The Christmas Ledger: Unpacking the Hidden Economic Impact of Holiday Gender Roles

The Unseen Balance Sheet of the Festive Season

As the festive season approaches, the air fills with the scent of pine needles and gingerbread, and our thoughts turn to celebration, family, and tradition. Yet, beneath the shimmering surface of holiday cheer lies a complex and often invisible economic engine. In a poignant letter to the Financial Times, Victoria Brombacher of Vienna, VA, touched upon a timeless observation: the persistence of traditional gender roles at Christmas (source). While this may seem like a purely social or cultural issue, for those in finance, business, and investing, it’s a critical data point that reveals profound truths about our economy, the nature of labor, and the creation of wealth.

The “magic” of Christmas doesn’t just happen. It is manufactured through countless hours of planning, budgeting, shopping, wrapping, cooking, and hosting. Historically and culturally, this labor—often unpaid and unacknowledged—has disproportionately fallen on women. This isn’t just a matter of fairness; it’s a significant economic phenomenon with measurable consequences for everything from household savings and the gender pay gap to corporate performance and the broader economy. By pulling back the tinsel, we can analyze the holiday season not just as a cultural event, but as a case study in behavioral economics, resource allocation, and the immense financial impact of unrecognized work.

Quantifying the Invisible: The Multi-Trillion Dollar Christmas Bonus No One Receives

In standard economic models, Gross Domestic Product (GDP) measures the market value of all final goods and services produced. However, it has a glaring blind spot: it completely ignores unpaid care and domestic work. This work, from childcare to elder care to the intensive project management of the holiday season, is the bedrock upon which the formal economy is built. When we fail to measure it, we fail to understand the true size and scope of our economic activity.

According to a report by the UN Women, women perform 76.2% of the total hours of unpaid care work, more than three times as much as men. If this labor were assigned a monetary value, it would constitute an estimated $10.8 trillion annually—an amount larger than the annual revenue of the world’s 50 largest companies combined (source). The holiday season acts as a massive annual spike in this “shadow economy.” The logistical complexity of coordinating family gatherings, managing gift lists, and adhering to budgets is a form of unpaid labor that, in a corporate setting, would be handled by a team of well-compensated project managers, event planners, and procurement specialists.

To put this in perspective, let’s consider the key tasks and their market-value equivalents during the holiday season.

| Holiday Task (Unpaid Labor) | Corporate Equivalent | Estimated Hourly Rate (USD) |

|---|---|---|

| Researching, purchasing, and wrapping gifts | Personal Shopper / Procurement Specialist | $25 – $75 |

| Planning and cooking holiday meals | Private Chef / Caterer | $30 – $100+ |

| Budgeting and tracking holiday expenses | Financial Planner / Bookkeeper | $40 – $150 |

| Organizing events and coordinating schedules | Event Planner / Project Manager | $50 – $120 |

| Cleaning and preparing the home for guests | Professional Cleaning Service | $20 – $50 |

When we multiply these rates by the dozens, or even hundreds, of hours invested during November and December, the economic value becomes staggering. This isn’t “free” labor; it’s uncompensated labor that subsidizes the formal holiday retail and service economy.

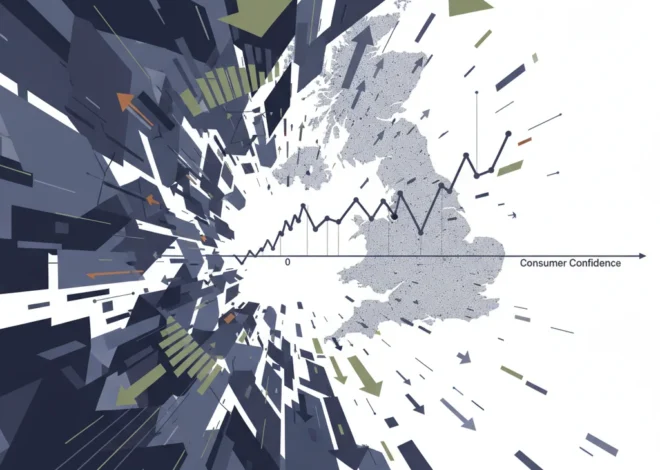

The Verdict on the UK Economy: Why Scrapping Jury Trials Could Rattle Global Investors

The Opportunity Cost of Mistletoe: A Drag on Wealth Creation and Investing

For finance professionals, the most critical concept here is opportunity cost. Every hour spent on uncompensated holiday labor is an hour *not* spent on activities with a direct financial return. This includes paid work, professional development, networking, managing an investment portfolio, or even launching a side business. Over a lifetime, the cumulative effect of this lost opportunity is a primary driver of the gender wealth gap.

