Unlocking Growth or Risking Stability? Decoding the Bank of England’s Bold Move on Banking Capital

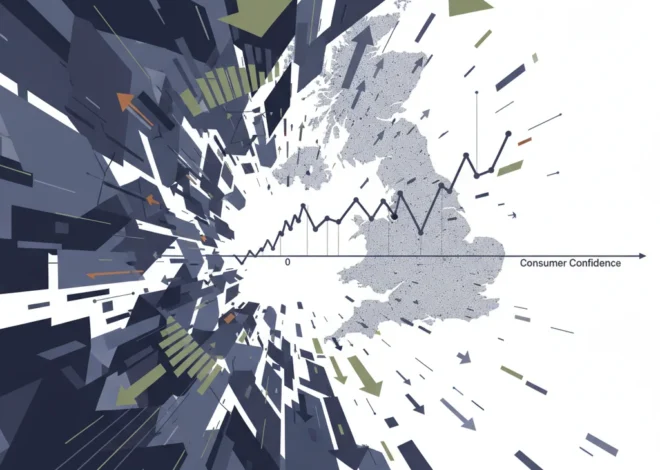

In the intricate world of finance, there exists a perpetual tug-of-war: the drive for economic growth versus the demand for unshakeable stability. This fundamental tension is at the heart of nearly every major regulatory decision, and a recent proposal by the Bank of England has brought it sharply back into focus. The plan? To reduce the capital requirements for smaller, UK-focused banks—a move championed by industry leaders like David Postings, Chief Executive of UK Finance, in a recent letter to the Financial Times.

But what does this mean for the average person, the savvy investor, or the broader UK economy? Is this a pragmatic step to unleash competition and fuel growth, or a risky loosening of the very safeguards put in place to prevent another financial meltdown? This article delves deep into the Bank of England’s “Strong and Simple” framework, exploring the powerful arguments for this regulatory shift, the potential risks lurking beneath the surface, and the far-reaching implications for the future of banking, investing, and financial technology in the UK.

The Ghost of 2008: A Primer on Why Bank Capital Matters

To understand the significance of the Bank of England’s proposal, we must first travel back to the financial crisis of 2008. The collapse of Lehman Brothers and the subsequent global turmoil revealed a terrifying truth: many of the world’s largest banks were dangerously undercapitalized. They had taken on massive risks without a sufficient financial cushion to absorb the losses when the markets turned.

In simple terms, a bank’s capital is its own money—from shareholders’ equity and retained earnings—that acts as a shock absorber. When a bank makes a loan that goes bad, it can write off the loss against its capital. If it runs out of capital, it becomes insolvent, threatening the entire financial system and requiring taxpayer-funded bailouts.

In response to the 2008 crisis, regulators worldwide, through the Basel Committee on Banking Supervision, implemented much stricter capital requirements, collectively known as Basel III. These rules forced banks to hold significantly more high-quality capital relative to their risk-weighted assets. The goal was clear: to build a more resilient banking system, one that could withstand severe economic shocks without collapsing. According to the Bank for International Settlements, these reforms have substantially increased the quantity and quality of capital in the global banking system, making it far more robust.

The “Strong and Simple” Framework: A New Philosophy

While the post-crisis regulations were necessary, they created a new problem: complexity and a one-size-fits-all approach. The rules designed to contain the systemic risk of a global behemoth like HSBC or Barclays were also applied to smaller, domestic building societies and challenger banks whose failure would not threaten the global economy.

This is where the Bank of England’s Prudential Regulation Authority (PRA) steps in with its proposed “Strong and Simple” framework. The core idea is proportionality. The PRA argues that subjecting smaller, non-systemic banks to the full, complex weight of international standards is not only inefficient but also stifles competition. The framework aims to simplify regulatory requirements for these firms, including a less onerous calculation for their capital buffers.

David Postings of UK Finance argues this is “a welcome dose of common sense.” The logic is that a simpler regime will free up both capital and compliance resources, allowing these smaller institutions to focus on their core business: lending to UK households and businesses.

To illustrate the potential change, consider the difference in regulatory burden:

| Regulatory Aspect | Large International Bank (Current System) | Small Domestic Bank (Proposed “Strong and Simple” System) |

|---|---|---|

| Capital Calculation | Complex internal models based on thousands of risk variables (Advanced Internal Ratings-Based approach). | Standardized, simpler calculation with fewer inputs. |

| Liquidity Rules | Subject to complex metrics like Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR). | Potentially simplified liquidity requirements tailored to a domestic deposit base. |

| Reporting & Disclosure | Hundreds of pages of detailed quarterly reports and stress test disclosures. | Streamlined reporting requirements, reducing administrative overhead. |

| Resulting Capital Buffer | Higher overall capital requirement due to global systemic risk buffers. | Lower overall capital requirement, freeing up funds for lending. |

Leon's Strategic Retreat: A Masterclass in Corporate Restructuring for a Turbulent Economy

The Economic Case: Fueling Competition and Growth

The proponents of this reform, including UK Finance, build their case on a powerful economic argument. By reducing the capital smaller banks must hold in reserve, the Bank of England is effectively unlocking a significant pool of money that can be injected directly into the economy.

