenges tomorrow, impacting everything from manufacturing orders to the health of the commercial real estate market, which relies on thriving high streets.

A Dangerous Game: When Politics and Central Banking Collide

Conclusion: A Glimmer of Hope or a Warning Sign?

The surprising boost from online jewellery sales in December is a fascinating case study in modern consumer psychology and the resilience of certain market segments. It demonstrates the power of digital commerce and the enduring appeal of tangible luxury. However, it would be a grave mistake to interpret this single data point as a sign of a robust economic recovery. The underlying trends—falling volumes, heavy discounting, and bifurcated spending—paint a much more sobering picture.

For business leaders, the message is clear: digital excellence, supply chain efficiency, and a deep understanding of your niche customer are paramount. For investors, a discerning, data-driven approach is essential to separate the long-term winners from those facing structural decline. And for economists, these figures serve as a stark reminder that headline numbers can often conceal more than they reveal. The UK retail sector may have found a little sparkle to end the year, but the road ahead in 2024 remains fraught with challenges, requiring vigilance, strategy, and a clear-eyed view of the economic realities at play.

user

Related Posts

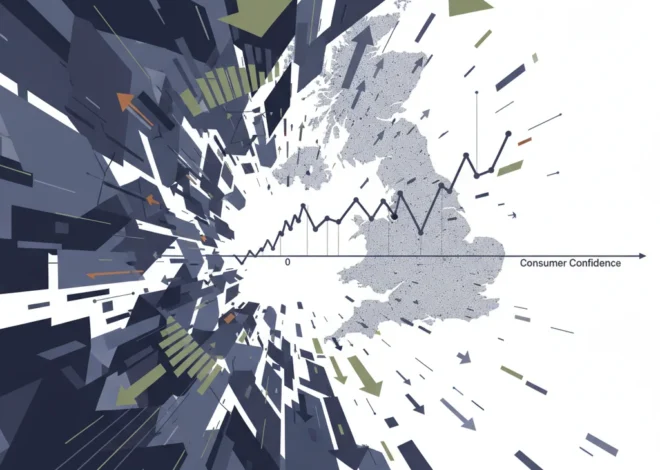

A Decade of Doubt: Unpacking Ten Years of Negative UK Consumer Confidence

The £1.5 Billion Green Failure: A Case Study in Government Waste, Investment Risk, and the Future of ESG