The Great Unraveling: Why Bitcoin’s “Digital Gold” Narrative is Shattering

The Promise of a Digital Safe Haven

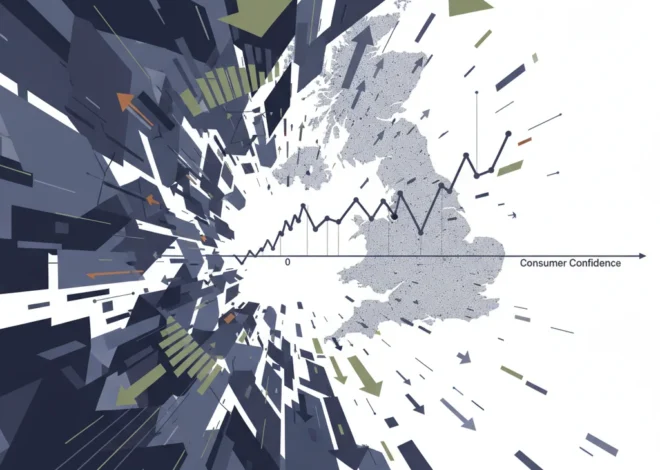

For over a decade, a powerful narrative has fueled the rise of Bitcoin: the idea of “digital gold.” Proponents have long argued that Bitcoin, with its mathematically enforced scarcity of 21 million coins and decentralized, censorship-resistant network, would serve as the ultimate safe-haven asset. In times of economic turmoil, geopolitical uncertainty, or rampant inflation, investors would flock to Bitcoin, just as they have traditionally flocked to physical gold, to preserve their wealth. It was meant to be the ultimate hedge—an uncorrelated asset that zigs when the traditional stock market zags.

This narrative was not just a fringe belief; it attracted billions of dollars from retail and institutional investors alike, all buying into the promise of a digital store of value for the 21st century. However, as the global economy has entered a classic “risk-off” cycle—characterized by rising interest rates, persistent inflation, and geopolitical conflict—this narrative is facing its most significant test yet. And by almost every objective measure, it is failing.

Instead of acting as a stabilizing force in portfolios, Bitcoin has been behaving like a high-beta technology stock, plunging in lockstep with the most speculative corners of the market. This article dissects the data, explores the macroeconomic forces at play, and explains why Bitcoin’s digital gold thesis is unraveling before our eyes.

The Data Doesn’t Lie: Bitcoin’s High Correlation to Risk Assets

The core of any safe-haven asset’s value proposition is its lack of correlation, or ideally, its negative correlation, with risk assets like stocks. When the stock market tumbles, a safe haven should hold its value or even appreciate. Gold has historically played this role with remarkable consistency. Bitcoin, on the other hand, has been doing the exact opposite.

Recent market performance reveals a striking and undeniable trend: Bitcoin’s price action is closely mirroring that of the Nasdaq 100, an index heavily weighted with high-growth technology companies. According to analysis, the correlation coefficient between Bitcoin and the Nasdaq 100 has been consistently high, often reaching levels above 0.75 (source). A coefficient of 1.0 indicates a perfect positive correlation, meaning the two assets move in perfect unison. This high correlation suggests that the market is treating Bitcoin not as a store of value, but as a speculative risk asset, much like a volatile tech stock.

Let’s examine how these assets have performed during recent periods of market stress.

The following table illustrates the performance divergence during key risk-off periods, highlighting how investors have treated these assets differently under pressure.

| Asset Class | Behavior During Recent Market Stress | Primary Investor Perception |

|---|---|---|

| Bitcoin (BTC) | High volatility; sharp price declines alongside equities, particularly during inflation and rate hike announcements. | Risk-On Speculative Asset |

| Nasdaq 100 (NDX) | Significant downturns driven by rising interest rates and recession fears, which negatively impact growth stock valuations. | Risk-On Growth Asset |

| Gold (XAU) | Relative stability and appreciation, particularly during the onset of geopolitical conflicts and periods of high inflation. | Risk-Off Safe-Haven Asset |

When Russia invaded Ukraine, a classic geopolitical risk-off event, gold rallied as investors sought safety. Bitcoin, however, fell along with the stock market (source). As central banks around the world began aggressively hiking interest rates to combat inflation, Bitcoin’s value plummeted, reflecting its sensitivity to tighter monetary policy—a hallmark of a risk asset, not an inflation hedge.

A Dangerous Game: When Politics and Central Banking Collide

Why Is This Happening? Deconstructing the Narrative Failure

The divergence between Bitcoin’s promise and its performance can be attributed to a confluence of powerful factors related to both its evolving investor base and the broader macroeconomic environment.

