Solving the Financial Puzzle: A Modern Investor’s Guide to Navigating a Complex World

There’s a unique satisfaction that comes from filling in the last square of a challenging crossword puzzle. Each clue, whether straightforward or cryptic, is a small problem to be solved. As the answers intersect and interlock, a coherent picture emerges from the chaos of empty boxes. This process, as any enthusiast of the venerable FT Crossword knows, is a masterful blend of logic, knowledge, and creative thinking.

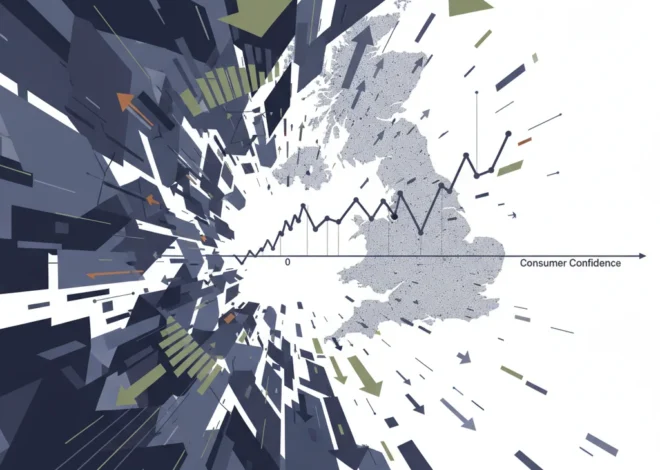

In many ways, navigating the modern financial landscape is a strikingly similar endeavor. The global economy presents us with a vast grid of interconnected challenges and opportunities. The “across” clues might be sweeping macroeconomic trends like inflation and interest rate policies, while the “down” clues are the specific performance metrics of individual companies on the stock market. And then there are the cryptic clues—disruptive forces like fintech and blockchain that demand a new way of thinking entirely.

For investors, finance professionals, and business leaders, understanding how these pieces fit together is not just an intellectual exercise; it’s essential for strategic decision-making and wealth creation. This guide will use the crossword metaphor to deconstruct the complex world of modern finance, helping you connect the dots and see the bigger picture, one clue at a time.

The “Across” Clues: Deciphering Macroeconomic Megatrends

The “across” clues in a crossword set the horizontal foundation, often defining the longest and most influential words in the puzzle. In the world of finance, these are the macroeconomic megatrends—the powerful, overarching forces that shape the entire investment environment. Ignoring them is like trying to solve a puzzle without understanding its fundamental structure.

Chief among these clues is inflation. For years, it was a dormant force in many developed economies, but its recent resurgence has rewritten the rules of investing. Rising inflation erodes purchasing power and compels central banks to act. This leads us to the next critical clue: interest rates. The decisions made by institutions like the U.S. Federal Reserve or the European Central Bank on interest rates have a cascading effect on everything from bond yields and corporate borrowing costs to mortgage rates and stock market valuations.

According to the International Monetary Fund, global inflation is forecast to fall from an average of 6.8 percent in 2023 to 5.8 percent in 2024, but it remains a persistent challenge for policymakers (source). Understanding the trajectory of these two forces is paramount. A high-inflation, rising-rate environment favors different asset classes (like commodities and value stocks) than a low-inflation, stable-rate environment (which often benefits growth stocks and technology).

Other major “across” clues include geopolitical shifts, global supply chain dynamics, and long-term demographic changes. Each of these trends creates both risks and opportunities. The savvy investor doesn’t just react to headlines; they analyze these foundational economic clues to anticipate market movements and position their portfolios for resilience and growth.

The “Down” Clues: Vertical Analysis of Companies and Sectors

While macroeconomic trends provide the context, the “down” clues represent the specific, vertical opportunities within the market. These are the individual companies, sectors, and industries that an investor can choose to back. Success here requires a different kind of analysis—a deep dive into the fundamentals of a business and its position within the broader economy.

This is the domain of fundamental analysis in trading and investing. It involves scrutinizing a company’s balance sheet, income statement, and cash flow. What is its revenue growth? Are its profit margins expanding? How much debt is it carrying? These questions are the equivalent of asking, “Does this five-letter word ending in ‘T’ fit the clue ‘a market high’?” The answer, of course, might be “asset,” but you need to check if it fits with the intersecting “across” clues.

