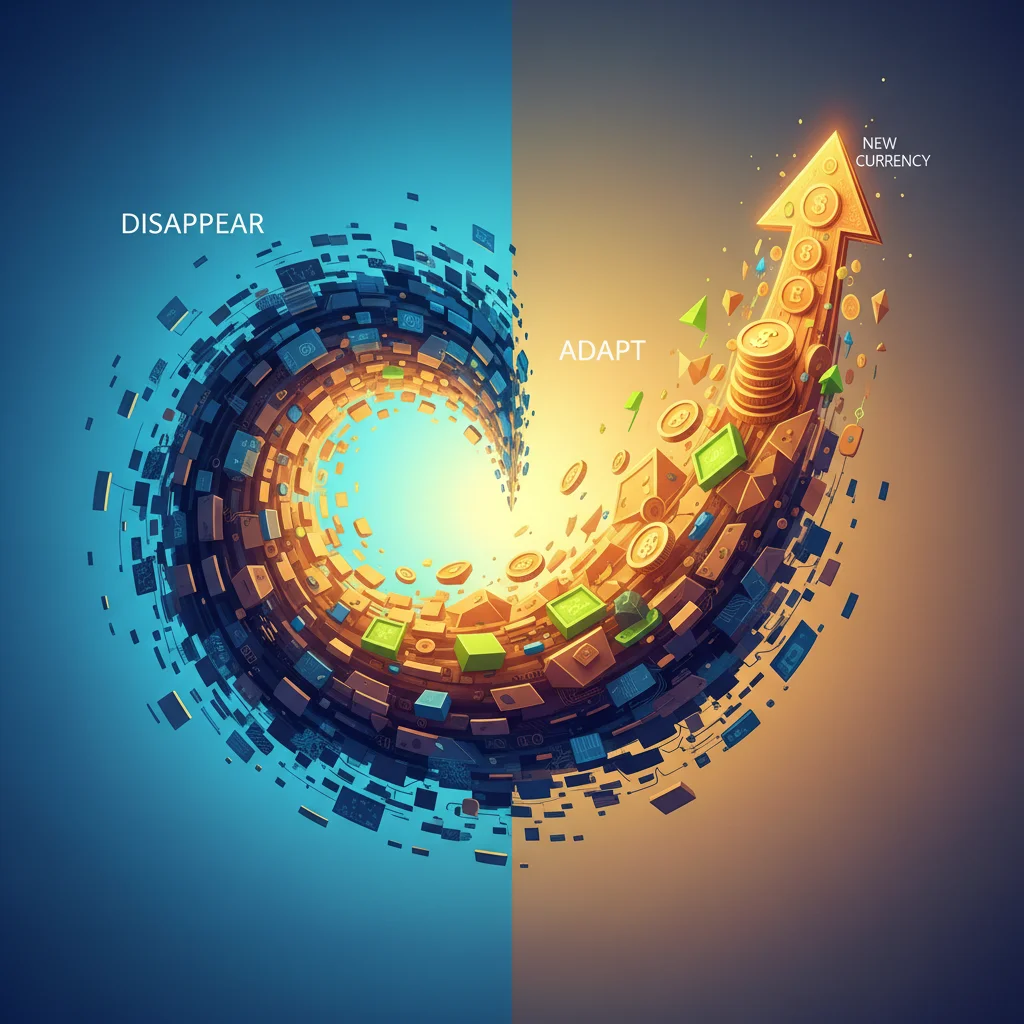

Adapt or Disappear: Why Upskilling is the New Currency in a Tech-Driven Economy

The Unrelenting Pace of Change: A New Professional Mandate

We stand at a pivotal moment in history, an era where the very foundations of the professional world are being reshaped by relentless technological advancement. Artificial intelligence, which once felt like the domain of science fiction, is now an integral part of our daily operations. Automation is not just optimizing assembly lines; it’s reconfiguring entire white-collar industries. This isn’t a distant future—it’s the present reality. For business leaders, investors, and professionals across the financial sector, the message is clear: the skills that built successful careers yesterday are rapidly becoming insufficient for tomorrow. The new imperative is not just to work harder, but to learn smarter and faster. This is the age of upskilling.

