The Dove on the Davos Menu: Decoding Trump’s “Board of Peace” and Its Impact on Global Markets

In the rarefied air of Davos, where global leaders and financial titans convene to chart the course of the world economy, symbolism is everything. Words are weighed, handshakes are analyzed, and even the catering choices can send a message. It is in this context that a cryptic, almost poetic dispatch from the Financial Times sent ripples through the circles of finance and politics: Donald Trump, a figure synonymous with disruption, had launched his ‘Board of Peace’. The menu for the occasion? A single, potent word: “dove” (source).

For the seasoned investor, the business leader, or the keen observer of global economics, this report is more than just a curious anecdote. It’s a complex signal layered with irony, potential, and significant risk. Is this a genuine pivot towards global cooperation from a historically nationalist leader? A masterful piece of political theatre designed to soothe anxious markets? Or simply a moment of surrealism at the world’s most elite gathering? Unpacking this single, symbolic act reveals a great deal about the delicate interplay between geopolitics, market sentiment, and the future of the global economy.

This post will delve into the implications of this Davos moment, exploring what it signifies for the stock market, international trade, and the evolving role of financial technology in an era of uncertainty. We will analyze the powerful connection between political rhetoric and market volatility, the tangible economics of peace, and why, for investors, looking beyond the menu is more critical than ever.

Decoding the Symbolism: Davos, Trump, and the Dove

The World Economic Forum (WEF) at Davos has long been the epicenter of globalist thought—a platform for promoting free trade, international cooperation, and multilateral solutions. It’s a philosophy that has often been at odds with the “America First” doctrine championed by Donald Trump during his presidency. His past appearances and pronouncements have frequently challenged the Davos consensus, creating friction and uncertainty in the global financial landscape.

Therefore, the announcement of a “Board of Peace” is a stark departure from the expected script. Peace, as a concept, is the ultimate goal of global cooperation. By launching such an initiative at this specific venue, the message—whether sincere or strategic—is one of engagement with the very systems previously criticized. The choice of the dove, the universal symbol of peace, as the reported menu item is a masterstroke of political communication. It’s a gesture so overt it borders on parody, yet it cannot be entirely dismissed.

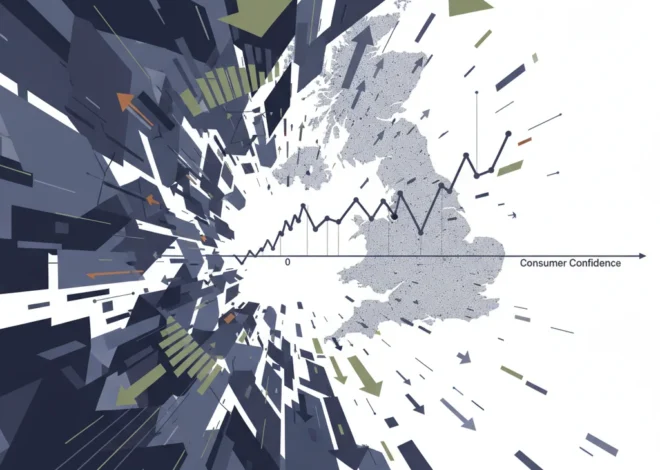

For those in finance, symbolism translates into sentiment, and sentiment moves markets. A perceived shift towards stability and predictability from a major political player can calm investor nerves, lower risk premiums, and encourage long-term investment. Conversely, if the gesture is seen as hollow, it can deepen cynicism and be dismissed as noise, leaving the underlying geopolitical risks unchanged.

The Ferguson Effect: What Man Utd & UK Politics Reveal About Long-Term Investment Strategy

Geopolitics, Rhetoric, and Your Portfolio

The Davos announcement serves as a powerful reminder of a fundamental truth in modern investing: geopolitics is a core component of risk analysis. In today’s interconnected world, a single speech, tweet, or symbolic dinner can send shockwaves through the stock market, currency exchanges, and commodity prices. This is particularly true when the statements come from leaders of the world’s largest economies.

We’ve seen this play out repeatedly. Announcements of trade tariffs have historically triggered sharp downturns in the stock market, while news of a potential trade agreement has sparked rallies. According to a 2022 study, geopolitical risk events have been shown to increase stock market volatility by an average of 15% in the subsequent weeks (source). This volatility creates both challenges and opportunities for those engaged in trading and active portfolio management.

The “Board of Peace” concept, therefore, must be analyzed through this lens. A credible move toward de-escalating global tensions could have profound effects on the economy:

- Supply Chains: Reduced political friction could stabilize global supply chains, lowering costs for businesses and potentially easing inflationary pressures.

