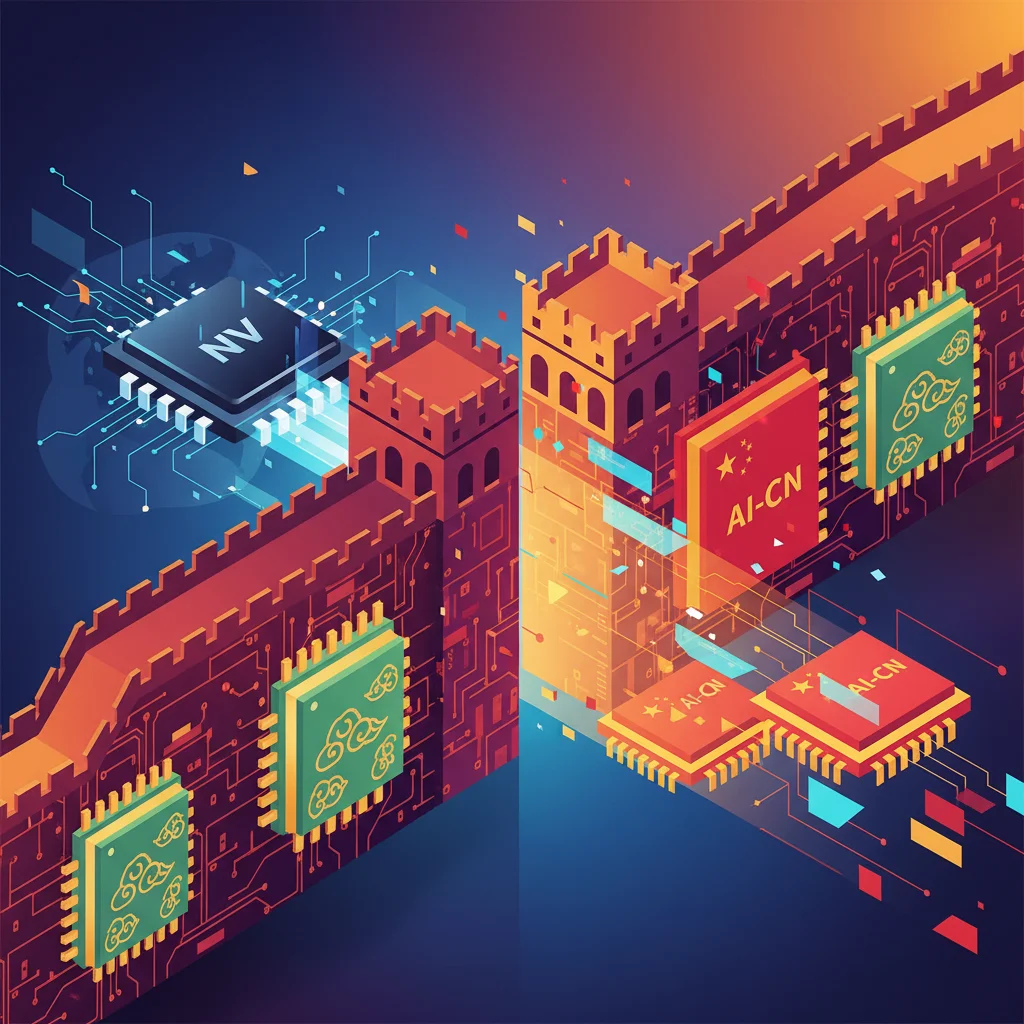

Beijing’s AI Firewall: China Mandates Domestic Chips, Challenging Nvidia’s Reign

The global race for artificial intelligence supremacy has just entered a new, dramatic phase. In a move that sends shockwaves through the tech industry, Beijing has officially mandated that its state-owned enterprises prioritize homegrown AI technology. For the first time, domestic AI chips from companies like Huawei and Cambricon have been added to China’s official government procurement lists, a decisive step towards building a self-reliant technological future.

This isn’t just another policy update; it’s a foundational shot across the bow in the escalating US-China tech rivalry. According to a report from the Financial Times, China’s Ministry of Industry and Information Technology (MIIT) and Ministry of Science and Technology (Most) issued new guidelines late last year, instructing state-owned firms to systematically increase their use of domestic hardware and software. The directive aims to have these powerful enterprises conduct yearly reports on their progress in replacing foreign technology, cementing a long-term strategy of “techno-nationalism.”

For years, Silicon Valley giant Nvidia has been the undisputed king of AI chips, its powerful GPUs and CUDA software ecosystem forming the backbone of machine learning development worldwide. But this new mandate is a clear and calculated effort to build a fortress around China’s burgeoning AI industry, insulating it from US sanctions and fostering a domestic ecosystem that can one day compete on the global stage. Let’s break down what this means for developers, startups, and the future of global innovation.

The Great Wall of Silicon: Understanding the New Mandate

At its core, the Chinese government’s directive is a powerful market-shaping tool. By adding domestic AI processors to the official procurement list, Beijing is essentially creating a massive, guaranteed customer base for its national tech champions. State-owned enterprises (SOEs) in China are colossal entities, spanning sectors from telecommunications and finance to energy and transportation. Forcing them to “buy Chinese” creates a predictable revenue stream and a vast real-world testing ground for homegrown technology.

The timing of this directive is particularly telling. The instructions were disseminated even before the Trump administration made a last-minute decision to allow Nvidia to continue exporting less-advanced AI chips to China (source). This indicates that Beijing’s strategy isn’t merely a reaction to specific sanctions but a proactive, long-term plan to achieve technological sovereignty. The goal is to sever the country’s dependence on foreign technology, which it increasingly views as a critical national security vulnerability.

