Revolutionary Investing: What the Sans-Culottes Can Teach Us About Market Cycles and Economic Rebellion

As the new year dawns, a familiar ritual takes hold across the Western world: “Dry January.” It’s a month of abstention, a collective cultural moment dedicated to discipline, wellness, and a temporary rejection of indulgence. We swap cocktails for mocktails, pints for sparkling water, and embrace a period of self-imposed austerity. On the surface, it’s a personal health choice. But viewed through a different lens, it’s a powerful metaphor for a specific type of economic and financial mindset: one of caution, belt-tightening, and risk aversion.

However, a recent letter to the Financial Times by Matt Shaw offers a potent historical counterpoint. He notes that the sans-culottes of the French Revolution would have been “appalled at the idea of a ‘dry January’.” This small but profound observation opens a door to a fascinating analogy—one that pits the modern, disciplined consumer against the revolutionary spirit that toppled a monarchy. This isn’t just a quaint historical comparison; it’s a framework for understanding the fundamental tensions that drive our modern economy, shape the stock market, and define the very future of finance.

The Spirit of the Sans-Culottes: Consumption as a Political Act

To grasp the analogy, we must first understand who the sans-culottes were. The term literally means “without knee-breeches.” They were the urban working class of late 18th-century France—the artisans, shopkeepers, and laborers. Their long trousers stood in stark contrast to the silk culottes (knee-breeches) worn by the aristocracy. This was more than a fashion statement; it was a potent political symbol of their rejection of the Ancien Régime’s oppressive social and economic structure.

The sans-culottes were the driving force of the revolution’s most radical phase. They were animated by grievances over inequality, food shortages, and the crushing weight of a system designed to benefit the few at the expense of the many. For them, consumption—particularly of staples like bread and wine—was not a luxury but a right. As Mr. Shaw’s letter eloquently states, they saw wine as “a symbol of their freedom and a source of strength… a source of calories, courage and camaraderie.” In their view, rejecting such a staple would have been a betrayal of their revolutionary ideals, a meek return to the very austerity they fought to escape.

This historical context provides us with two opposing economic philosophies, which we can call the “Dry January Mindset” and the “Sans-Culottes Spirit.”

Two Economic Philosophies: A Comparative View

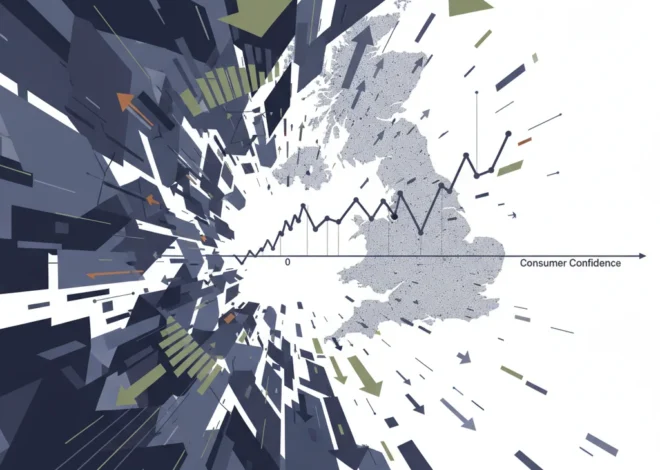

These two mindsets represent the psychological poles of an economy, influencing everything from individual spending habits to national monetary policy. The tension between them often defines the economic narrative of an era.

| Economic Factor | The “Dry January” Mindset (Austerity & Caution) | The “Sans-Culottes” Spirit (Consumption & Rebellion) |

|---|---|---|

| Consumer Behavior | Increased savings, debt reduction, focus on essentials, delayed discretionary spending. | Increased spending, borrowing for consumption, “revenge spending,” focus on experiences. |

| Market Sentiment | Risk-off. Favoring bonds, defensive stocks (utilities, staples), and cash. Bearish outlook. | Risk-on. Favoring growth stocks, technology, and speculative assets. Bullish outlook. |

| Corporate Strategy | Cost-cutting, share buybacks, strengthening balance sheets, cautious investment. | Expansion, M&A activity, heavy R&D investment, aggressive growth targets. |

| Government Policy | Fiscal austerity, raising interest rates to curb inflation, balanced budgets. | Fiscal stimulus, lowering interest rates, infrastructure spending, social support programs. |

| Guiding Emotion | Fear (of recession, job loss, inflation). | Optimism / Greed (for growth, opportunity, wealth). |

Understanding which of these mindsets is dominant is critical for anyone involved in investing or business leadership. A “Dry January” economy calls for defensive posturing, while a “Sans-Culottes” economy rewards those willing to embrace risk and innovation.

The Investor’s Playbook: Navigating Market Revolutions

For an investor, this framework provides a powerful lens for strategic allocation. Your portfolio’s composition should, in many ways, reflect your assessment of which spirit is ascendant in the stock market.