1. Institutional Adoption: A Double-Edged Sword

For years, the crypto community yearned for institutional adoption. That dream has become a reality, with hedge funds, asset managers, and even publicly traded companies adding Bitcoin to their balance sheets. However, this has come with an unintended consequence. These large-scale financial players largely view Bitcoin through a traditional portfolio management lens. They don’t see it as a revolutionary new form of money, but rather as a high-growth, high-risk asset to be placed at the most speculative end of their portfolios.

Consequently, when their risk models flash red and they need to de-leverage, Bitcoin is often one of the first assets they sell, alongside their tech stocks and other growth-oriented holdings. This institutional behavior has effectively tethered Bitcoin’s fate to the whims of the broader stock market, particularly the tech sector. The very capital that legitimized Bitcoin has also compromised its narrative as an uncorrelated safe haven.

2. The End of Easy Money

Bitcoin’s most spectacular bull runs occurred during an unprecedented era of dovish monetary policy. For over a decade, global central banks engaged in quantitative easing (QE) and held interest rates near zero. This firehose of liquidity flooded the financial system, encouraging immense risk-taking and pushing investors into speculative assets in search of yield. Bitcoin was arguably one of the biggest beneficiaries of this environment.

Now, the tide has turned. With inflation at multi-decade highs, central banks, led by the Federal Reserve, have pivoted to aggressive quantitative tightening (QT) and rapid interest rate hikes. This macroeconomic shift fundamentally alters the landscape for all assets. As one analyst noted, in a world where you can get a respectable yield on a risk-free government bond, the appeal of a non-yielding, highly volatile asset like Bitcoin diminishes significantly (source). Higher interest rates increase the opportunity cost of holding assets like Bitcoin and gold, but the impact is felt far more acutely by assets perceived as speculative.

The End of an Era: Unpacking the Financial Legacy of Kathleen Kennedy's Lucasfilm

3. The Psychology of an Immature Market

Despite its trillion-dollar market capitalization at its peak, the Bitcoin market remains psychologically immature compared to established asset classes like gold or equities. Its price is still heavily influenced by narrative, social media sentiment, and momentum-chasing retail traders. This leads to extreme volatility that is antithetical to the concept of a “safe haven.”

A true store of value should be relatively boring; its primary job is to preserve purchasing power with low volatility. Bitcoin, with its daily price swings that can exceed 10-15%, is anything but boring. This inherent volatility makes it unsuitable for the capital preservation role that gold fulfills in a diversified portfolio. Until the market matures and volatility subsides, its utility as a reliable hedge will remain limited.

What This Means for Investors and the Future of Crypto

The evidence is clear: in the current economic cycle, Bitcoin has failed to live up to its “digital gold” billing. It is not an inflation hedge. It is not a safe-haven asset. It is a high-beta, risk-on asset that is highly sensitive to monetary policy and deeply correlated with the stock market.

This realization has profound implications for anyone involved in finance, investing, and financial technology:

- For Investors: Portfolio allocation must be based on Bitcoin’s demonstrated behavior, not its aspirational narrative. Including Bitcoin in a portfolio currently adds more risk and volatility, behaving similarly to a leveraged bet on the technology sector. It should not be considered part of a portfolio’s defensive allocation.

- For the Crypto Industry: The failure of the digital gold narrative is a significant blow. The industry must now reckon with Bitcoin’s true identity in the modern financial ecosystem. Perhaps its primary value proposition is not as a store of value, but as a decentralized, global settlement network—a piece of groundbreaking fintech.

- For the Future: Narratives in finance are powerful, but they must eventually be backed by performance. The “digital gold” story may re-emerge in a future crisis, but for the foreseeable future, it has been sidelined. The focus in the blockchain space may shift toward assets and protocols that provide tangible utility, such as decentralized finance (DeFi) platforms or smart contract networks, rather than purely monetary assets.

The Milk Market Meltdown: Why a Dairy Crisis is a Red Flag for the Global Economy

In conclusion, the dream of Bitcoin as a digital fortress against economic storms has dissolved in the face of macroeconomic reality. The very forces it was supposed to protect against—inflation and market uncertainty—have proven to be its kryptonite. As the world of economics and trading evolves, market participants are learning a crucial lesson: in investing, you must follow the data, not the story. And right now, the data tells us that Bitcoin is a ship caught in the same storm as the stock market, not the lifeboat investors were hoping for.