The Biggest Shake-Up in Credit Scoring: How Your Rent Is About to Redefine Your Financial Future

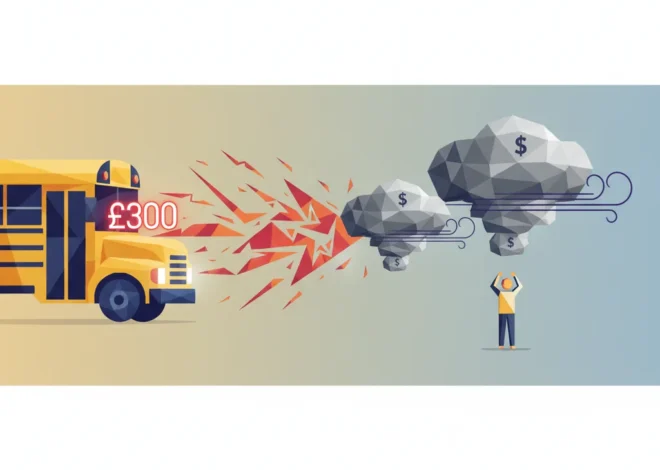

For decades, the path to a strong credit score has been a well-trodden, yet narrow, road. It was paved with credit cards, mortgages, and personal loans—a financial landscape that often excluded millions of responsible individuals. But the ground is shifting. In a move that signals a seismic change in the world of personal finance, a major credit ratings agency has announced that rental payments will now be incorporated into credit scores. This isn’t just a minor tweak; it’s a fundamental re-evaluation of what it means to be a creditworthy individual, driven by the relentless march of financial technology.

The announcement, first reported by the BBC, states that this change will provide lenders with a more holistic view of a borrower’s financial habits. For the 44 million households that rent in the U.S. alone and the millions more in the UK and worldwide, this development could be the key that unlocks new financial opportunities. But what does this mean for the average renter, the savvy investor, or the established banking institution? This post will dissect this pivotal moment, exploring its profound implications for financial inclusion, risk assessment, the broader economy, and the burgeoning fintech sector that is making it all possible.

Understanding the Old Guard: The Anatomy of a Traditional Credit Score

Before we can appreciate the magnitude of this change, we must first understand the system it seeks to improve. A credit score is a three-digit number that has long held immense power over our financial lives. It determines eligibility for everything from a mortgage to a car loan, and often influences interest rates, insurance premiums, and even rental applications. Traditionally, these scores have been calculated based on a handful of key factors:

- Payment History (35%): Your track record of paying bills on time.

- Amounts Owed / Credit Utilization (30%): How much of your available credit you are using.

- Length of Credit History (15%): The age of your oldest account and the average age of all accounts.

- Credit Mix (10%): The variety of credit you have (e.g., credit cards, installment loans).

- New Credit (10%): Recent credit inquiries and newly opened accounts.

This model has served as the bedrock of consumer lending for half a century. However, its limitations have become increasingly apparent in a modern economy. The system inadvertently penalizes certain demographics, creating a class of “credit invisibles.” These are individuals who may be financially responsible—diligently paying rent, utilities, and other bills on time—but have no formal credit history to show for it. According to the Consumer Financial Protection Bureau (CFPB), approximately 26 million American adults are credit invisible, with millions more having “unscorable” credit files. This has locked them out of mainstream financial products, forcing them into higher-cost alternatives.

The New Frontier: Integrating Alternative Data into Credit Reports

The inclusion of rental payment data is the most significant step yet in a broader movement to incorporate “alternative data” into credit scoring. This isn’t about replacing the old model but augmenting it to create a richer, more accurate financial portrait. Rent is often a household’s single largest monthly expense, and a consistent history of on-time payments is a powerful indicator of financial reliability—arguably more so than a small retail credit card.

So, how does this work in practice? It relies on a new ecosystem of fintech platforms that act as intermediaries. Renters can opt-in to services that verify their monthly payments with their landlord or property management company and then report that data directly to credit bureaus like Experian, Equifax, and TransUnion. This transforms a previously invisible financial behavior into a tangible asset for building credit.