- Energy Markets: Geopolitical stability, particularly in key regions, is a primary driver of stable energy prices, impacting everything from transportation costs to household spending.

- Capital Flows: A more predictable global environment encourages cross-border investing, as corporations and funds are more willing to deploy capital when the risk of sudden policy shifts or conflicts is lower.

Investors and financial institutions must increasingly integrate sophisticated geopolitical analysis into their economic models. This involves moving beyond traditional financial metrics to understand the motivations, strategies, and potential actions of global leaders. The dove on the menu is, in essence, a qualitative data point that traders and analysts must now attempt to quantify.

The Spy in the Boardroom: Cold War Lessons on Trust, Treachery, and Modern Financial Risk

The Tangible Economics of Global Stability

While the symbolism is abstract, the economic benefits of peace and stability are concrete and measurable. The field of economics has long studied the “peace dividend”—the economic growth that can result from a reduction in defense spending and a reallocation of resources to more productive sectors like infrastructure, education, and technology.

A stable global order reduces the costs of doing business, fosters trust in international banking and finance, and allows for long-term planning. Conversely, conflict and instability impose staggering economic costs. A report from the Institute for Economics & Peace estimated the global economic impact of violence to be $14.4 trillion in 2019, equivalent to 10.5% of global GDP (source). These costs include not only direct military expenditure but also the indirect impacts of lost productivity, economic disruption, and the long-term consequences of displacement and trauma.

To illustrate the contrast, consider the impact on key economic indicators:

| Economic Indicator | Environment of Geopolitical Stability | Environment of Geopolitical Instability |

|---|---|---|

| Stock Market Volatility (VIX) | Generally lower and more predictable | Prone to sharp spikes and elevated levels |

| Foreign Direct Investment (FDI) | Tends to increase as long-term confidence grows | Often decreases as investors become risk-averse |

| Global Trade Volumes | Expand as trade routes are secure and tariffs are low | Contract due to sanctions, tariffs, and logistical disruptions |

| Currency Markets | More stable, with less demand for “safe-haven” currencies | High volatility, with capital flight to perceived safe assets |

This data underscores why a credible “Board of Peace” would be so significant for the global economy. A genuine reduction in global tensions isn’t just a political victory; it’s a direct catalyst for economic growth and prosperity.

The Role of Financial Technology in Underpinning Peace

While leaders talk of peace at high-level summits, the true architecture of a stable, interconnected world is increasingly being built with code. The fields of financial technology (fintech), banking, and blockchain are creating the tools that can either reinforce or undermine global cooperation. A durable peace requires more than treaties; it requires transparent, efficient, and equitable financial systems.

Consider the role of financial technology in this context:

- Cross-Border Payments: High-friction, high-cost international banking systems can be a barrier to global trade and aid. Fintech innovations are drastically lowering the cost and increasing the speed of sending money across borders, fostering greater economic integration.

- Supply Chain Transparency: Blockchain technology offers the potential for an immutable, transparent ledger to track goods from source to consumer. This can help enforce trade agreements, combat illicit trade, and ensure ethical sourcing—all of which reduce sources of international conflict.

- Financial Inclusion: In post-conflict or developing regions, fintech can provide access to banking and credit for populations ignored by traditional institutions. Economic empowerment is a cornerstone of lasting stability.

Therefore, the conversations happening in the fintech pavilions and blockchain side-sessions at Davos are, in many ways, just as important as the pronouncements from the main stage. The technological infrastructure of our global economy will determine whether the ideals of cooperation and peace are achievable. A “Board of Peace” in the 21st century must be supported by a robust and modern financial technology framework.

Political Chess: How Delayed Elections Could Impact the UK Economy and Your Investments

Conclusion: From Symbolic Gestures to Investment Strategy

The image of Donald Trump’s “Board of Peace” dining on dove at Davos is a potent, almost surreal, snapshot of our current global moment. It encapsulates the collision of political theatre, economic reality, and the constant search for market-moving signals. For the general public, it’s a curious headline. For finance professionals, it’s a complex variable to be factored into a global risk equation.

The ultimate takeaway is one of cautious vigilance. Symbolic gestures can set a new tone and open doors for genuine progress, but they are no substitute for concrete policy and verifiable action. Investors and business leaders must continue to ground their strategies in fundamental analysis of the economy, while also developing a more sophisticated understanding of how political narratives can shape market sentiment.

Whether the dove was a harbinger of a new era of cooperation or merely a fleeting piece of political performance art remains to be seen. But its appearance on the menu has forced the world of finance to once again contemplate the profound and unbreakable link between the quest for peace and the pursuit of prosperity.