A recent comprehensive report by the Financial Times highlights this seismic shift, examining how both companies and their employees are scrambling to adapt to a world of work in constant flux (source). The concept of a “job for life” has been replaced by a “life of learning.” In this new paradigm, your value is not defined by what you know, but by your capacity to learn, unlearn, and relearn. This continuous evolution is no longer a competitive advantage; it’s a fundamental requirement for survival and relevance in the modern economy.

The Technological Tsunami: Forces Driving the Skills Revolution

To understand the urgency behind upskilling, we must first appreciate the scale of the disruption. This isn’t a single wave of change but a convergence of powerful technological currents, each transforming industries like banking, finance, and investing in profound ways.

- Artificial Intelligence and Machine Learning (AI/ML): AI is no longer just a back-office tool for data analysis. It’s now a co-pilot in decision-making processes. In the world of trading, algorithms execute complex strategies in microseconds. In wealth management, robo-advisors provide personalized investment advice at scale. This shift demands that professionals move from being data processors to data interpreters and AI system supervisors.

- Automation and Robotics: Repetitive, rules-based tasks—from data entry and compliance checks to basic accounting—are prime candidates for automation. This frees up human capital for higher-value activities like strategic planning, client relationship management, and creative problem-solving. A recent analysis suggests that up to 30% of tasks in a majority of occupations could be automated by 2030 according to industry experts, fundamentally altering job descriptions across the board.

- Blockchain and Distributed Ledger Technology (DLT): Beyond cryptocurrencies, blockchain technology is poised to revolutionize everything from trade finance and supply chain management to clearing and settlement systems. Understanding its principles is becoming essential for anyone involved in asset management, international finance, or corporate transactions.

- Fintech and Digital Transformation: The rise of financial technology (Fintech) has completely upended the traditional banking landscape. Digital-native challengers are forcing legacy institutions to innovate at breakneck speed. This requires a workforce that is not only digitally literate but also agile, customer-centric, and fluent in the language of modern product development.

These forces are not merely changing *how* we work; they are changing the *work itself*. The demand for purely manual or repetitive cognitive skills is plummeting, while the value of technological, social, and higher-order cognitive skills is soaring.

The Green Paradox: Why the Netherlands' Renewable Success Is a Critical Warning for Global Investors

The Skills Ledger: Redefining the Modern Professional’s Toolkit

The transition from the old work paradigm to the new requires a fundamental overhaul of the professional skillset. The competencies that were once considered niche or technical are now becoming the baseline. Below is a comparison of the skills in high demand today versus those of the previous era.

| Legacy Skillset (The “What”) | Emerging Skillset (The “How” and “Why”) |

|---|---|

| Manual Data Entry & Reporting | Data Science & Advanced Analytics (Python, R, SQL) |

| Basic Spreadsheet Proficiency | Data Visualization & Storytelling (Tableau, Power BI) |

| Following Prescribed Processes | Critical Thinking & Complex Problem-Solving |

| Siloed Functional Knowledge | Cross-Functional Collaboration & Systems Thinking |

| Product Knowledge | Understanding of AI/ML Models & Fintech Ecosystems |

| In-Person Client Service | Digital Communication & Virtual Relationship Management |

As the table illustrates, the shift is from execution to strategy, from processing information to deriving insight. A financial analyst is no longer just someone who can build a discounted cash flow model in Excel; they must now be able to build, interpret, and challenge a model generated by an AI, understanding its underlying assumptions and potential biases. This represents a significant cognitive leap and a core challenge for corporate training programs.

