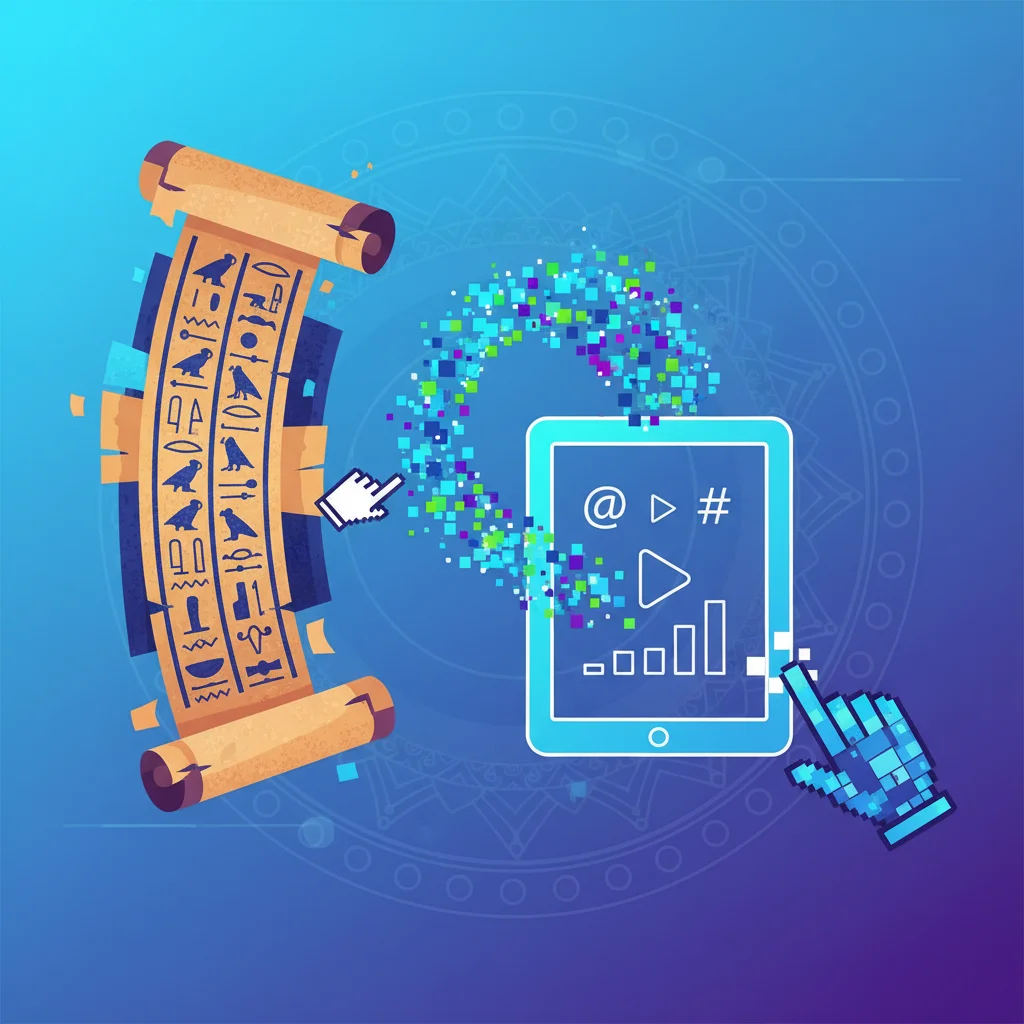

From Post to Pixels: Is the Digital Economy a Return to Hieroglyphics?

The Provocation: When Progress Feels Like Regression

In a brief but potent letter to the Financial Times, a reader from Como, Italy, offered a startling observation: “The end of letter delivery is like a return to hieroglyphics… It is the end of civilisation as we know it.” This statement, while seemingly hyperbolic, strikes a deep chord in our increasingly dematerialized world. As we race to digitize every facet of our lives—from our currency to our legal contracts—are we inadvertently trading a universal language of trust and tangibility for a new, more cryptic form of communication? Are we building a more advanced civilization, or simply a more complex and fragile one?

This isn’t merely a nostalgic lament for the age of ink and paper. It’s a critical examination of the fundamental shifts occurring within our global economy. The decline of physical mail is a powerful symbol for a much broader trend: the abstraction of value, assets, and agreements into purely digital forms. For investors, finance professionals, and business leaders, understanding the profound implications of this transition is not an academic exercise; it is essential for navigating the future of commerce, investing, and risk management.

We will explore how this shift from the physical to the digital impacts everything from the stock market to everyday banking, question whether new technologies like blockchain are a solution or a new set of hieroglyphics, and analyze what we truly risk losing in our relentless pursuit of digital efficiency.

The Fading Ink: Charting the Decline of a Global Institution

The postal service was more than just a delivery mechanism; it was the circulatory system of modern commerce and society for over a century. It was a marvel of logistics and a testament to a universal service obligation—the idea that a letter could travel thousands of miles for the price of a single stamp. This physical infrastructure underwrote the growth of the modern economy, enabling everything from mail-order catalogues to the secure delivery of stock certificates and legal deeds.

Today, that system is in a state of managed decline. In the United States, for example, First-Class Mail volume has plummeted by over 50% since its peak in 2001, falling from 103.5 billion pieces to just 48.9 billion in 2023, according to the USPS’s own strategic reports. Similar trends are visible worldwide. This isn’t just because of email; it’s a result of a wholesale migration of critical financial infrastructure online, including billing, payments, official notices, and direct marketing.