- “Dry January” Investing: In a market dominated by fear and austerity, capital preservation is key. This strategy favors value stocks with strong balance sheets, reliable dividend-paying companies, and defensive sectors like consumer staples and healthcare. Government bonds become more attractive as a safe haven. The goal is not to hit home runs but to avoid striking out. This is the financial equivalent of staying home with a cup of tea instead of a night out.

- “Sans-Culottes” Investing: When optimism and a “risk-on” mentality prevail, the strategy shifts dramatically. This is the time for growth stocks, disruptive technology, and emerging markets. Investors pour capital into companies pioneering new fields, from artificial intelligence to green energy. This is also the environment where more speculative assets, including certain blockchain-based cryptocurrencies, can thrive as they represent a fundamental rebellion against the traditional banking system. This approach is about capturing exponential growth and being part of the next big thing.

The most successful investors are often those who can identify the turning points—the moments when the collective mood shifts from one pole to the other. This often means embracing a contrarian view: buying into the “Sans-Culottes” assets when the world is deep in a “Dry January” fear, and taking profits when the revolutionary fervor reaches a fever pitch.

Fintech: The Modern Sans-Culottes of Finance

The analogy extends beyond market sentiment and into the very structure of our financial system. The revolutionary spirit of the sans-culottes was about tearing down aristocratic privilege and democratizing power. Today, a similar revolution is underway, driven not by pikes and guillotines, but by code and algorithms. This is the revolution of financial technology, or fintech.

For centuries, the world of high finance was an exclusive club, a walled garden accessible only to the wealthy and well-connected—the modern aristocracy. The tools of wealth creation, from sophisticated trading platforms to private equity, were kept behind high barriers to entry. Fintech has taken a sledgehammer to these walls.

Consider the parallels:

- Democratization of Trading: Commission-free trading apps have done for market access what the printing press did for information. Anyone with a smartphone can now buy and sell stocks, options, and ETFs with a few taps, a power once reserved for those who could afford a broker. This is the modern equivalent of the sans-culottes donning their trousers in defiance of the elite.

- The Rise of DeFi: Decentralized Finance, built on blockchain technology, is perhaps the most radical expression of this new revolutionary spirit. It aims to create a parallel financial system without traditional intermediaries like banks. It’s an open, permissionless vision of banking that is, in its purest form, a direct challenge to the established financial order. According to a report by the IMF, the DeFi ecosystem, while volatile, represents a fundamental innovation in financial infrastructure.

- Alternative Capital Formation: Crowdfunding and peer-to-peer lending platforms allow individuals to bypass traditional venture capital and banks, enabling a more distributed and democratic form of capital allocation.

This fintech revolution, much like the French Revolution, is messy, volatile, and fraught with risk. But its core principle is undeniably that of the sans-culottes: to empower the many and challenge the privileges of the few. A study by Ernst & Young before the pandemic showed that global fintech adoption had already reached 64%, a number that has only accelerated since.

From Leaky Pipes to Leaky Portfolios: The Investment Drain of the UK Water Crisis

Economic Policy at the Crossroads

Finally, this tension is at the heart of the most critical debates in modern economics and government policy. After the 2008 financial crisis, the world embarked on a long, painful “Dry January” of fiscal austerity. Governments cut spending and central banks kept a tight leash on the economy, a period of slow growth and financial discipline.

In stark contrast, the response to the COVID-19 pandemic was pure “Sans-Culottes Spirit.” Governments unleashed unprecedented fiscal stimulus, sending checks directly to citizens. Central banks flooded the system with liquidity. The goal was to spark a revolution of consumption to keep the economy from collapsing. It worked, but it also unleashed the inflationary pressures we are grappling with today, as highlighted by research from the Federal Reserve Bank of San Francisco. This has forced policymakers into their current “Dry January” of rate hikes, attempting to put the revolutionary genie back in the bottle.

This oscillation between stimulus and austerity, between empowering consumption and enforcing discipline, is the central drama of modern economic management. Pushing too hard on austerity risks social unrest and economic stagnation. Pushing too hard on stimulus risks runaway inflation and financial instability.

xAI Under Fire: Lawsuit Exposes a Multi-Trillion Dollar Question for AI Investors

Conclusion: Raise a Glass to Economic Understanding

The simple observation that the sans-culottes wouldn’t believe in Dry January provides a remarkably rich metaphor for the forces shaping our world. It reminds us that the economy is not just a collection of data points and charts; it is a profoundly human system driven by a constant struggle between fear and optimism, discipline and desire, caution and rebellion.

For investors, business leaders, and citizens, the lesson is clear. To navigate the complexities of modern finance, we must be both historians and psychologists. We need to understand not just the balance sheets, but also the prevailing spirit of the age. Are we in a moment of collective belt-tightening, a “Dry January” of the soul? Or is there a revolutionary fervor bubbling beneath the surface, a “Sans-Culottes Spirit” ready to fuel the next wave of growth and disruption? Recognizing the season we are in is the first and most crucial step toward making decisions that are not only profitable but also prudent.