A Canary in the Coal Mine: What One Restaurant’s Closure Reveals About the Broader Economy

The Unpalatable Truth of Modern Economics

In the picturesque town of Beaminster, Dorset, a culinary gem is dimming its lights. The Ollerod, a celebrated, award-winning restaurant, recently announced it would be closing its kitchen from March. The reason cited was not a lack of patrons or critical acclaim, but a far more insidious and widespread challenge: the relentless surge in the costs of food, staff, and utilities. While the closure of a single establishment might seem like a local story, it serves as a powerful microcosm of the immense pressures facing businesses globally. It’s a canary in the economic coal mine, signaling a volatile environment that investors, finance professionals, and business leaders must navigate with extreme caution.

This isn’t merely a story about hospitality; it’s a case study in modern economics, a real-world demonstration of margin compression, supply chain fragility, and the direct impact of macroeconomic policy on small and medium-sized enterprises (SMEs). Understanding the confluence of factors that led to this decision provides a crucial lens through which to analyze the current state of the economy and anticipate future challenges in the world of finance and investing.

Deconstructing the “Cost of Doing Business” Crisis

The phrase “rising costs” has become ubiquitous, yet its true impact is often understated. For a business like a restaurant, which operates on notoriously thin margins, these increases are not minor inconveniences; they are existential threats. Let’s dissect the three core pillars of this crisis.

1. The Supply Chain Squeeze: Food & Ingredient Inflation

The cost of raw ingredients has been on a turbulent upward trajectory. Lingering effects from the pandemic, geopolitical conflicts disrupting grain and oil supplies, and extreme weather events have created a perfect storm for food inflation. According to the UK’s Office for National Statistics, while the headline inflation rate has fallen, food and non-alcoholic beverage prices were still 7.0% higher in the year to January 2024. This isn’t just an abstract number; it means the foundational costs for a restaurant have fundamentally shifted, forcing a difficult choice between absorbing the cost (destroying profitability) or passing it on to consumers (risking a drop in demand).

2. The Talent War: Rising Staff Costs

The labor market has undergone a seismic shift. A post-pandemic reassessment of work-life balance, coupled with a competitive hiring landscape, has driven up wages, particularly in the hospitality sector. While fair wages are essential, for businesses already grappling with other rising expenses, this adds another layer of financial pressure. This isn’t just about salaries; it includes national insurance contributions, pension schemes, and the cost of training and recruitment. Effective financial management becomes paramount when your largest variable cost is both essential and increasingly expensive.

3. The Energy Bill Shock: Utility Volatility

Perhaps the most dramatic increase has been in energy costs. Commercial energy prices have seen unprecedented volatility. For an energy-intensive business like a restaurant—with its ovens, refrigeration, and lighting—these hikes can be crippling. A report from the Federation of Small Businesses highlighted that utilities were the most-cited cause of rising costs for over 60% of small businesses in late 2023. This operational cost, once a predictable line item, has become a major source of financial uncertainty, complicating everything from budgeting to long-term investment planning.

To put these pressures into perspective, consider the combined assault on a business’s profit and loss statement:

| Cost Category | Nature of the Challenge | Impact on Business Finance |

|---|---|---|

| Food & Ingredients | Persistent high inflation and supply chain volatility. | Direct hit to Cost of Goods Sold (COGS), squeezing gross margins. |

| Staff & Labor | Competitive labor market and rising wage expectations. | Increased operational expenditure (OpEx), impacting net profitability. |

| Utilities (Energy & Water) | Extreme price volatility and significant overall increases. | Unpredictable and inflated overheads, creating cash flow instability. |

Beyond the Bottle: Kikkoman’s Multi-Billion Dollar Recipe for Global Dominance

The Macroeconomic Context: From Local Kitchen to Global Economy

The Ollerod’s predicament is a direct consequence of broader macroeconomic trends. Central banks, including the Bank of England and the Federal Reserve, have been aggressively raising interest rates to combat inflation. While this is a necessary tool in monetary policy, it acts as a double-edged sword for the economy. Higher interest rates make borrowing more expensive, stifling investment and expansion for businesses. Simultaneously, they reduce the disposable income of consumers with mortgages and other debts, leading to a pullback in discretionary spending—the very lifeblood of the hospitality industry.

