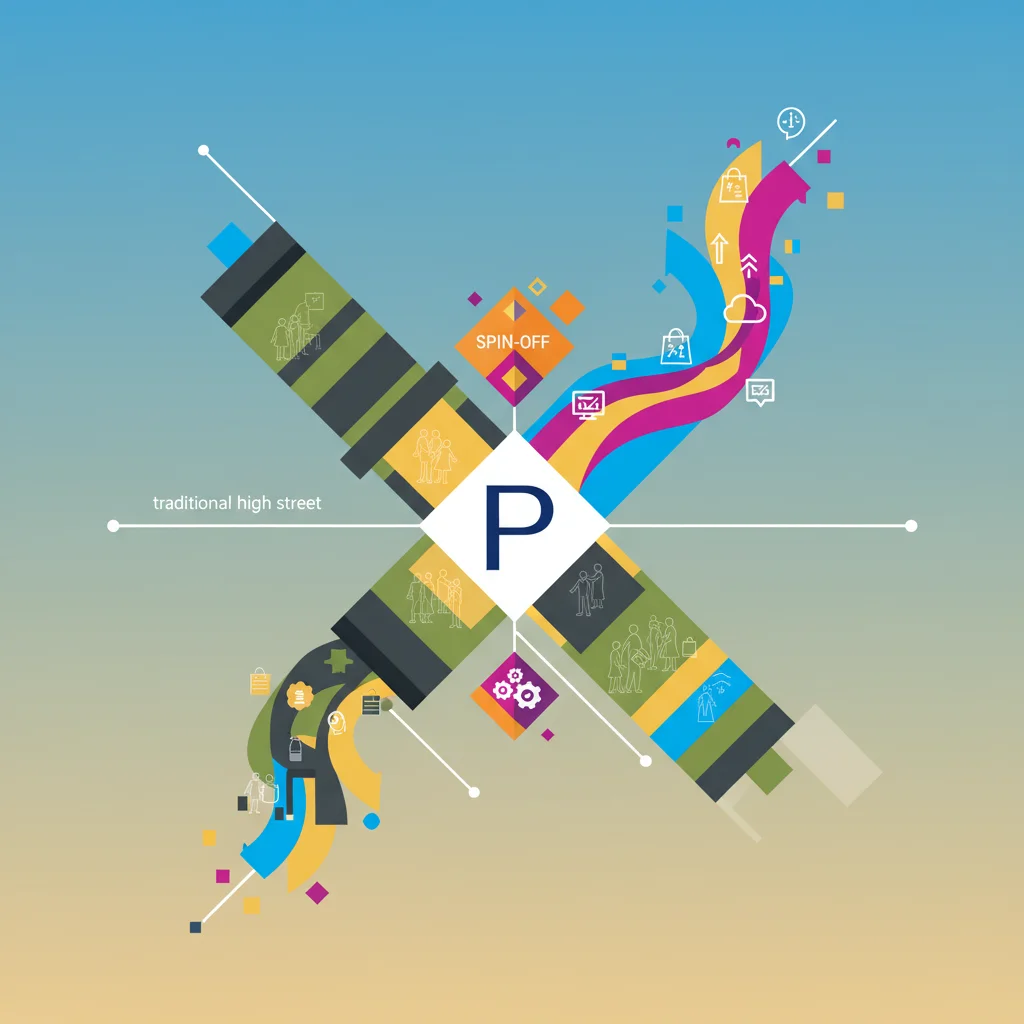

Primark at a Crossroads: Why a Potential Spin-Off Could Redefine a Retail Empire

For decades, Primark has been an unshakable titan of the British high street. Its sprawling stores, packed with budget-friendly fashion, have become a cultural and economic staple. Yet, even titans can feel the tremors of a shifting economic landscape. Recent reports have sent ripples through the finance and investment communities: Primark’s parent company, Associated British Foods (ABF), is reportedly exploring a spin-off of the fashion chain following a dip in UK sales. This isn’t just a minor corporate reshuffle; it’s a potential tectonic shift that speaks volumes about consumer behavior, corporate strategy, and the future of retail investing.

The news, highlighted by a BBC report, indicates that UK shoppers are cutting back on fashion purchases, forcing one of the world’s most successful conglomerates to reconsider its structure. For investors, business leaders, and anyone with an interest in the health of our economy, this development raises critical questions. Is this a sign of weakness for Primark, or a shrewd strategic move by ABF to unlock greater value? To understand the implications, we must delve into the complex world of corporate finance, the psychology of the modern consumer, and the intricate dance between a parent company and its star subsidiary.

The Economic Headwind: Understanding the Sales Slump

At the heart of this strategic consideration is a simple but powerful economic reality: consumers are feeling the pinch. Persistent inflation, rising interest rates, and stagnant wage growth have created a cost-of-living crisis that is fundamentally altering household budgets. When money is tight, discretionary spending is the first to go, and for many, that means new clothes.

Primark’s model, built on high volume and low prices, has historically been resilient during economic downturns. However, the current climate appears to be challenging even this budget-friendly giant. The reported fall in UK sales suggests a broader trend where consumers are not just trading down, but are actively reducing their consumption of non-essential goods altogether. This shift in the macroeconomic environment is a crucial piece of the puzzle, forcing a re-evaluation of how different business units perform under stress. While ABF’s food divisions—home to staples like Twinings tea, Jordans cereals, and Silver Spoon sugar—offer stability and predictable revenue, the cyclical nature of fashion retail introduces a level of volatility that can be a drag on the overall corporate profile.

The Conglomerate’s Conundrum: Why Separate Food and Fashion?