Similarly, a company with strong earnings might seem like a great investment. But if it operates in an industry facing severe macroeconomic headwinds (an unfavorable “across” clue), its growth potential could be limited. Conversely, a mediocre company in a booming sector might be lifted by a rising tide. The key is to find where strong fundamentals intersect with favorable macro trends.

Sector analysis is another crucial component. The rise of artificial intelligence, the global push for renewable energy, or shifts in consumer behavior are powerful vertical themes. By identifying these trends early, investors can find opportunities in companies that are poised to become leaders in the next wave of economic evolution. This granular, bottom-up approach, combined with the top-down macroeconomic view, is how a complete and coherent investment picture begins to form.

The Force of Finance: Decoding the Economic Impact of a Leadership Shift at Lucasfilm

The Cryptic Clues: Unraveling Fintech, Blockchain, and Digital Assets

Every great crossword has its cryptic clues—the ones that require you to think laterally and decode wordplay, anagrams, and hidden meanings. In modern finance, the cryptic clues are the disruptive technologies that are challenging the very definitions of money, assets, and transactions. For many, fintech and blockchain fall squarely into this category.

Financial technology, or fintech, is the broad term for any technology used to improve or automate financial services. It’s the reason you can apply for a loan on your phone, send money internationally with minimal fees, or use an app to manage your entire investment portfolio. These innovations are fundamentally changing the business of traditional banking by increasing efficiency, reducing costs, and improving access to financial services. The global fintech market is projected to grow to nearly $700 billion by 2030, a testament to its disruptive power (source).

To better understand this shift, consider the differences between the old and new guards:

| Traditional Banking & Finance | Modern Fintech Solutions |

|---|---|

| Physical branches, limited hours | Mobile-first, 24/7 access |

| Slow, paper-based loan approvals | AI-driven, often instant credit decisions |

| High fees for international transfers | Low-cost, transparent remittance services |

| Generic investment products | Personalized robo-advisors and micro-investing |

| Centralized, siloed data systems | Open banking APIs and interconnected platforms |

Blockchain is perhaps the most cryptic clue of all. At its core, it is a decentralized, distributed ledger technology. Instead of a single entity (like a bank) controlling the record of transactions, the ledger is shared and validated by a network of computers. This creates a system that is transparent, secure, and resistant to censorship. While its most famous application is cryptocurrencies like Bitcoin, its potential extends far beyond. Blockchain could revolutionize everything from supply chain management and real estate transactions to voting systems and intellectual property rights.

For investors and business leaders, these technologies are not a passing fad. They represent a fundamental rewiring of the financial plumbing. Understanding them is crucial to identifying the next generation of growth companies and avoiding the disruption facing legacy incumbents.

Putting It All Together: The Interlocking Solution

The final, most rewarding stage of solving a crossword is when the last few words fall into place. The interlocking answers confirm each other, and the completed grid stands as a testament to your effort. Similarly, a robust financial strategy is one where all the pieces—macro, micro, and technological—fit together into a coherent whole.

Your understanding of the global economy should inform which sectors you explore. Your analysis of those sectors should guide your individual stock selections. And your appreciation for disruptive financial technology should overlay this entire process, helping you identify both threats and once-in-a-generation opportunities. The rise of AI in finance, for example, is accelerating this integration, with algorithms now capable of analyzing vast datasets to find these interlocking patterns far faster than any human. The market for AI in finance is exploding, expected to reach over $140 billion by 2032 (source), highlighting the shift towards data-driven trading and investment decisions.

The world of finance may seem as daunting as a blank crossword grid. But it is not an unsolvable puzzle. By approaching it with structure, curiosity, and a commitment to continuous learning, you can begin to fill in the squares. Start with the foundational “across” clues of economics, drill down into the specific “down” clues of the stock market, and don’t be afraid to tackle the cryptic clues of innovation. In doing so, you will not only protect and grow your capital but also gain a deeper understanding of the powerful forces shaping our world.