Here’s how the theory works:

- Increased Lending Capacity: With lower capital requirements, a bank can support a larger loan book with the same amount of capital. This means more mortgages for homebuyers, more financing for small and medium-sized enterprises (SMEs), and more credit for consumers.

- Enhanced Competition: The UK banking sector is highly concentrated. High regulatory barriers make it difficult for new entrants and smaller players to challenge the dominance of the “big four.” Simplifying the rules and lowering capital costs levels the playing field, fostering a more competitive market. This could lead to better products, lower interest rates for borrowers, and better service for customers.

- Targeted Economic Stimulus: Smaller, regional banks and building societies often have a better understanding of local economies. They are more likely to lend to local businesses that larger, more centralized banks might overlook. Empowering these institutions could provide a much-needed boost to regional economic development. Research from bodies like the Federation of Small Businesses consistently highlights the challenges SMEs face in accessing finance, a gap challenger banks are well-positioned to fill.

The Other Side of the Coin: The Risks of Deregulation

No decision in financial regulation is without its trade-offs. Critics and skeptics raise several important concerns about easing capital rules, even for smaller players.

- The Fallacy of “Not Systemic”: While the failure of a single small bank is manageable, the danger lies in correlated risk. If an economic downturn hits a specific sector, like commercial real estate, it could cause dozens of smaller banks with similar loan exposures to fail simultaneously. This “death by a thousand cuts” could create a systemic crisis just as damaging as the failure of one large institution.

- Moral Hazard: Reducing capital requirements could inadvertently encourage some banks to take on more risk. With a smaller capital cushion at stake, the incentive to chase higher yields through riskier lending might increase, creating pockets of instability in the financial system.

- Regulatory Arbitrage and Complexity: Creating a two-tiered system introduces a new kind of complexity. What happens when a “simple” bank grows and approaches the threshold to become a “complex” one? It might deliberately stunt its growth or restructure its operations to avoid the higher regulatory burden. This could lead to inefficient market distortions.

–

–

The challenge for the Bank of England is to calibrate the framework perfectly—making it simple enough to boost competition but strong enough to prevent these risks from materializing. It’s a fine line to walk, and the consequences of miscalculation could be severe for the entire economy.

Beyond the Handout: Analyzing the UK's New Cash Payout Scheme as an Economic Strategy

Implications for Investors, Fintech, and the Broader Economy

This regulatory shift is not just an abstract debate for economists and bankers. It has tangible implications for anyone involved in the UK’s financial ecosystem.

For investors, the stocks of smaller, UK-focused banks like Virgin Money, Metro Bank, or Paragon Banking Group could become more attractive. A lower capital requirement can directly translate into a higher Return on Equity (ROE), a key metric for banking investors. However, this potential for higher returns will likely come with higher perceived risk, creating new dynamics in the stock market for the financial sector.

For the world of financial technology (fintech), this is a pivotal development. Many fintech firms, from neobanks to specialized lenders, are navigating the complex process of becoming fully licensed banks. A simpler regulatory pathway makes the UK a more attractive destination for fintech innovation and investment. It lowers the barrier to entry, potentially accelerating the disruption of traditional banking models. This could even have knock-on effects for adjacent technologies like blockchain, as new, more agile banking players may be quicker to adopt innovative solutions for payments and settlements.

Ultimately, for the UK economy, this is a calculated gamble. The upside is a more dynamic, competitive banking sector that is better equipped to finance the next generation of British businesses. The downside is a potential increase in financial fragility. The success of this policy will be a crucial test of the UK’s post-Brexit regulatory philosophy—one that aims to be more agile and tailored than its European counterpart.

A Fragile Calm: Navigating Market Risk as US-Iran Tensions Subside

Conclusion: A Delicate Balancing Act

The Bank of England’s proposal to create a “Strong and Simple” framework is a significant and pragmatic recalibration of post-crisis financial regulation. As David Postings rightly points out, applying the same rules designed for global giants to local building societies is neither efficient nor effective. By embracing proportionality, regulators can foster much-needed competition and channel more capital into the real economy.

However, this is not a return to the light-touch regulation of the pre-crisis era. It is an evolution towards a more sophisticated, risk-based approach. The framework’s success will hinge on vigilant supervision and the ability to adapt as the financial landscape changes. For investors, business leaders, and policymakers, the message is clear: the world of banking and economics is in a constant state of flux. This move is a bold attempt to balance the scales, and the entire financial world will be watching to see if it unlocks a new era of growth without awakening the ghosts of the past.