The primary beneficiaries of this policy are companies like Huawei and Cambricon. Huawei’s Ascend 910B chip is widely considered China’s most competitive domestic alternative to Nvidia’s powerful GPUs. While it may not yet match the raw performance of Nvidia’s top-tier H100 or A100 chips, the government’s backing ensures it will be deployed at an unprecedented scale. This forced adoption cycle is designed to accelerate innovation, improve performance through real-world feedback, and build a robust software ecosystem around Huawei’s hardware.

Riding the Data Wave: How AI is Reshaping Our Fight Against Sea Level Rise

The Players on the New AI Battlefield

To understand the shifting dynamics, it’s helpful to compare the key players in this high-stakes competition. While Nvidia has a commanding lead today, China is betting that a state-driven, protected market can close the gap over time.

| Company | Key AI Platform | Country of Origin | Strategic Advantage |

|---|---|---|---|

| Nvidia | A100/H100 GPUs & CUDA Software | USA | Superior hardware performance and a deeply entrenched, mature software ecosystem (CUDA) that is the industry standard for machine learning and AI programming. |

| Huawei | Ascend 910B AI Processor & CANN Software | China | Strong government backing, guaranteed domestic market through procurement mandates, and tight hardware-software integration. Considered the leading domestic alternative. |

| Cambricon | MLU Series AI Accelerators | China | An early pioneer in China’s AI chip space with strong academic roots. Now positioned to capture a significant share of the state-mandated market. |

Huawei knows this. Their challenge isn’t just to build a faster chip; it’s to build a compelling alternative to CUDA with their CANN (Compute Architecture for Neural Networks) platform. This government mandate is the ultimate catalyst. It forces a critical mass of Chinese developers and companies to learn and build on CANN. It’s a brute-force method of ecosystem creation. Will it be as innovative or open as CUDA? Probably not initially. But will it become “good enough” for China’s domestic needs? Absolutely. We could be witnessing the birth of a bifurcated global AI standard—one for China and one for the rest of the world. This has profound implications for global collaboration, software compatibility, and the very future of AI innovation.

The Global Ripple Effect: What This Means for You

This policy shift in Beijing isn’t happening in a vacuum. It will have far-reaching consequences for tech professionals, entrepreneurs, and the global market.

For Developers and Tech Professionals

The rise of a parallel AI stack means a growing divergence in required skills. Developers in China will increasingly need to master Huawei’s CANN and other domestic platforms. For international developers, this could mean that building software or SaaS products for the Chinese market requires a completely different technical approach. The era of a single, global standard for AI programming might be coming to an end, creating new niches for specialization.

For Startups and Entrepreneurs

For Chinese startups, this is a golden opportunity. The government has effectively de-risked building on domestic hardware. Startups that align with the national strategy can expect preferential treatment, government contracts, and a protected market. For startups outside China, however, this move raises the barrier to entry. The massive Chinese market, once a key target for expansion, is becoming increasingly insular and difficult to penetrate without deep local partnerships and a willingness to adapt to a completely different tech stack.

From Fusion Dreams to Cancer Cures: How a Google-Backed Startup is Shipping the Future, Today

For Global Tech Giants like Nvidia

The impact on Nvidia cannot be overstated. China has historically been a massive market for the company. A report from last year highlighted that Chinese sales accounted for a significant portion of Nvidia’s data center revenue. While the company will still be able to sell some chips, the most lucrative government and state-affiliated contracts will now be off-limits. This forces a strategic pivot, likely increasing focus on other markets in Europe, India, and Southeast Asia to compensate for the slowdown in China.

For Cybersecurity and Automation

A state-controlled, vertically integrated tech stack from the silicon up to the software layer has massive cybersecurity implications. From Beijing’s perspective, it eliminates the risk of foreign backdoors and enhances national security. For the rest of the world, it creates a “black box” problem. Technology that is difficult to audit and verify by international standards can breed mistrust. This could complicate international collaboration on AI safety and ethics, and impact how global companies approach automation and cloud services that rely on Chinese infrastructure.

The Ultimate Question: Can “Made-in-China” AI Compete?

Despite the aggressive government push, the road ahead for China’s domestic chipmakers is challenging. Nvidia’s dominance was not built overnight. It is the result of decades of relentless innovation, massive R&D investment, and, most importantly, listening to the needs of the developer community.

Currently, even the best Chinese chips lag behind Nvidia’s top-tier products in both performance and power efficiency. Furthermore, the software tools are often described as less mature and more difficult to use than the polished, feature-rich CUDA platform. However, performance isn’t the only metric that matters in this new paradigm. For a state-owned bank or a municipal government’s cloud infrastructure, the criteria are different. “Sovereign,” “secure,” and “compliant” may become more important than “fastest.”

This procurement policy is a long-term investment. By guaranteeing sales and deployment at scale, China is giving its domestic champions the resources and runway to iterate, improve, and eventually close the technological gap. It’s a state-sponsored feedback loop designed to accelerate innovation at a pace the free market alone might not support.

The AI Gold Rush Goes Public: Anthropic's IPO Move Ignites a High-Stakes Race with OpenAI

A New Digital Curtain

Beijing’s decision to mandate homegrown AI chips is more than just an economic policy; it’s a declaration of technological independence. It signals a firm commitment to decoupling its critical digital infrastructure from the West, creating a self-contained ecosystem that it can control and secure.

The global tech community is now at a crossroads. We are watching a real-time experiment testing two different models of innovation: the market-driven, open ecosystem of Silicon Valley versus the state-driven, top-down model of China. The outcome will shape the future of artificial intelligence, machine learning, and international relations for decades to come. The digital iron curtain is rising, and the world on either side will look increasingly different.