The Great Pension Reversal: Why UK Companies Are Holding Back Billions

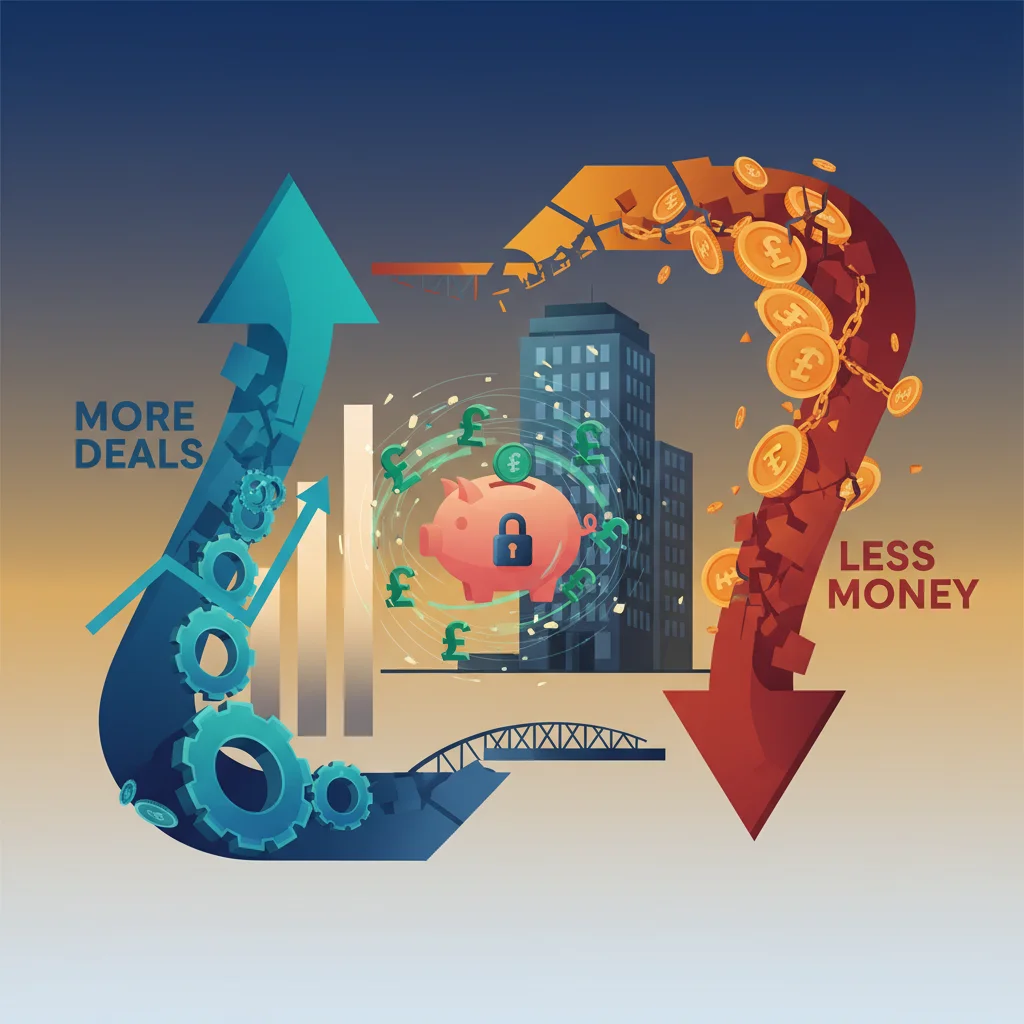

A Paradox in the Pension Market: More Deals, Less Money

In the world of corporate finance, a curious and counterintuitive trend has emerged, sending ripples through the UK’s economic landscape. At first glance, the pension buyout market appears to be thriving. A record number of UK companies—204 in total—decided to offload their defined benefit pension schemes in 2023. This process, known as a “buyout,” involves transferring the assets and liabilities of a company pension plan to an insurer, effectively de-risking the corporate balance sheet from future pension obligations. Yet, despite this flurry of activity, the total value of these deals plummeted to £29.1 billion, a stark three-year low.

This isn’t just a statistical anomaly; it’s a signal of a profound strategic shift occurring in the boardrooms of Britain’s largest corporations. While smaller companies are rushing for the exit, the giants of the FTSE 100 are hitting the brakes. They are deliberately choosing to retain control of their pension schemes, which, for the first time in over a decade, are no longer financial burdens but potential cash cows. This reversal is reshaping the dynamics of corporate finance, attracting a new breed of aggressive investors from across the Atlantic, and raising fundamental questions about the future of retirement funding and corporate strategy.

The Unexpected Gift of Rising Interest Rates

To understand this strategic pivot, we must look at the macroeconomic forces that have reshaped the global economy. For years, rock-bottom interest rates created a nightmare scenario for companies with defined benefit (or “final salary”) pension schemes. These schemes promise to pay retirees a set income for life, and calculating the future cost of these promises—the scheme’s liabilities—is heavily dependent on interest rates. Low rates meant companies had to set aside enormous sums to cover future payouts, leading to massive pension deficits that were a constant drag on profitability and the stock market valuation.