To illustrate the shift, let’s compare the traditional and emerging models of credit assessment.

| Data Point Category | Traditional Credit Model | Emerging Alternative Data Model |

|---|---|---|

| Payment History | Credit cards, mortgages, auto loans, student loans. | Includes all traditional data PLUS rent, utilities, and subscription services (e.g., streaming). |

| Financial Stability | Inferred from debt levels and credit utilization. | Directly measured through bank account data (cash flow, average balance, saving patterns). |

| Data Sources | Lenders and financial institutions. | Lenders, landlords, utility companies, telecom providers, and consumer-permissioned bank data. |

| Target Audience | Individuals with established credit histories. | Includes established borrowers AND the “credit invisible” or “thin-file” populations. |

The Ripple Effect: What This Means for Everyone

This change extends far beyond the individual renter. It creates a domino effect that will be felt across the financial landscape, impacting investors, lenders, and the stock market itself.

For Renters and Consumers

The primary benefit is clear: a new, accessible pathway to financial empowerment. For young people, immigrants, and lower-income individuals who have been historically underserved by the credit system, this is a game-changer. A positive rental history can help them build a score from scratch, eventually qualifying for better interest rates and saving them thousands of dollars over their lifetime. However, the sword has two edges. Just as on-time payments can build credit, late payments reported to the bureaus could now damage it, adding a new layer of financial pressure.

For Lenders and the Banking Industry

For lending institutions, this is a data goldmine. It allows them to more accurately assess the risk of a significant, previously un-scorable segment of the population. This could unlock a vast new market of creditworthy customers. An analysis by TransUnion found that 100% of unscorable tenants became scorable after just one month of rent reporting. This enhanced visibility reduces uncertainty, potentially leading to lower default rates and more confident investing in consumer credit products.

For Investors and the Economy

From a macroeconomic perspective, greater financial inclusion is a powerful catalyst for growth. When more people can access fair and affordable credit, they are better able to invest in education, start businesses, and make large purchases, all of which stimulate the economy. For those involved in trading and the stock market, companies at the forefront of this shift—from the credit bureaus themselves to the innovative fintech startups enabling this data transfer—represent a compelling new area for growth and investment.

The Fintech Engine: Powering the Credit Revolution

This entire transformation would be impossible without the explosion of financial technology. Traditional banking and credit institutions were not built to collect and process monthly rent payments from millions of individual landlords. It is the agile, tech-driven startups that have built the necessary infrastructure.

Companies like CreditLadder (UK), Rental Kharma (US), and Esusu have developed platforms that seamlessly integrate with property management software and landlord payment systems. They handle the verification and reporting, turning a logistical nightmare into a streamlined, automated process. This is a classic example of fintech identifying a major friction point in the legacy financial system and building a solution that benefits all parties involved. Their success is forcing the large, incumbent credit agencies to adapt or risk becoming irrelevant, a dynamic we see playing out across the entire finance sector.

Beyond the Headlines: Decoding the Landmark US-China Deal on TikTok, Rare Earths, and Global Trade

Navigating the New World: Challenges and Opportunities

Despite the immense potential, the road ahead is not without its obstacles. The success of this initiative hinges on widespread adoption and a few key challenges must be addressed:

- Landlord Participation: The system largely depends on landlords or property managers being willing and able to report payments. While large management companies may adopt this easily, convincing smaller, individual landlords could be difficult.

- Data Accuracy and Disputes: What happens when there is a dispute between a tenant and a landlord over a payment? A robust and fair dispute resolution process is essential to ensure tenants are not unfairly penalized.

- Cost and Accessibility: Many rent-reporting services come with a fee. For this to be a true tool for financial inclusion, it must be affordable and accessible to the very people it’s designed to help.

For individuals, the takeaway is to be proactive. If you are a renter, investigate these reporting services and have a conversation with your landlord. For investors and business leaders, the key is to recognize the broader trend. The use of alternative data is the future of lending, economics, and risk management. Understanding the technologies and companies driving this change is crucial for making informed decisions in today’s rapidly evolving financial ecosystem.

The Hidden Rot: How the UK's Housing Mould Crisis Creates Billions in Risk and Opportunity

Conclusion: A More Inclusive Financial Future

The decision to incorporate rental payments into credit scores is more than a procedural update; it is a philosophical shift. It acknowledges that financial responsibility takes many forms and that the traditional metrics of creditworthiness are no longer sufficient for our diverse and dynamic economy. By leveraging the power of fintech and embracing a more inclusive approach to data, the financial industry is taking a critical step toward building a system that is more equitable, accurate, and reflective of modern life.

This evolution will undoubtedly face growing pains, but its direction is clear. We are moving towards a future where every responsible financial action, no matter how small, can contribute to building a stronger financial identity. For millions of people, the simple act of paying their rent will no longer be a transaction that disappears into the ether, but a stepping stone toward a more secure and prosperous future.