A Decade of Doubt: Why UK Consumer Confidence is Stuck in a 10-Year Slump

An Unprecedented Milestone: Ten Years of Economic Pessimism

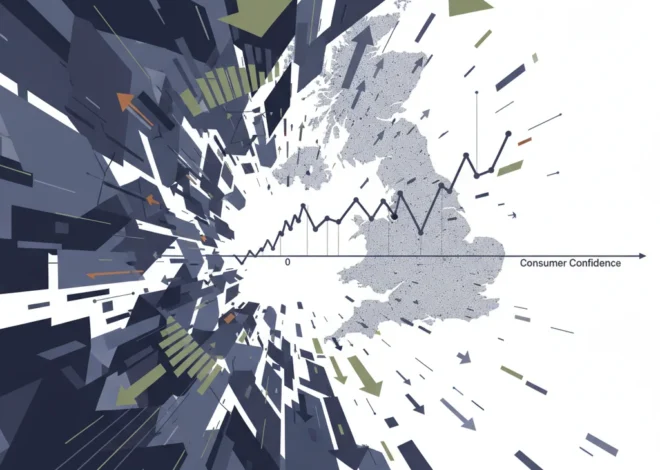

In the world of economics, sentiment is a powerful, often predictive force. It shapes spending, drives investment, and can either fuel or stifle growth. For the United Kingdom, a sobering milestone has just been passed, one that speaks volumes about the nation’s economic psyche: a full decade without a single positive reading in consumer confidence. It’s a statistic that is as stark as it is concerning, painting a picture of a nation grappling with persistent uncertainty.

The latest data from the long-running GfK Consumer Confidence Index offers a flicker of movement, but hardly a beacon of hope. In January, the index nudged up by a single point to minus 16. While this is an improvement from the low of minus 23 seen in April 2023 (source), it remains deeply in negative territory. A negative score simply means that, on balance, more people feel pessimistic about the economy and their personal finances than optimistic. The fact that an entire generation of young adults has never experienced a time of net-positive consumer sentiment in the UK is a profound statement on the challenges the country has faced.

This isn’t just a headline number; it’s the culmination of a tumultuous period marked by Brexit, a global pandemic, political instability, and a severe cost of living crisis. This article will delve into the anatomy of this decade-long confidence deficit, explore its far-reaching consequences for the UK economy, investing landscape, and banking sector, and ask the crucial question: what will it take to finally turn the tide?

The UK’s Economic Mood Ring: Deconstructing the GfK Index

Before we can understand the impact, we must first understand the measurement. The GfK Consumer Confidence Index is more than just a survey; it’s a vital economic barometer that has been tracking the public’s mood since 1974. Policymakers at the Bank of England, strategists in the corporate world, and investors on the stock market watch it closely because how people feel about their financial future is a strong leading indicator of how they will behave in the near future.

The overall index score is an average of five key questions asked to a representative sample of the UK population:

This table breaks down the components that form the headline GfK Consumer Confidence score, providing insight into the specific areas of consumer concern.

| Component Question | What It Measures | Implication for the Economy |

|---|---|---|

| Personal Financial Situation (Last 12 Months) | A retrospective view of how an individual’s finances have changed. | Reflects the real-world impact of wage growth vs. inflation. |

| Personal Financial Situation (Next 12 Months) | A forward-looking view on personal financial expectations. | Directly influences household saving and spending decisions. |

| General Economic Situation (Last 12 Months) | Perception of the broader UK economy’s recent performance. | Indicates public sentiment towards government economic policy. |

| General Economic Situation (Next 12 Months) | Expectations for the overall economy in the coming year. | Affects business investment and hiring confidence. |

| Major Purchase Index | Likelihood of spending on big-ticket items (e.g., cars, furniture). | A key indicator for the retail and manufacturing sectors. |

A persistently negative score across these metrics, as seen over the last decade, signals a deep-seated caution. Consumers are more likely to save rather than spend, delay significant purchases, and adopt a defensive financial posture. This caution creates a challenging headwind for economic growth.

A Fragile Calm: Navigating Market Risk as US-Iran Tensions Subside

Charting a Lost Decade: The Anatomy of Persistent Pessimism

How did the UK arrive at this point? This decade of doubt wasn’t caused by a single event, but a relentless series of economic and political shocks that eroded confidence layer by layer.