Consider two individuals with equal earning potential. If one consistently dedicates an extra 15-20 hours per week during the fourth quarter to unpaid holiday management, while the other uses that time for career-advancing projects or financial education, their wealth trajectories will diverge dramatically. This isn’t a theoretical exercise. Research consistently shows a significant gender gap in investing. While many factors contribute, the “time poverty” created by the unequal distribution of domestic labor is a major, yet often overlooked, component. Managing a diversified portfolio, researching the stock market, and staying abreast of economic trends requires time—a resource that is finite and unequally distributed along gender lines.

This time deficit directly impacts financial literacy and confidence. When one’s time is consumed by the logistics of the present, long-term strategic planning—the cornerstone of successful investing—is inevitably pushed aside. The result is often more conservative, less-informed financial decision-making, which further widens the wealth gap over time.

From Kitchen Tables to Trading Floors: How Fintech and New Banking Models Can Help

Recognizing the problem is the first step; finding solutions is the next. The worlds of banking, fintech, and even emerging technologies like blockchain offer potential pathways to mitigate this economic imbalance. The goal is not to eliminate holiday traditions, but to rebalance the labor and provide tools that reduce the administrative burden.

Modern financial technology is already making strides. Sophisticated budgeting apps can automate expense tracking, collaborative platforms can help families share and manage gift lists and event planning, and automated investment services (robo-advisors) can lower the time-commitment barrier to entering the stock market. These tools can help transform the “Chief Holiday Officer” role from a solitary, all-consuming job into a more collaborative, manageable team effort.

For business leaders and investors, the implications are clear. Companies that acknowledge this “fourth quarter crunch” on their employees (particularly women) with flexible policies and support systems are likely to see better employee retention and productivity. From an ESG (Environmental, Social, and Governance) perspective, a company’s internal policies on parental leave, flexible work, and family support are leading indicators of a healthy corporate culture and sustainable long-term governance. This is no longer a “soft” issue; it’s a hard data point for savvy investors analyzing corporate risk and potential.

The Investor's Fog of War: Navigating Market Uncertainty in an Age of Geopolitical Turmoil

Furthermore, there’s a massive market opportunity for fintech companies that specifically design products to address the financial and administrative load of household management. Imagine a platform that integrates family budgeting, collaborative shopping lists, automated savings for holiday goals, and investment tools—all designed to be shared and managed transparently by multiple family members. Such a platform would directly address the economic friction point we see amplified every holiday season.

Recalculating the Value of a Holiday: A Call for a New Economic Perspective

The gentle observation in the Financial Times letter opens a door to a much larger economic conversation. The traditions we cherish are not separate from the world of finance and economics; they are deeply intertwined with it. The unpaid labor that powers the holidays is a massive economic subsidy that, once made visible, changes how we should view everything from GDP calculations to personal wealth management strategies.

For individuals, the takeaway is to make the invisible visible. Have open conversations about the division of labor, use technology to streamline and share the load, and consciously allocate time for financial planning and investing, even during the busiest seasons. For business leaders, it’s about recognizing the external pressures on your workforce and building a supportive infrastructure that acknowledges the whole employee. For investors, it’s about looking beyond the balance sheet to the social factors that will drive long-term corporate success and economic stability.

By applying a financial lens to our festive traditions, we don’t diminish their magic. Instead, we gain a deeper appreciation for the true effort involved and can begin to build a more equitable and prosperous future—one where the burdens and the benefits of the holiday season, and the economy at large, are shared by all.

The Hidden Economic Toll of 'Carspreading': A New Risk for Your Portfolio?