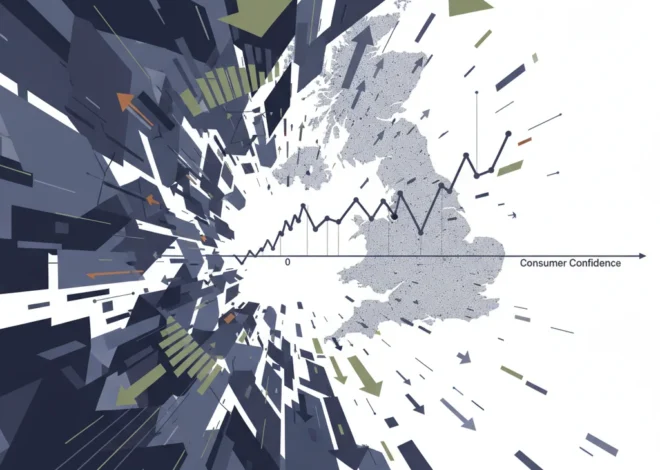

This environment creates a vicious cycle. As consumer spending tightens, businesses cannot easily pass on their increased costs, leading to severe margin compression. This is a classic economics problem where aggregate demand is being deliberately cooled while supply-side costs remain stubbornly high. For investors, this signals a period of heightened risk in consumer-facing sectors. The performance of hospitality and retail stocks on the stock market often acts as a leading indicator of consumer confidence and the health of the wider economy.

Navigating the New Normal: The Role of Financial Technology and Innovation

In this challenging landscape, traditional approaches to business management are insufficient. This is where the intersection of finance and technology offers a path forward. The evolution of financial technology (fintech) provides powerful tools that can help businesses mitigate the very pressures that forced The Ollerod’s kitchen to close.

Modern fintech solutions offer sophisticated ways to manage finances with greater precision:

- Advanced Expense Management: AI-powered platforms can analyze spending in real-time, identifying inefficiencies in procurement and utility usage that would be impossible to spot manually.

- Dynamic Pricing Models: While risky, technology can help businesses model the impact of small price changes, finding a sweet spot that improves margins without alienating customers.

- Supply Chain & Inventory Tech: Emerging technologies, including concepts from blockchain for transparent sourcing, can help businesses optimize inventory, reduce waste, and secure more stable pricing from suppliers. By creating an immutable record of goods, blockchain can enhance trust and efficiency in trading relationships.

- Smarter Banking and Lending: Fintech lenders often use more dynamic data to assess creditworthiness, potentially offering more flexible financing options to SMEs than traditional banking institutions during tight credit cycles.

These tools are no longer a luxury for large corporations; they are becoming essential for the survival of SMEs. The ability to leverage financial technology is a key differentiator in an economy defined by volatility.

The Unbiased Broker: Can AI Deliver the Brutal Financial Truths We Need to Hear?

Investment Implications and the Path Forward

For investors and finance professionals, the closure of businesses like The Ollerod offers several critical takeaways. It underscores the importance of scrutinizing the operational leverage and cost structure of any company in an investment portfolio, particularly in the consumer discretionary sector. Companies with high fixed costs and vulnerability to commodity price swings face significant headwinds.

Conversely, this environment creates opportunities. Investing in the technology companies that provide solutions—the fintech platforms, supply chain management software, and energy efficiency technologies—can be a strategic move. These are the “picks and shovels” of the new economy, providing the essential tools for other businesses to survive and thrive.

The broader stock market will continue to be sensitive to these micro-level stories, as they are the data points that form the mosaic of the overall economy. Analysts who can look past the headline inflation numbers and understand the on-the-ground reality for businesses will be better positioned to make informed trading and investment decisions.

The fate of The Ollerod is a poignant loss for its community and a warning for the wider business world. It highlights that passion and quality are not always enough to withstand the powerful currents of global economics. Success in this era requires a new trinity of virtues: a superior product, operational excellence, and, most importantly, profound financial acumen. As we move forward, the businesses that master this combination will be the ones that define the next chapter of our economy.

The AI Power Play: Why a Push for an Emergency Grid Auction Could Reshape Energy Investing