- The Post-Financial Crisis Hangover & Brexit (2014-2019): The decade began in the shadow of the 2008 financial crisis, with austerity measures and slow wage growth. This was swiftly followed by the seismic political event of the 2016 Brexit referendum. The ensuing years of uncertainty over the UK’s future relationship with its largest trading partner weighed heavily on both business and consumer sentiment, as documented by institutions like the Bank of England.

- The COVID-19 Pandemic (2020-2021): The global pandemic brought the economy to a standstill. While unprecedented government support cushioned the immediate blow, the long-term effects of lockdowns, supply chain disruptions, and the sheer uncertainty of the health crisis dealt another major blow to confidence.

- The Cost of Living Crisis & Geopolitical Shocks (2022-Present): Just as the world emerged from the pandemic, Russia’s invasion of Ukraine triggered a massive spike in energy prices. This, combined with post-pandemic supply chain issues, unleashed a wave of inflation not seen in 40 years. The Bank of England responded with aggressive interest rate hikes, squeezing mortgage holders and businesses alike, and creating what the Office for National Statistics has extensively tracked as the most significant cost of living crisis in a generation.

The Ripple Effect: When Pessimism Permeates the Economy

Low consumer confidence is not an isolated statistic; its effects ripple outwards, touching every corner of the nation’s finance and commerce.

Retail and Hospitality Suffer: The most immediate victims are consumer-facing sectors. When the “Major Purchase Index” is low, it means fewer new cars sold, home renovations postponed, and technology upgrades delayed. This directly impacts revenue and employment in these critical industries.

Business Investment Stalls: Why would a company invest in a new factory or expand its workforce if it anticipates weak consumer demand? Low confidence acts as a brake on corporate investment, which is a key driver of long-term productivity and economic growth. Business leaders look at consumer sentiment as a proxy for future revenue streams.

Impact on Investing and the Stock Market: While not a direct correlation, consumer sentiment can influence the stock market. A pessimistic population is generally more risk-averse. This can lead to lower retail investor participation in trading and a preference for safer assets over growth stocks. It also affects the performance of companies reliant on UK consumer spending, from high-street banks to homebuilders.

Challenges for Banking and Fintech: The banking sector feels the chill through reduced demand for loans, mortgages, and credit. While this caution can reduce default rates, it also stifles growth. This environment creates both a challenge and an opportunity for the financial technology sector. On one hand, people are less likely to try new, risky financial products. On the other, fintech companies that offer tools for budgeting, saving, and improving financial literacy can thrive as consumers actively seek ways to manage their strained finances.

A Glimmer of Hope or a False Dawn?

So, is the tiny one-point rise in the index a sign of a turning point? It’s prudent to be cautious. There are valid reasons for a tentative rise in optimism. Inflation has fallen significantly from its peak, wage growth is now narrowly outpacing price rises, and markets are anticipating that the Bank of England may begin cutting interest rates later this year. These are tangible improvements that people are starting to feel in their wallets.

However, significant headwinds remain. Household energy bills are still substantially higher than they were pre-crisis, geopolitical instability continues to threaten global supply chains, and an upcoming general election adds a layer of political uncertainty. The path back to positive territory is fraught with potential setbacks.

Looking further ahead, some argue that true, resilient confidence can only be built on new foundations. Concepts like blockchain and decentralized finance (DeFi) have emerged from a desire to create financial systems less susceptible to the shocks and centralized policy decisions that have characterized the last decade. While still a nascent and volatile space, the underlying philosophy of these technologies speaks to a search for greater stability and control in an increasingly uncertain world, a theme that resonates with the UK’s current economic mood.

A Ticking Time Bomb: How a 15-Year-Old Boeing Flaw Shakes the Foundations of the Stock Market

Conclusion: The Long Road to Rebuilding Trust

The latest GfK index figure is a footnote in a much larger story. The real headline is the ten-year anniversary of consumer pessimism. This long-term trend underscores the deep structural challenges and successive crises that have battered the UK economy. A sustained recovery in confidence will require more than just a few months of positive data; it will demand a prolonged period of economic stability, predictable policymaking, and tangible improvements in living standards.

For investors, this means a continued focus on resilience and careful analysis of a UK market that remains sensitive to domestic sentiment. For business leaders, it requires strategies that acknowledge consumer caution while finding innovative ways to offer value. And for policymakers, it is a stark reminder that economic recovery is not just about balancing the books, but about restoring the faith of the people in their own financial future. Until that faith is meaningfully rebuilt, the UK’s economic engine will struggle to move into a higher gear.