To grasp the logic behind a potential spin-off, one must first understand the structure of Associated British Foods. ABF is a classic conglomerate—a multi-industry company with a diverse portfolio of businesses. On one hand, it has a robust, defensive portfolio of grocery, sugar, agriculture, and ingredients businesses. On the other, it has Primark, a high-growth, high-volume global fashion retailer. For years, this diversification has been a source of strength. The steady, reliable profits from the food divisions could fund Primark’s aggressive international expansion, while Primark’s explosive growth provided the excitement and upside for the stock market.

However, investors and financial analysts often apply what is known as a “conglomerate discount” to such companies. The theory is that the market values a collection of disparate businesses less than it would value each of them as standalone, “pure-play” entities. Why? The reasons are multifaceted:

- Lack of Focus: It’s difficult for a single management team to be experts in both sugar production and fast fashion. A spin-off would allow each company to have a dedicated leadership team focused on its specific industry challenges and opportunities.

- Capital Misallocation: In a conglomerate, divisions must compete internally for capital. A standalone Primark could raise and allocate capital based solely on the needs of its retail operations, potentially investing more aggressively in areas like financial technology for e-commerce or supply chain innovation.

- Investor Clarity: Different investors have different appetites. An investor seeking stable, dividend-paying stocks might be drawn to the ABF food business, while a growth-oriented investor might prefer a pure-play Primark. A spin-off allows investors to choose the profile that best fits their strategy.

The exploration of a spin-off, as reported by the BBC, is ABF’s acknowledgment of this very real financial dynamic. It is a calculated move to potentially unlock billions in shareholder value that may be trapped within the current conglomerate structure.

Deconstructing the Deal: A Tale of Two Companies

A corporate spin-off involves the parent company separating one of its divisions into a new, independent public company. Existing shareholders of the parent company (ABF) would typically receive shares in the newly created company (Primark) on a pro-rata basis. The result would be two distinct entities trading on the stock market, each with its own valuation, strategy, and investor base.

To better understand the strategic trade-offs, let’s examine the potential pros and cons from a finance and investing perspective.

Here is a breakdown of the strategic considerations for a potential Primark spin-off:

| Potential Benefits of a Spin-Off | Potential Risks and Drawbacks |

|---|---|

| Elimination of Conglomerate Discount: The market may assign a higher “pure-play” valuation to both the food business and Primark as separate entities. | Loss of Diversification: A standalone Primark would be fully exposed to the cyclicality of the retail sector without the stable cash flows from the food business to cushion downturns. |

| Enhanced Management Focus: Dedicated leadership teams for each company can react more nimbly to their respective market dynamics. | Increased Volatility: Primark’s stock could be more volatile as a standalone company, subject to the whims of fashion trends and consumer spending. |

| Tailored Capital Strategy: Each company can optimize its capital structure and investment strategy for its specific industry (e.g., high-growth for retail, stable returns for food). | Execution Risk: Corporate spin-offs are complex and costly. There is always a risk of operational disruption during the separation process. |

| Greater Transparency for Investors: Clearer financial reporting and performance metrics make it easier for analysts and investors to value each business accurately. | Weaker Credit Profile: The smaller, less diversified entities might have lower credit ratings, potentially increasing their cost of borrowing from banking institutions. |

Implications for the Broader Market and Your Portfolio

Should this spin-off proceed, the impact will extend far beyond ABF’s boardroom. For current shareholders, it would mean a transition from holding stock in a diversified conglomerate to holding shares in two more specialized companies. This requires a re-evaluation of their investment thesis. Do they want exposure to stable consumer staples, high-growth retail, or both?

For the wider stock market, the introduction of a publicly traded, pure-play Primark would be a major event. It would become a key bellwether for the health of the high-street retail sector and the European consumer. Analysts in the trading and banking sectors would be intensely focused on its performance, margins, and growth strategy, particularly its approach to online retail and international expansion. The move would also set a precedent, potentially encouraging other conglomerates to examine their own structures to see if value can be unlocked by separating high-growth divisions from more mature, stable ones. This is a core theme in modern corporate finance and economics.

The consumer spending cutbacks that triggered this consideration (source) are a powerful indicator of the current economic climate. This move by ABF shows how corporate strategy must adapt to macroeconomic realities.

Beyond the Cockpit: Deconstructing the UK-Turkey Fighter Jet Deal and Its Economic Shockwaves

The Future of Retail in a New Financial Era

Primark’s situation is a microcosm of the challenges facing the entire fast-fashion industry. Beyond economic pressures, the sector is grappling with calls for greater sustainability, intense competition from online-only players like Shein and Temu, and complex supply chain vulnerabilities. A newly independent Primark would need to confront these issues head-on. This could involve leveraging technology to improve efficiency and transparency. Innovations like blockchain, for instance, offer the potential for transparent supply chain tracking, addressing consumer and regulatory demands for ethical sourcing.

Furthermore, a standalone Primark would need a robust fintech strategy. Building an online shopping platform from scratch requires seamless payment gateways, fraud detection systems, and potentially “buy now, pay later” integrations—all core components of modern financial technology. The ability to execute this digital transformation would be a key determinant of its long-term success on the stock market.

Conclusion: A Strategic Pivot, Not a Panic Button

The news of Primark’s sales dip and a potential spin-off from ABF is far more than a simple story of a retailer in trouble. It is a fascinating case study in corporate finance, strategic adaptation, and the relentless pressure of the modern economy. It reflects a shift from the age of the sprawling conglomerate to an era of focused, pure-play specialists designed to maximize value in a competitive market.

Whether Primark is ultimately spun off or remains within the ABF family, the very exploration of this path signals a new chapter. It underscores the profound impact of macroeconomic forces on corporate decision-making and highlights the strategic tools companies can use to navigate uncertainty. For those involved in finance, investing, and business leadership, the story of Primark’s potential transformation will be a crucial narrative to follow, offering powerful lessons on value creation in a world of constant change.