However, the recent aggressive hiking of interest rates by central banks to combat inflation has flipped this equation on its head. Higher rates mean that the present-day value of future liabilities is lower. Simultaneously, the assets held by these pension funds (like bonds) have started generating higher returns. The result? Decades of deficits have miraculously transformed into significant surpluses for many of the UK’s largest schemes.

Suddenly, a pension scheme is no longer a liability to be offloaded at the earliest opportunity. It’s an asset. This surplus cash can, under certain conditions, be returned to the sponsoring company, used to fund investments, or even pay out special dividends to shareholders. For a CFO, the choice has become much more complex than simply “de-risking.” The new question is: “How can we leverage this multi-billion-pound asset we now control?”

The Arctic Treasure Chest: Why Denmark's Sovereign Fund Is Doubling Down on Greenland

Enter the Titans: US Private Capital Smells Opportunity

As UK corporate giants pause to reconsider their options, a new and powerful force is entering the arena: US private capital. Juggernauts of the investing world like Apollo, KKR, and Carlyle are piling into the UK’s bulk annuity market. They see a colossal opportunity in the trillions of pounds locked away in UK defined benefit schemes.

Their strategy is twofold. First, they are establishing their own insurance platforms or partnering with existing ones to compete directly in the pension buyout market. These firms believe their expertise in alternative investments can generate higher returns than traditional insurers, allowing them to offer more competitive pricing on buyout deals. They are not just participants; they are aiming to disrupt the established order of UK banking and insurance.

Second, they are offering alternative solutions to companies that aren’t ready for a full buyout. This could include managing a portion of the pension assets or providing sophisticated financing options. This influx of American capital is injecting a new level of competition and innovation into a market historically dominated by a handful of UK insurers. According to the Financial Times, established players like Legal & General, which commanded a third of the market in 2023, are now facing a formidable new challenge.

The Pension Buyout Market at a Glance

To put the current market dynamics into perspective, let’s look at the key figures that tell the story of this transition period.

| Metric | 2023 Figure | Context & Implication |

|---|---|---|

| Total Deal Value | £29.1 Billion | A three-year low, indicating that while activity is high, the largest “mega-deals” are on hold. |

| Number of Deals | 204 | A record high, driven by small and mid-sized schemes eager to de-risk. |

| Average Deal Size | ~£142 Million | Significantly smaller than in previous years, confirming the absence of large corporate buyouts. |

| Market Leader (2023) | Legal & General | Captured roughly one-third of the market, but faces growing competition from new entrants. |

| Projected 2024 Market | £50 Billion+ | Analysts predict a massive rebound as pent-up demand and larger schemes re-enter the market. |

This data illustrates the clear split in the market: a high volume of smaller transactions, while the big-ticket deals that drive overall value are temporarily sidelined. The projection for 2024 suggests that this pause is not permanent, but rather a strategic delay as companies weigh their newfound options.

Arctic Tensions, European Ambitions: Why Defence Stocks Are the New Market Darlings

The Future: A Rebound or a New Normal?

The consensus among market analysts is that the 2023 slowdown is merely the calm before the storm. The pipeline for 2024 is robust, with experts predicting the market could easily surpass £50 billion and potentially set new records. Several factors fuel this optimism:

- Pent-Up Demand: Many large companies that paused their buyout plans in 2023 are expected to resume the process as they finalize their new strategies.

- Favorable Pricing: The increased competition from US firms could lead to more attractive pricing for companies looking to offload their schemes.

- Regulatory Clarity: As governments provide clearer rules on accessing pension surpluses, companies will have a better framework for making long-term decisions.

However, the landscape has been permanently altered. The idea of retaining a well-funded pension scheme as a strategic asset is now firmly on the table. This introduces a new layer of complexity to corporate finance and governance. Boards will need to weigh the benefits of a potential cash windfall against the long-term risks of market volatility and changing economics. If interest rates were to fall again, today’s surpluses could quickly evaporate, leaving companies once again exposed.

This new environment demands a more sophisticated approach to pension management, blending elements of treasury, risk management, and long-term investing strategy. The decisions made in the coming years will not only impact corporate balance sheets but will also define the financial security of millions of retirees.

The Santana Effect: How to Transform an Undervalued Asset into a Multi-Million Dollar Success

Conclusion: A High-Stakes Game for Billions

The slowdown in the UK pension buyout market is far more than a statistical dip; it’s a watershed moment. Driven by the powerful undercurrent of rising interest rates, the very nature of corporate pension schemes is being redefined—from a burdensome liability to a valuable strategic asset. While smaller players continue the well-trodden path of de-risking, the UK’s corporate giants are exploring a new frontier, weighing the allure of retaining multi-billion-pound surpluses against the inherent risks of market exposure.

As US private capital muscles in, bringing both immense financial power and innovative approaches, the competitive pressure will only intensify. The stage is set for a record-breaking year in 2024, but the deals struck will be the result of more complex calculations than ever before. For investors, employees, and business leaders, the unfolding drama in the quiet world of pension finance is a crucial indicator of the broader shifts in corporate strategy and the global economic order. The great pension reversal has begun, and its consequences will be felt for decades to come.