The economic logic is undeniable. Digital is faster, cheaper, and more efficient. But the transition raises uncomfortable questions. What happens to the trust engendered by a notarized signature on a physical document? How do we ensure inclusivity for the millions who remain on the wrong side of the digital divide? A 2021 Pew Research Center study found that a quarter of Americans aged 65 and older do not use the internet, creating a significant barrier to participation in an increasingly digital-first financial ecosystem. By abandoning a universal, physical system, we risk creating a two-tiered economic society where access to essential services is dictated by digital literacy and connectivity.

2025 and Beyond: Navigating the Economic Tremors of a Potential Trump 2.0

The New Hieroglyphics: Fintech, Abstraction, and the Nature of Trust

The letter writer’s “hieroglyphics” analogy is most potent when applied to modern finance. Consider the journey of a single share of stock. It began as an ornate, physically printed certificate—a tangible claim on a piece of a company. Today, it is a fleeting entry in a vast, distributed digital ledger, bought and sold in microseconds by algorithms engaged in high-frequency trading. While this system is incredibly efficient, it is also profoundly abstract.

This abstraction is the hallmark of the fintech revolution. We no longer visit a bank teller; we interact with an app. We don’t sign a loan document; we click “I Agree.” This dematerialization has consequences:

- Psychological Distance: The tangible weight of a legal document or a bundle of cash commands a different level of psychological gravity than a digital transaction. This distance can alter risk perception and decision-making for both consumers and institutional investors.

- Systemic Risk: While physical documents can be lost or forged, the risks are often localized. In a deeply interconnected digital financial system, a single software bug, a sophisticated cyberattack, or a critical server failure can trigger cascading effects across the entire global economy. The “flash crashes” we’ve witnessed on the stock market are a testament to this new form of digital fragility.

- A Crisis of Verification: A wet signature on paper, verified by a notary, is a universally understood and legally robust form of authentication. Its digital equivalents—passwords, two-factor authentication, biometric scans—are a constantly evolving arms race against bad actors. They are, in a sense, a complex new language of security that is far from universal.

Enter blockchain, a technology often heralded as the solution to digital trust. By creating a decentralized, immutable ledger, it aims to replicate the permanence and verifiability of a physical record. Yet, for the average person, the mechanics of private keys, hashing algorithms, and consensus mechanisms are far more opaque than a simple signature. Is a tokenized asset on a blockchain a step toward clarity, or is it the ultimate form of hieroglyphics—a system whose meaning is accessible only to a new priestly class of cryptographers and developers?

To better understand this shift, let’s compare the attributes of financial instruments across these different eras.

| Feature | Traditional (e.g., Paper Bond) | Modern Digital (e.g., E-Trade Holding) | Blockchain-Based (e.g., Security Token) |

|---|---|---|---|

| Tangibility | High (Physical Certificate) | None (Digital Entry in a Centralized Database) | None (Cryptographic Entry on a Distributed Ledger) |

| Verification | Physical inspection, notary, official seal | Login credentials, trusted third-party (broker) | Cryptographic proof, public ledger transparency |

| Transfer Speed | Slow (Days to Weeks) | Fast (Seconds to Minutes) | Variable (Minutes to Hours, depending on network) |

| Accessibility | Requires physical access and intermediaries | Requires internet and a trusted intermediary | Requires internet and technical knowledge (self-custody) |

| Security Profile | Risk of physical theft, loss, or forgery | Risk of hacking, data breach, intermediary failure | Risk of key loss, smart contract bugs, 51% attacks |

Navigating the New Scribes: Implications for Investors and Leaders

Understanding this paradigm shift is critical for strategic decision-making in today’s economy. The “end of the letter” is not just a cultural curiosity; it’s a leading indicator of deeper infrastructural changes that create both opportunities and novel risks.

For investors, the decline of old infrastructure presents clear opportunities in the new. The focus shifts from legacy systems to the enablers of the digital world: cybersecurity firms, cloud computing giants, fintech payment processors, and specialized logistics companies that handle the explosion in e-commerce parcels—the one area where physical delivery is booming. According to Statista, global parcel volume is projected to more than double between 2020 and 2026, a direct consequence of the digital economy’s reliance on physical fulfillment.

However, business leaders must also become fluent in the language of digital risk. The concentration of our financial and commercial lives onto a handful of digital platforms creates systemic vulnerabilities. Leaders must ask critical questions:

- Resilience: Is our operational and financial infrastructure diversified? What is our contingency plan for a major internet or power outage?

- Security: How do we protect our data and assets when the “walls” of our organization are no longer physical but digital and permeable?

- Inclusivity: Is our business model inadvertently excluding a segment of the population by being digital-only? What is the long-term cost of that exclusion?

The principles of sound economics and prudent investing haven’t changed, but the medium has. The need for due diligence, verification, and a clear chain of title is as important as ever. The challenge is learning to perform these essential functions in a world of digital abstraction.

Solving the Market: What the FT Crossword Teaches Us About Modern Finance

Conclusion: Deciphering the Future

Richard Allen’s letter to the Financial Times serves as a powerful allegory. The end of universal letter delivery is not, in itself, the end of civilization. But it symbolizes our unceremonious abandonment of systems that were built on principles of tangibility, universality, and a shared, easily understood language of trust. In their place, we have erected a dazzling but complex edifice of financial technology—a system of digital hieroglyphics whose fluency is limited to a select few.

The path forward is not to reject technology and return to the past. It is to consciously design our digital future to embody the best principles of our analog history. It means building financial and economic systems that are not only efficient but also resilient, not only powerful but also inclusive, and not only complex but also, at their core, comprehensible. If we fail, we may find that we have built an incredibly advanced society that has forgotten how to speak a common language of value, leaving us to decipher the cryptic symbols of our own creation.