The Corporate Mandate: Building a Future-Ready Workforce

The responsibility for upskilling doesn’t rest solely on the individual. Forward-thinking organizations understand that their most valuable asset is their human capital, and they are investing heavily to protect and grow it. A passive approach to learning and development is a recipe for obsolescence. Leading companies are actively building a culture of continuous learning through several key initiatives:

- Strategic L&D Investment: Companies are moving beyond ad-hoc training sessions to create structured “upskilling academies.” These programs are often co-developed with universities and EdTech platforms to provide curated learning paths in high-demand areas like data science, cybersecurity, and financial technology. Corporate investment in digital upskilling programs has seen a year-over-year increase of over 40% in some sectors.

- Internal Mobility Platforms: Smart organizations are using AI-powered talent marketplaces to identify employees in roles at risk of automation and proactively match them with internal opportunities and the necessary training to transition. This not only retains institutional knowledge but also boosts morale and reduces recruitment costs.

- Fostering a Growth Mindset: The most crucial element is cultural. Leaders must champion curiosity, experimentation, and psychological safety, where employees feel empowered to learn new skills without fear of failure. This involves rewarding learning and development as a core part of performance metrics, not just an extracurricular activity.

A prime example is a major investment bank that launched a mandatory “Digital Fluency” program for all its managing directors, ensuring that leadership not only understands the new technologies but can also lead their teams through the transition effectively.

Beyond the Boardroom: Sweden's Blueprint for Investor Power in the Digital Age

An Investor’s Guide to the Upskilling Economy

For the astute investor, this global upskilling trend is more than just a workplace phenomenon—it’s a powerful, secular growth driver creating a host of new investing opportunities. Looking at the stock market through the lens of upskilling can reveal hidden value and long-term potential.

Key areas of opportunity include:

- Education Technology (EdTech): Companies providing online learning platforms, digital credentialing, and virtual reality training solutions are at the forefront of this wave. The global corporate e-learning market is projected to grow into a multi-hundred billion dollar industry within the next five years (source).

- Human Capital Management (HCM) Software: Platforms that help companies manage skills inventories, facilitate internal mobility, and personalize learning paths are becoming indispensable business tools.

- Specialized Consulting and Training Firms: Niche firms that specialize in retraining workforces in areas like AI ethics, green economics, and digital transformation are experiencing explosive demand.

Furthermore, when evaluating any company for a long-term investment, its approach to upskilling should be a key due diligence metric. Ask critical questions: Does the company disclose its investment in employee training? Is there a clear strategy for reskilling its workforce? A company that proactively invests in its people is building a more resilient, adaptive, and innovative organization, making it a potentially more stable and profitable long-term holding.

The Haiku That Captured a Global Tax Headache: Deconstructing the Economics of Property Levies

The Macroeconomic Picture: A Challenge and an Opportunity

On a broader scale, the upskilling imperative has profound implications for the global economy. A successfully upskilled workforce can lead to massive productivity gains, drive innovation, and increase a nation’s competitive advantage. It’s a critical component of modern industrial and economics policy.

However, the transition is not without risks. If not managed effectively, it could exacerbate income inequality, creating a stark divide between the “skill-haves” and the “skill-have-nots.” This “skills gap” could lead to structural unemployment even in a growing economy, posing significant social and political challenges. Addressing this requires a concerted effort from governments, educational institutions, and private enterprise to ensure that opportunities for lifelong learning are accessible and affordable for all segments of the population.

Conclusion: The Future is a Skill You Learn

The technological disruption of the workplace is not a future event to be prepared for; it is a present reality to be navigated. Upskilling is no longer a corporate buzzword but the essential engine of personal and organizational resilience. For the individual, it means embracing a mindset of perpetual learning. For the business leader, it means building an organization that can adapt as quickly as technology evolves. And for the investor, it represents a new lens through which to identify the companies that are truly built for the future.

The path forward is clear. In an economy where the only constant is change, the ability to learn and adapt is the most valuable currency you can possess.