Taiwan’s ‘T-Dome’: The Multi-Billion Dollar Shield Reshaping Global Investment Strategy

The New Fault Line in Global Finance: A Missile Shield in the Taiwan Strait

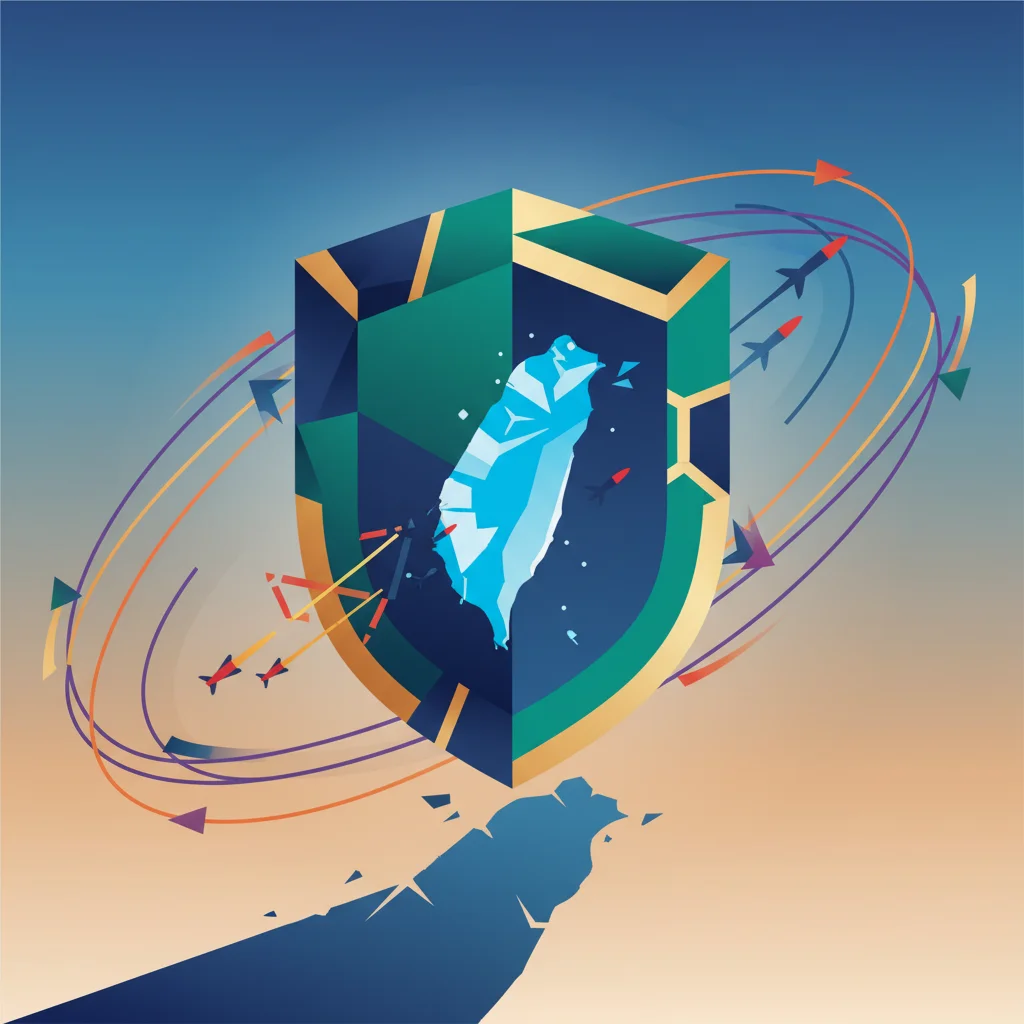

In the intricate dance of global geopolitics, few regions command as much attention—or carry as much economic weight—as the Taiwan Strait. It is the world’s most critical waterway for trade and, more importantly, home to the semiconductor industry’s undisputed leader. Now, a new development is sending ripples through the worlds of international relations and high finance. Taiwan’s President Lai Ching-te has announced an acceleration of the nation’s ambitious “T-dome” missile defense plan, a strategic move designed to create a “safety net” against the escalating threat from China. While the headlines focus on military hardware, the real story for investors, business leaders, and financial professionals lies beneath the surface. This is not just about defense; it’s about de-risking a lynchpin of the global economy, and the financial implications are profound.

The T-dome initiative is a direct response to heightened military pressure and represents a significant shift in Taiwan’s defensive posture. But to view it solely through a military lens is to miss the larger picture. This multi-billion dollar investment is a critical variable in the complex equation of global investing, supply chain stability, and the future of the tech-driven stock market. Understanding its impact is no longer a niche concern for policy wonks—it is essential for anyone involved in international finance.

Deconstructing the ‘T-Dome’: More Than Just Military Hardware

So, what exactly is this “T-dome”? The project, formally known as the “Advanced Surface-to-Air Missile System,” is envisioned as a multi-layered defense network. Unlike Israel’s famous Iron Dome, which is designed to intercept short-range rockets and artillery shells, Taiwan’s system is being developed to counter a more sophisticated and varied arsenal, including cruise missiles, drones, and potentially higher-altitude threats. The goal is to create a comprehensive shield, integrating high-altitude detection with rapid interception capabilities.

This initiative is part of a broader strategic effort by Taiwan to bolster its self-defense capabilities. The acceleration of the plan signals a new urgency within the administration. The development is a joint effort between the National Chung-Shan Institute of Science and Technology (NCSIST) and other domestic partners, showcasing Taiwan’s indigenous technological prowess. This self-reliance is a key theme, but the project’s scale will inevitably involve international collaboration and procurement, opening up a new frontier for the global defense industry.

The Economic Calculus: A Nation’s Security as a Financial Asset

A defense system of this magnitude comes with a colossal price tag. While exact figures are closely guarded, estimates run into the tens of billions of dollars over its development and deployment lifetime. This represents a massive allocation of national resources and has direct consequences for Taiwan’s economics. Such spending can act as a fiscal stimulus, channeling funds into high-tech engineering, research, and manufacturing sectors. It creates jobs, fosters innovation, and strengthens the domestic industrial base.

However, this expenditure also presents classic economic trade-offs. How will it be financed? Will it necessitate higher taxes, increased borrowing, or reallocation of funds from other public services? These are the questions that credit rating agencies and international investors will be asking. A nation’s ability to secure its sovereignty is, in a very real sense, a prerequisite for a stable and attractive investment environment. From this perspective, the T-dome is not just a cost; it is an investment in the continuity of Taiwan’s powerhouse economy. The stability it promises underpins everything from the local banking sector to the global technology supply chain.

Market Volatility and the ‘Taiwan Premium’ in Global Trading

For anyone engaged in stock trading or long-term investing, geopolitical risk has become a permanent fixture on the dashboard. The Taiwan Strait is arguably the single most significant source of this risk today. Every military exercise, political statement, or defense announcement sends tremors through global markets. The acceleration of the T-dome plan is a double-edged sword for investors.

- On one hand, it signals rising tensions. The very need for such a system highlights the severity of the threat, which can spook markets and increase volatility, particularly in tech and shipping stocks.

- On the other hand, it demonstrates a credible commitment to defense. A more secure Taiwan is a more stable partner in the global supply chain. This can, over the long term, reduce the perceived risk and potentially lower the “Taiwan premium” that investors demand for holding assets linked to the region.

The most immediate impact is felt in the semiconductor sector. Taiwan Semiconductor Manufacturing Company (TSMC) alone produces over 60% of the world’s semiconductors and over 90% of the most advanced chips. A conflict in the strait would halt this production, triggering a global economic crisis